As the year 2025 approaches, taxpayers are gearing up for another tax season. One of the most crucial aspects of filing taxes is obtaining the necessary forms to accurately report income, deductions, and credits. The IRS provides a range of forms that taxpayers can use to file their federal income taxes, including printable versions that can be easily accessed online.

With the convenience of printable tax forms, taxpayers can easily download and print the necessary documents from the comfort of their own homes. This eliminates the need to visit a physical location or wait for forms to be mailed out. As technology continues to advance, the IRS has made it simpler for taxpayers to access and submit their tax information electronically.

2025 Federal Income Tax Forms Printable

2025 Federal Income Tax Forms Printable

When it comes to filing taxes, accuracy is key. Using the correct forms ensures that taxpayers are reporting their financial information correctly and avoiding any potential mistakes that could lead to penalties or audits. The IRS provides a comprehensive list of forms for different types of income, deductions, and credits, making it easier for taxpayers to navigate the filing process.

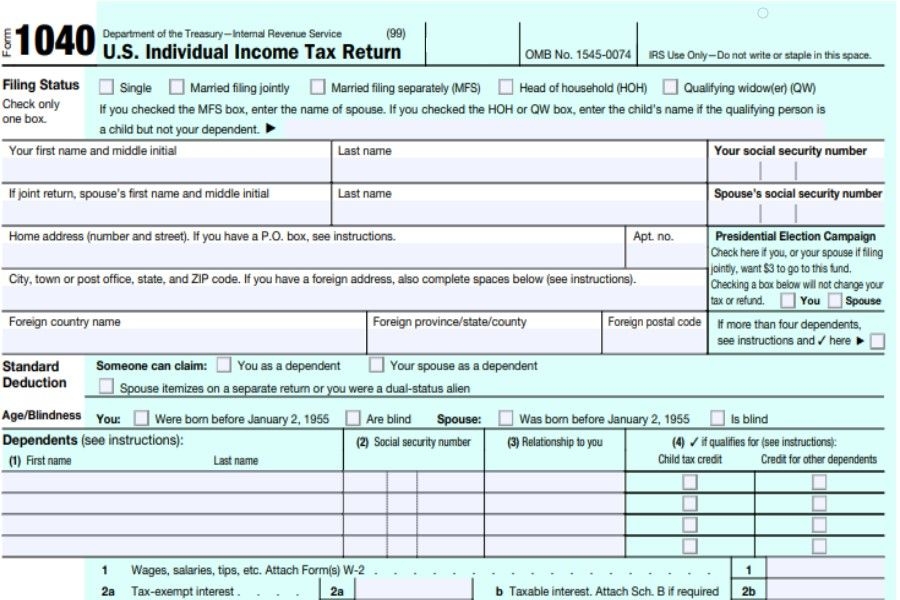

From Form 1040 for individual tax returns to Form 1099 for reporting various types of income, there are a variety of forms that taxpayers may need to file their federal income taxes. By utilizing printable versions of these forms, taxpayers can easily fill them out and submit them to the IRS either electronically or by mail. This streamlines the tax filing process and helps ensure that taxpayers meet the deadline for filing their taxes.

As the tax season approaches, it is important for taxpayers to familiarize themselves with the available forms and begin gathering the necessary documentation to accurately report their income. By utilizing printable tax forms, taxpayers can stay organized and on track with their tax filing responsibilities. Whether filing as an individual or a business, having access to printable tax forms can simplify the process and help taxpayers meet their obligations to the IRS.

In conclusion, the availability of printable federal income tax forms for the year 2025 provides taxpayers with a convenient and efficient way to file their taxes. By utilizing these forms, taxpayers can accurately report their income, deductions, and credits, ultimately ensuring compliance with IRS regulations. As technology continues to evolve, taxpayers can expect to see more streamlined processes for filing taxes in the future.