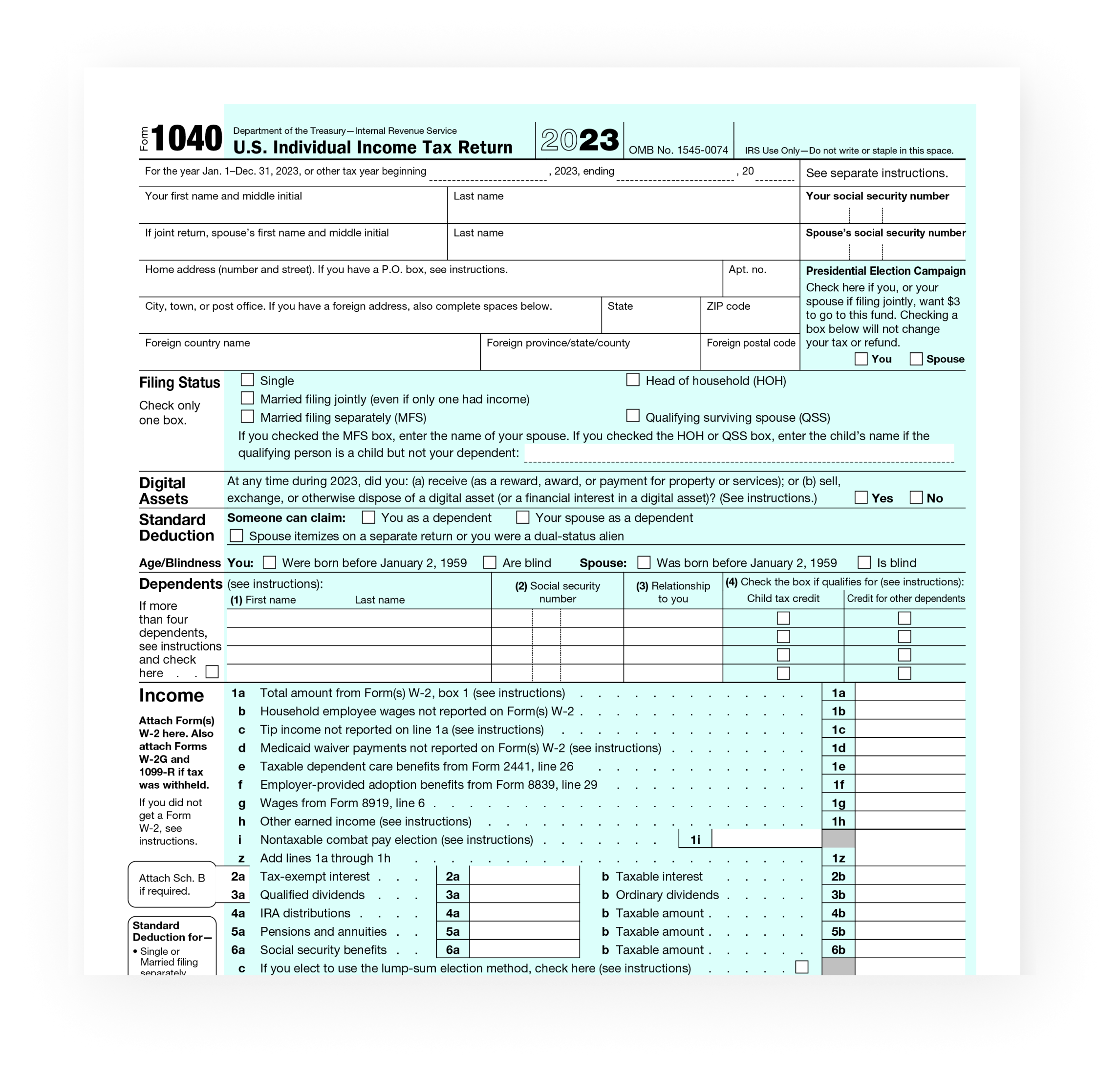

Filing your federal income tax return can be a daunting task, but having the necessary forms at your disposal can make the process much easier. The 2014 Federal Income Tax Form 1040 is an essential document for individuals who need to report their income and calculate their tax liability for the year.

By utilizing the printable 2014 Federal Income Tax Form 1040, taxpayers can accurately report their income, deductions, and credits to ensure they are meeting their tax obligations. This form is designed to capture all relevant financial information for the tax year, making it easier for individuals to file their taxes accurately and on time.

Printable 2014 Federal Income Tax Form 1040

Printable 2014 Federal Income Tax Form 1040

When completing the 2014 Federal Income Tax Form 1040, taxpayers must carefully follow the instructions provided to ensure they are reporting their income and deductions correctly. It is important to review all information entered on the form for accuracy and completeness before submitting it to the IRS.

One of the key benefits of using the printable 2014 Federal Income Tax Form 1040 is that it provides a clear and organized format for taxpayers to report their financial information. This can help individuals avoid mistakes and ensure they are claiming all eligible deductions and credits to minimize their tax liability.

Overall, the printable 2014 Federal Income Tax Form 1040 is a valuable tool for individuals who need to file their federal income tax return. By using this form, taxpayers can accurately report their income, deductions, and credits to ensure they are meeting their tax obligations for the year.

As tax season approaches, be sure to take advantage of the printable 2014 Federal Income Tax Form 1040 to help streamline the filing process and ensure you are meeting your tax obligations. By following the instructions provided on the form and carefully reviewing all information entered, you can file your taxes with confidence and accuracy.