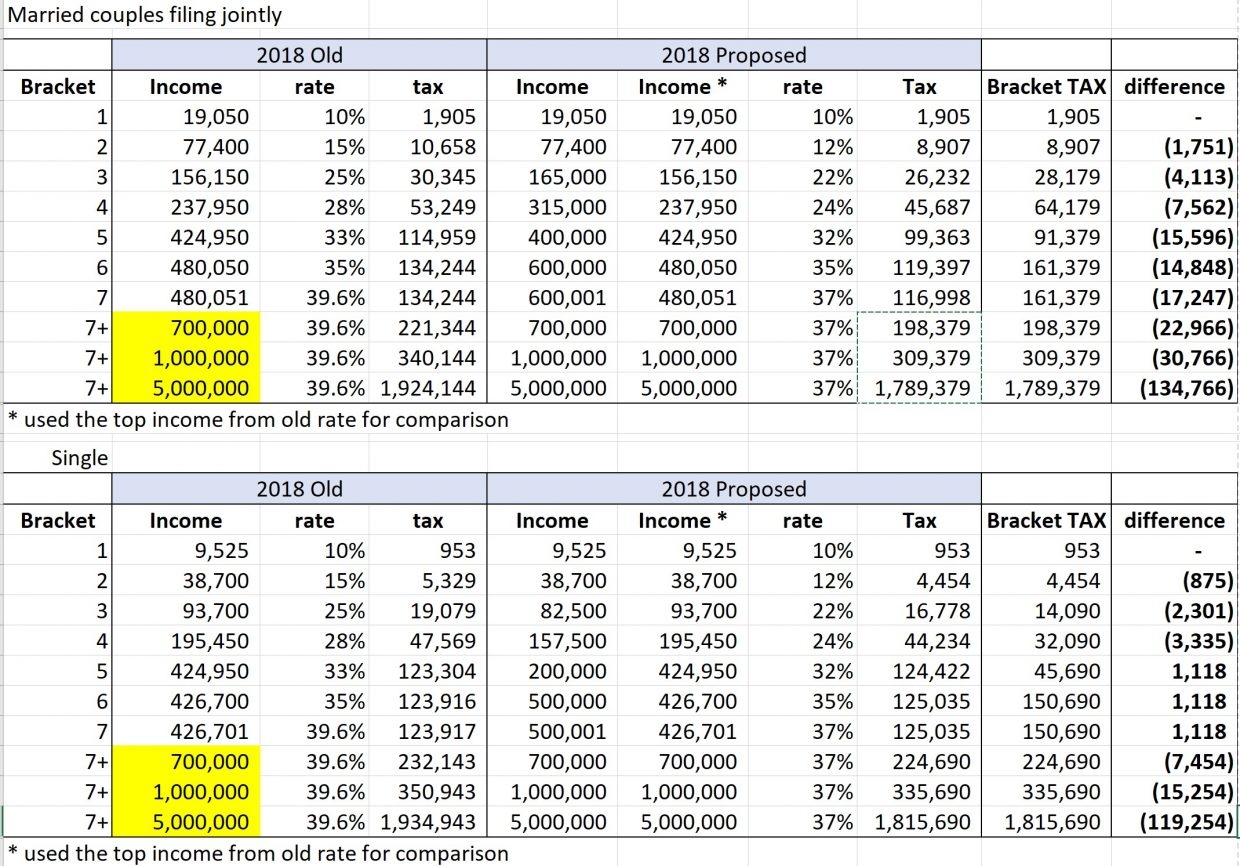

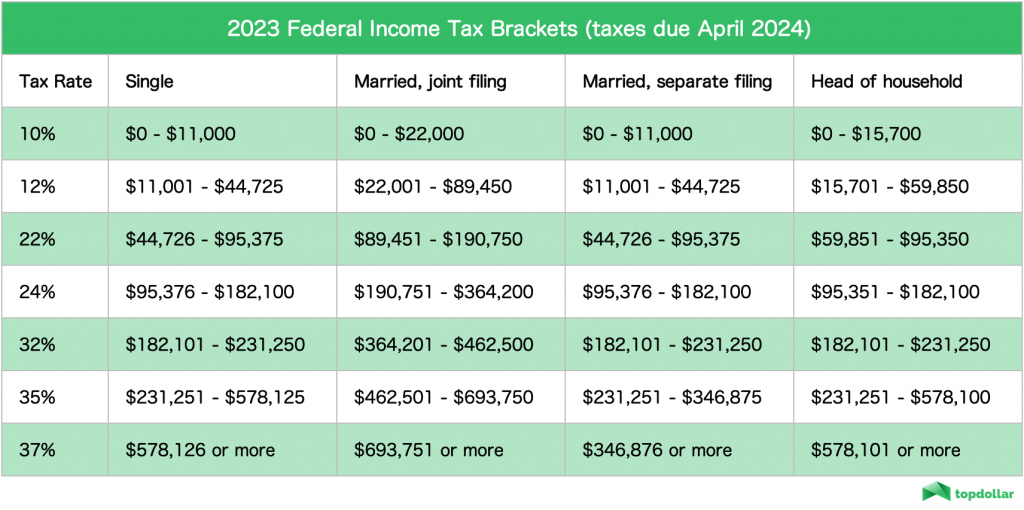

As the tax season approaches, many Americans are starting to gather their financial documents in preparation for filing their taxes. One important aspect to consider when filing your taxes is which federal income tax bracket you fall into. Understanding the federal income tax brackets for 2018 can help you determine how much you owe in taxes and plan accordingly.

