Being self-employed comes with its own set of challenges, one of which is managing your income and expenses. Keeping track of your earnings is crucial for tax purposes and financial planning. One way to stay organized is by using printable self-employment income sheets.

These printable templates make it easy for self-employed individuals to record their income, expenses, and other financial transactions in one place. By using these sheets, you can easily calculate your net income, track your business performance, and prepare for tax season.

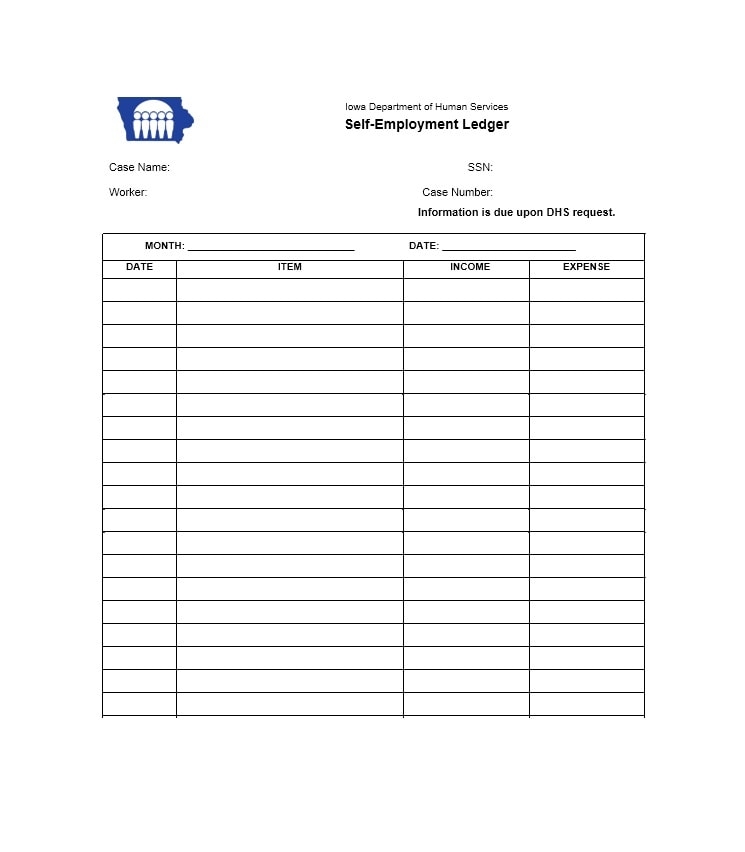

Printable Self Employemnt Income

Printable Self Employemnt Income

Printable self-employment income sheets typically include sections for recording income sources, payment dates, amounts received, and any deductions or expenses related to your business. You can customize these templates based on your specific needs and preferences.

By diligently filling out these sheets on a regular basis, you can gain a better understanding of your cash flow, identify any areas of improvement, and make informed financial decisions for your business. Additionally, having organized financial records will make it easier to file your taxes accurately and on time.

Whether you’re a freelancer, consultant, or small business owner, printable self-employment income sheets can be a valuable tool in managing your finances effectively. These templates provide a simple yet effective way to track your earnings and expenses, helping you stay on top of your financial obligations and goals.

In conclusion, printable self-employment income sheets offer a convenient and practical solution for self-employed individuals to keep their finances in order. By utilizing these templates, you can streamline your financial management process, improve your business performance, and ensure compliance with tax regulations. Take advantage of these resources to stay organized and informed about your income and expenses as a self-employed professional.