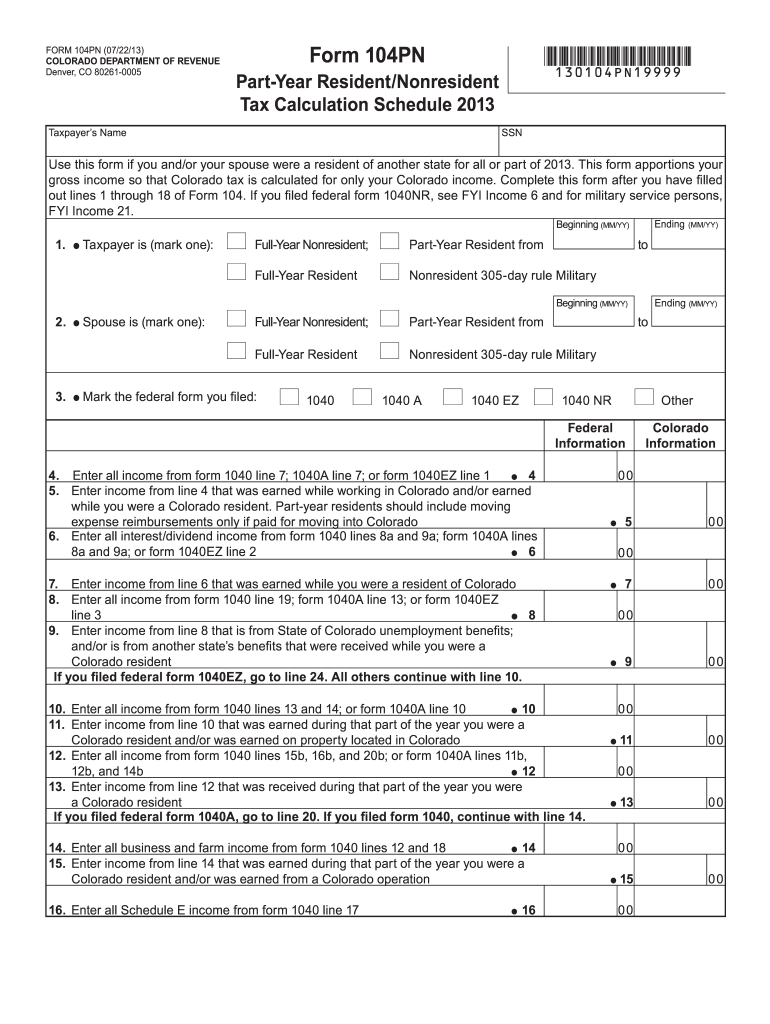

Colorado Income Tax form 104 is a document used by residents of Colorado to report their annual income and calculate their state income tax. The form is used by individuals, married couples filing jointly, and heads of households to report their income, deductions, and credits for the tax year.

It is important to note that the Colorado Income Tax Form 104 is specific to the state of Colorado and should not be confused with federal income tax forms. The form must be filed by the April deadline each year to avoid penalties and interest on any tax owed.

Printable Colorado Income Tax Form 104 2019

Printable Colorado Income Tax Form 104 2019

Printable Colorado Income Tax Form 104 2019

The Printable Colorado Income Tax Form 104 for the year 2019 can be easily found online on the Colorado Department of Revenue website. This form can be downloaded, printed, and filled out by hand for submission. Alternatively, taxpayers can also choose to file their taxes electronically using the department’s online portal.

When filling out the form, taxpayers will need to provide information such as their name, address, social security number, and details of their income including wages, salaries, tips, and any other sources of income. They will also need to report deductions such as mortgage interest, property taxes, and charitable contributions to calculate their taxable income.

Once all the necessary information has been provided, taxpayers can then calculate their tax liability using the tax tables provided with the form. Any tax credits that apply can be deducted from the total tax owed to determine if a refund is due or if additional tax payment is required.

After completing the form, taxpayers must sign and date it before submitting it to the Colorado Department of Revenue. It is recommended to keep a copy of the completed form for personal records and to track any refunds or payments made.

In conclusion, the Printable Colorado Income Tax Form 104 for the year 2019 is a crucial document for residents of Colorado to accurately report their income and calculate their state income tax liability. By filling out the form correctly and submitting it on time, taxpayers can ensure compliance with state tax laws and avoid any penalties or interest on unpaid taxes.