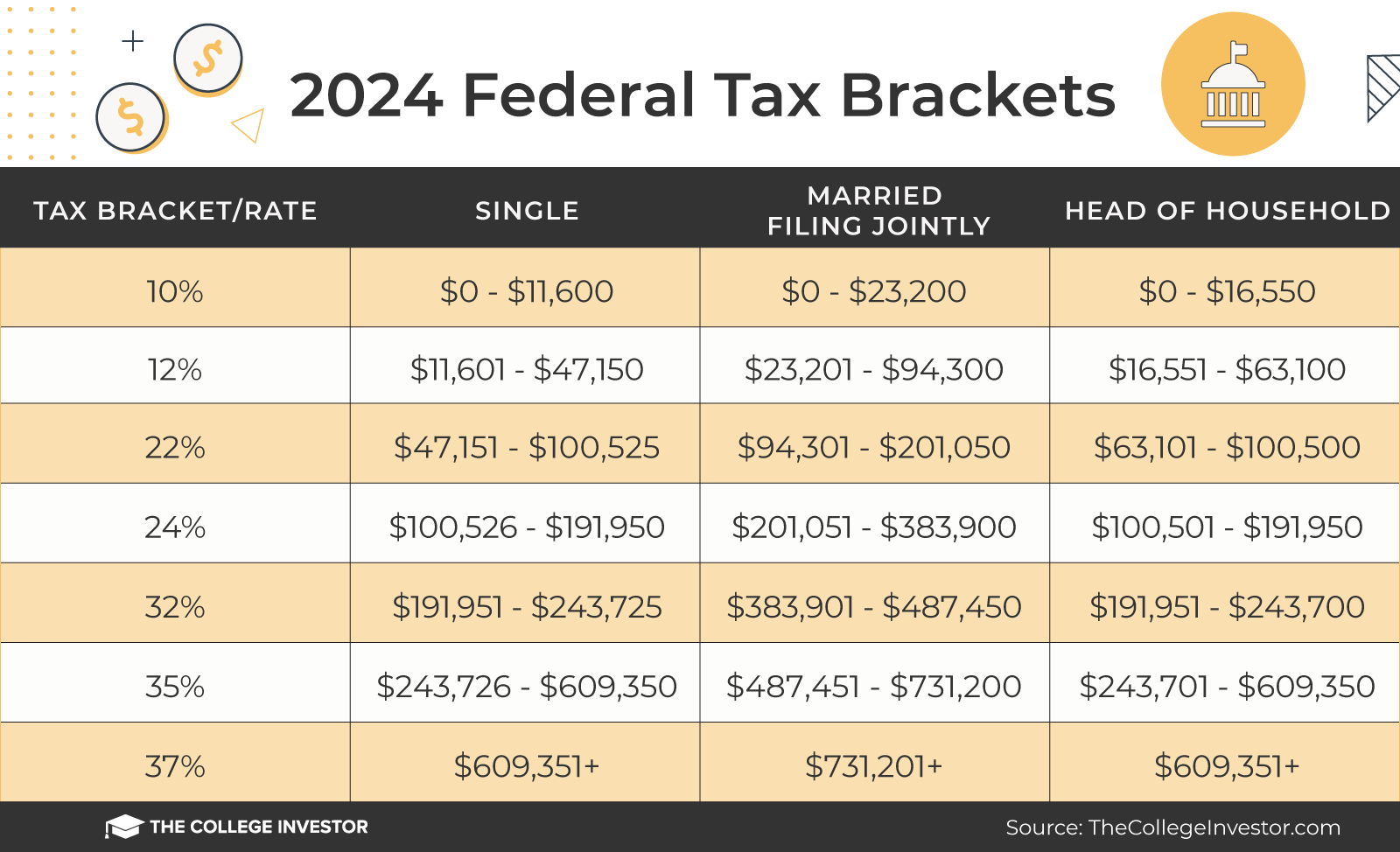

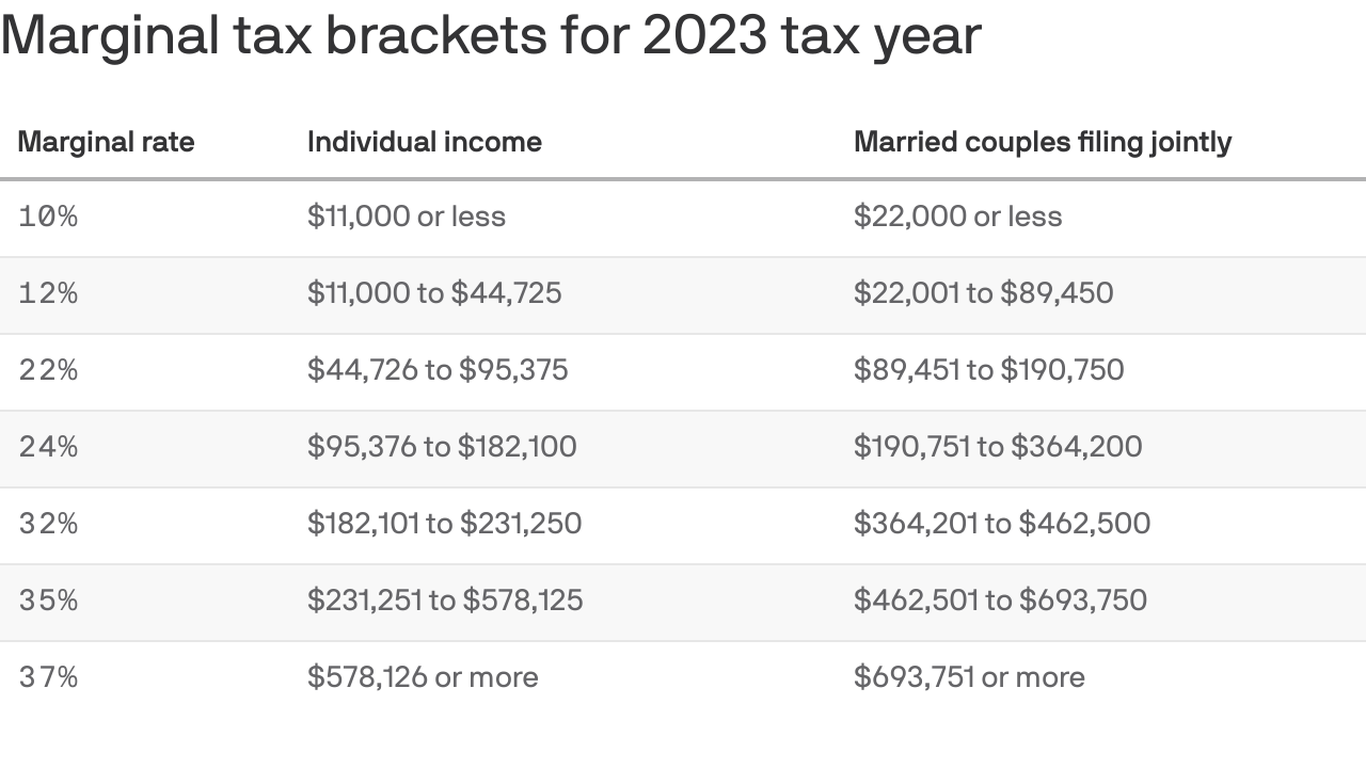

Each year, the IRS releases updated tax brackets based on inflation and changes in the tax code. For the tax year 2018, there are seven tax brackets ranging from 10% to 37%. The tax bracket you fall into is determined by your taxable income, which is your total income minus any deductions or credits you qualify for.

