As we move further into the digital age, many tasks that were once done on paper are now completed online. However, when it comes to filing income taxes, some individuals still prefer the old-fashioned method of filling out paper forms. There are several reasons why printable paper income tax forms are still relevant today.

One of the main reasons people choose to fill out paper income tax forms is convenience. Not everyone has access to a computer or may feel more comfortable with a pen and paper. Printable forms allow individuals to complete their taxes at their own pace without the need for an internet connection.

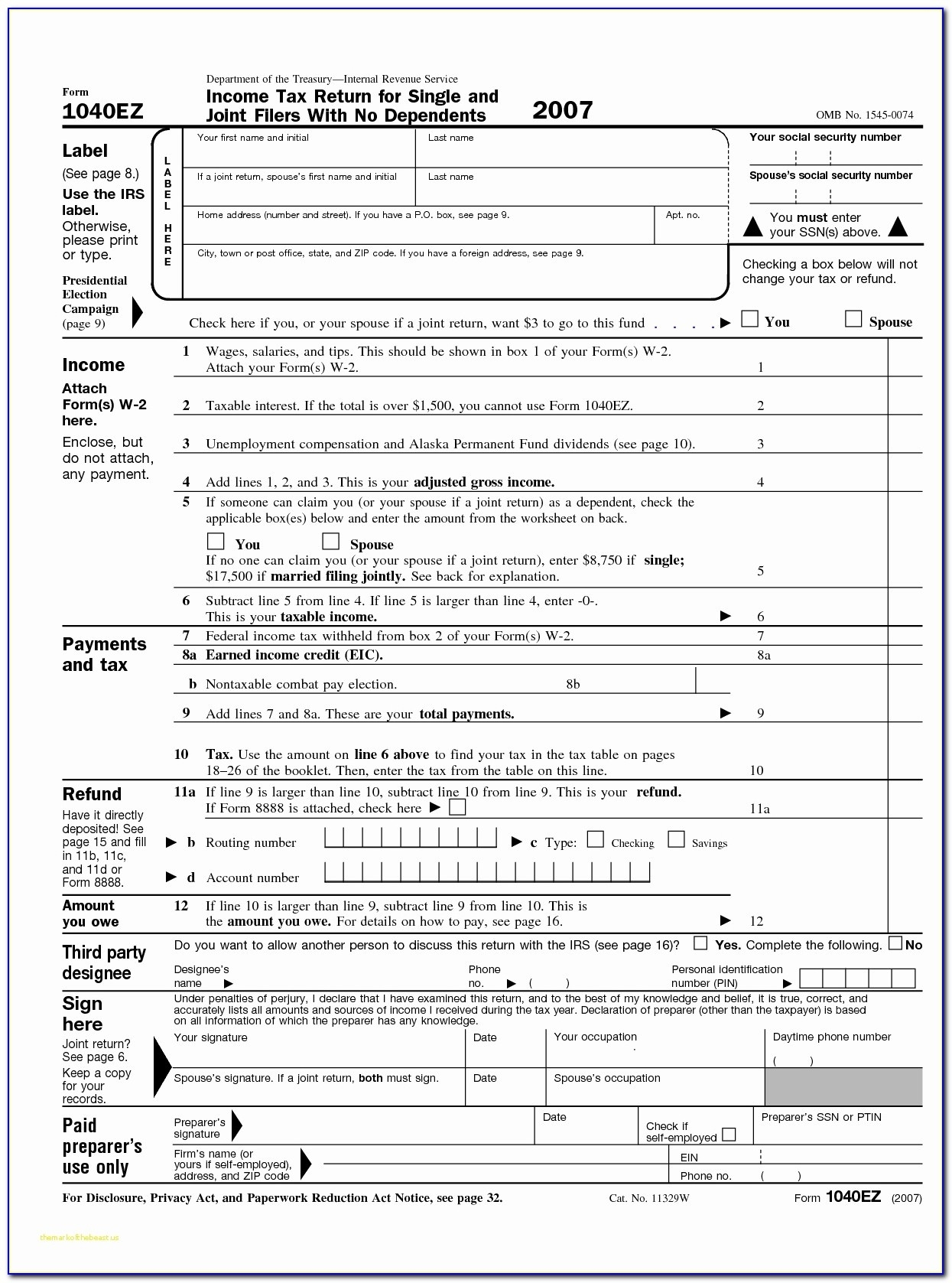

Printable Paper Income Tax Forms

Printable Paper Income Tax Forms

Another advantage of printable paper income tax forms is the ability to easily review and reference information. When filling out forms online, it can be challenging to go back and double-check calculations or verify data. With paper forms, individuals can easily flip through pages and make annotations as needed.

In addition, some individuals may have more complex tax situations that require additional schedules or forms. Printable paper forms often include these extra documents, making it easier for individuals to ensure they are completing all necessary paperwork for their specific tax situation.

Lastly, some individuals simply prefer the tactile experience of filling out paper forms. It can feel more satisfying to physically write out information and check off boxes than to type on a keyboard. For those who find comfort in the traditional method, printable paper income tax forms provide a sense of familiarity and ease.

In conclusion, while digital tax filing options continue to grow in popularity, printable paper income tax forms still have their place in today’s society. Whether for convenience, ease of use, or personal preference, paper forms offer a reliable and familiar way for individuals to complete their taxes. So, if you’re someone who enjoys the simplicity of pen and paper, don’t hesitate to reach for those printable forms come tax season.