As tax season approaches, it’s important to have all the necessary forms ready for filing your taxes. In 2013, there were several income tax forms that individuals and businesses needed to fill out in order to report their earnings and expenses to the IRS.

One of the most commonly used forms for individual taxpayers in 2013 was the Form 1040. This form is used to report an individual’s income, deductions, and credits for the year. It is important to fill out this form accurately and completely in order to avoid any potential issues with the IRS.

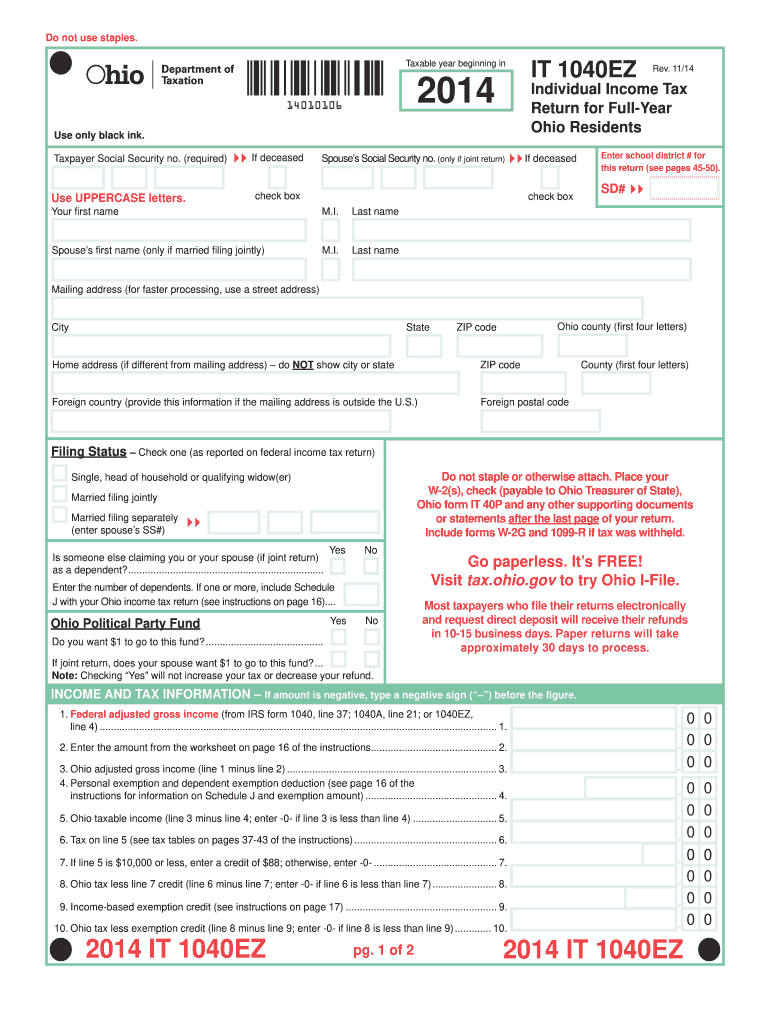

2013 Income Tax Forms Printable

2013 Income Tax Forms Printable

For those who are self-employed or have income from a business, the Form 1099-MISC was also a crucial document in 2013. This form is used to report miscellaneous income, such as earnings from freelance work or rental income. It’s important to report all sources of income on this form to ensure compliance with tax laws.

In addition to these forms, there were also various schedules and worksheets that individuals and businesses may have needed to fill out in 2013. These forms help calculate specific deductions and credits, such as the Schedule A for itemized deductions or the Schedule C for business income.

For individuals who received income from investments, the Form 1099-DIV and Form 1099-INT were important documents to have on hand in 2013. These forms report dividends and interest earned throughout the year, which must be reported on your tax return.

Overall, having all the necessary 2013 income tax forms printable and ready to fill out is essential for a smooth tax filing process. Make sure to gather all the required documents and information before starting your tax return to ensure accuracy and compliance with IRS regulations.