As the tax season approaches, many Californians are gearing up to file their state income taxes. One of the most commonly used forms is the California State Income Tax Form 540. This form is used by residents to report their income, deductions, and credits for the year 2019.

Form 540 is essential for residents to accurately report their income and claim any deductions or credits they may be eligible for. It is important to fill out this form correctly and completely to avoid any potential issues with the California Franchise Tax Board.

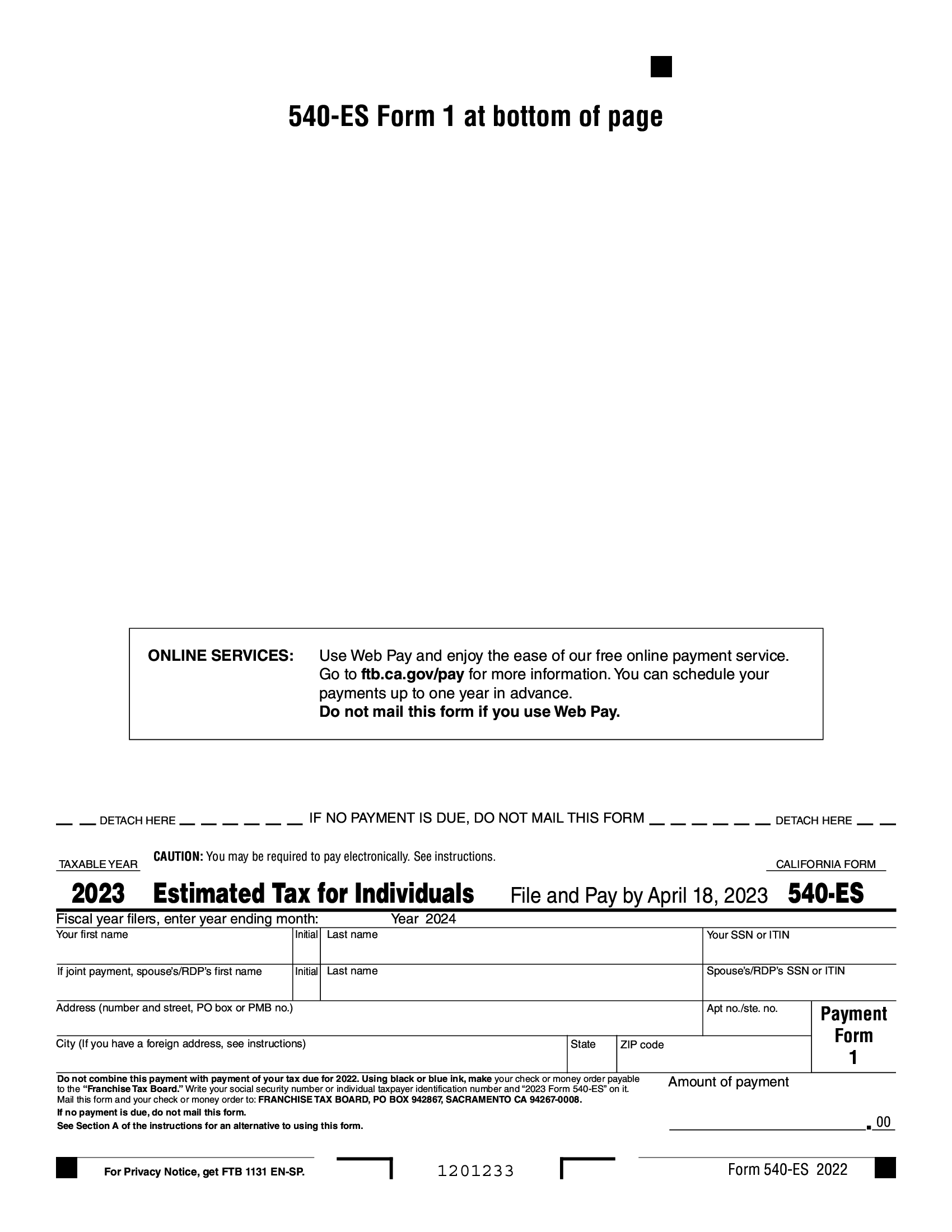

California State Income Tax Forms 540 Printable For 2019

California State Income Tax Forms 540 Printable For 2019

When filling out Form 540, taxpayers will need to provide information about their income sources, deductions, and any tax credits they are claiming. This form is used to calculate the amount of tax owed or the refund due to the taxpayer.

Residents can easily access and print Form 540 from the California Franchise Tax Board website. The form is available in a printable format, making it convenient for taxpayers to fill out and submit either electronically or by mail.

It is crucial for California residents to file their state income taxes accurately and on time to avoid penalties or interest charges. By utilizing Form 540 and following the instructions provided, taxpayers can ensure that their taxes are filed correctly and efficiently.

Overall, Form 540 is a vital document for California residents to report their income and claim any deductions or credits for the year 2019. By filling out this form accurately and completely, taxpayers can avoid any potential issues and ensure that their taxes are filed correctly.