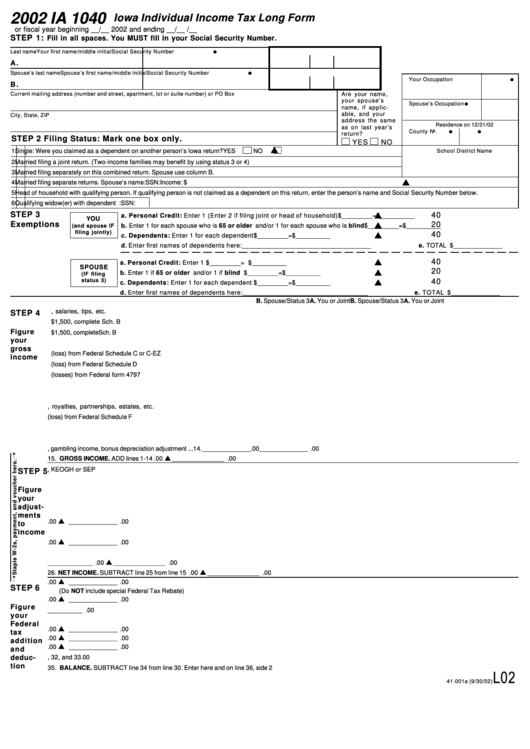

As tax season approaches, it’s important to be prepared with all the necessary forms to file your taxes accurately and on time. One important form for residents of Iowa is the IA 1040 Iowa Individual Income Tax Form. This form is used to report your income earned in the state of Iowa and calculate the amount of tax you owe.

Understanding how to properly fill out the IA 1040 form is crucial to avoid any errors or penalties. It’s recommended to seek guidance from a tax professional or use online resources to ensure accurate completion of this form.

2018 Ia 1040 Iowa Individual Income Tax Form Printable

2018 Ia 1040 Iowa Individual Income Tax Form Printable

When filling out the IA 1040 form, you will need to provide information such as your income, deductions, credits, and any taxes paid throughout the year. It’s important to gather all relevant documents, such as W-2s, 1099s, and receipts, to support the information you provide on the form.

After completing the IA 1040 form, you can choose to file electronically or mail it to the Iowa Department of Revenue. Be sure to double-check all information before submitting to avoid any delays in processing your tax return.

Overall, the IA 1040 Iowa Individual Income Tax Form is an essential document for Iowa residents to accurately report their income and fulfill their tax obligations. By staying organized and seeking assistance when needed, you can navigate the tax filing process with ease.

As the tax deadline approaches, be sure to download and print the 2018 IA 1040 Iowa Individual Income Tax Form to get started on filing your taxes for the year. Remember to keep copies of all documents for your records and reach out to the Iowa Department of Revenue if you have any questions or need assistance.