Federal Income Tax Bracket 2018 Chart Printable

Federal Income Tax Bracket 2018 Chart Printable

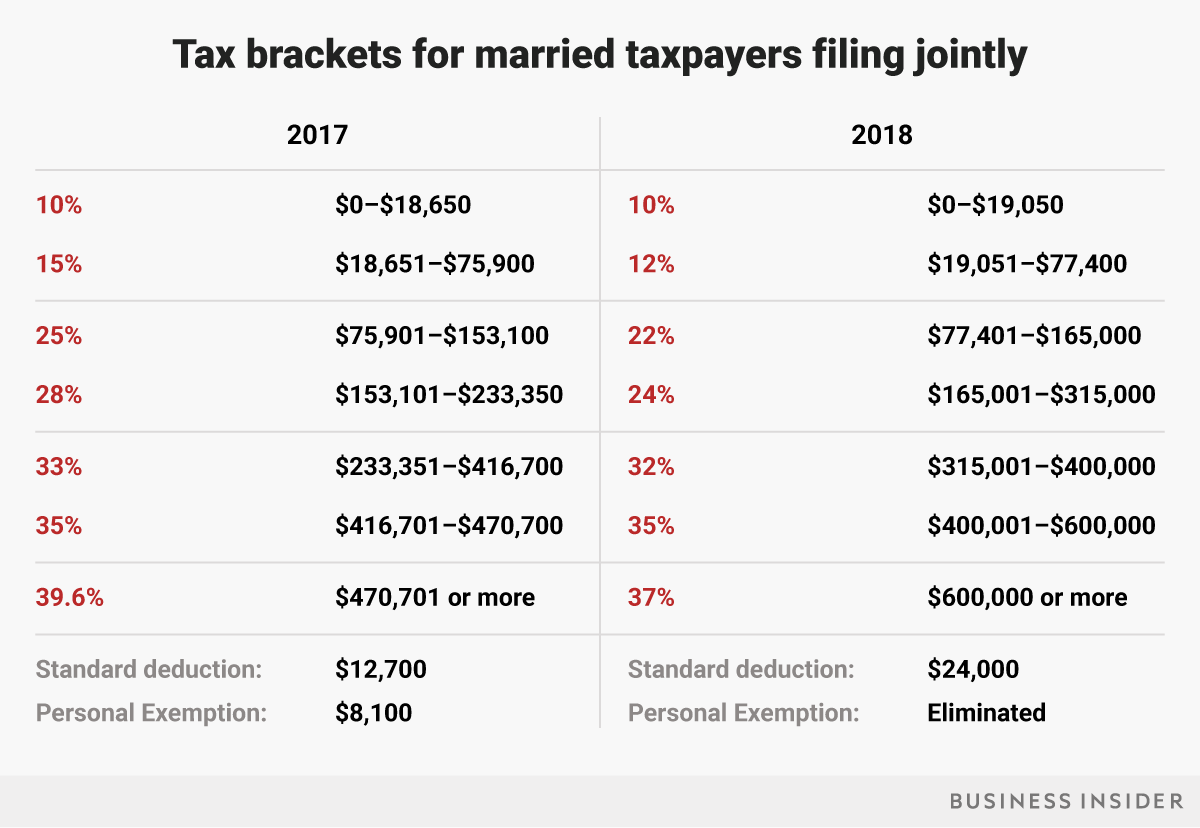

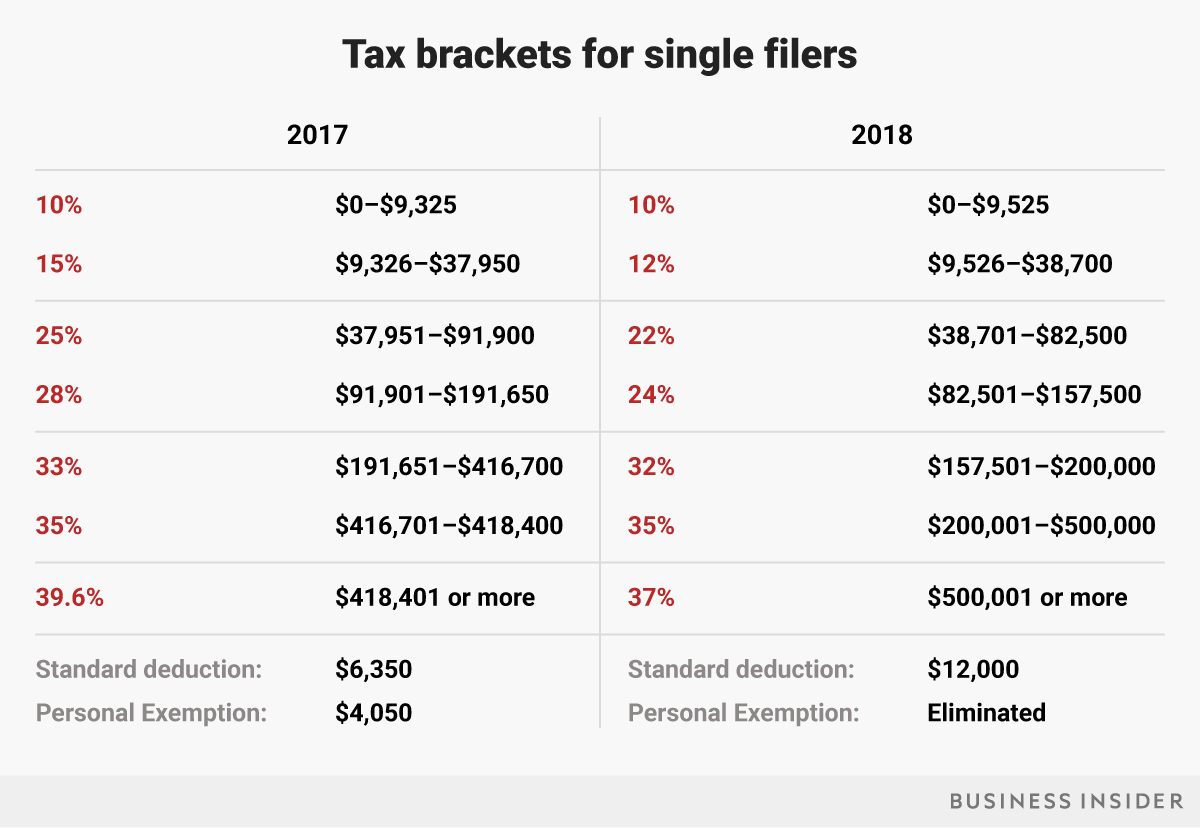

For single filers in 2018, the tax brackets are as follows:

- 10% on income up to $9,525

- 12% on income between $9,526 and $38,700

- 22% on income between $38,701 and $82,500

- 24% on income between $82,501 and $157,500

- 32% on income between $157,501 and $200,000

- 35% on income between $200,001 and $500,000

- 37% on income over $500,000

Married couples filing jointly have slightly different tax brackets, with the highest bracket starting at $600,000 of taxable income. It’s important to note that these tax brackets are based on taxable income, not gross income. This means that after accounting for deductions and credits, your taxable income may be lower than your actual earnings.

Having a printable federal income tax bracket chart for 2018 can be a helpful tool in determining how much you owe in taxes and planning your finances accordingly. By referencing the chart and knowing which tax bracket you fall into, you can better estimate your tax liability and make informed decisions about deductions and credits to maximize your tax savings.

In conclusion, understanding the federal income tax brackets for 2018 is essential for filing your taxes accurately and efficiently. By utilizing a printable tax bracket chart, you can easily determine your tax liability and plan your financial future with confidence.

Get and Print Federal Income Tax Bracket 2018 Chart Printable

Here 39 S How Your Tax Bracket Will Change In 2018 AOL Finance

Here 39 S How Your Tax Bracket Will Change In 2018 AOL Finance

Tax Bracket 2025 Philippines Kamilah Ryan

Tax Bracket 2025 Philippines Kamilah Ryan

2024 Income Tax Bracket Calculator Carol Cristen

2024 Income Tax Bracket Calculator Carol Cristen

Federal Income Tax Bracket 2025 Arlyn Caitrin

Federal Income Tax Bracket 2025 Arlyn Caitrin

Thank you for visiting our page! Whether you’re handling your personal budget or managing a side hustle, our income-tracking printable sheets are designed to help you stay organized. With user-friendly formats and customizable features, tracking your income has never been more effective. These templates are perfect for financial planning, preparing taxes, or organizing your income records. Try an income-tracking printable right away and feel the improvement in how you manage finances. Follow us for regular updates and useful resources. Organize your budgeting path—one printable at a time!