When it comes to tax season, many individuals and families are looking for ways to maximize their refunds. One way to do this is by taking advantage of the Earned Income Credit (EIC). This refundable tax credit is designed to help low to moderate-income individuals and families by reducing the amount of tax they owe and potentially providing a refund.

For those who qualify for the Earned Income Credit, it is important to fill out the necessary forms accurately to ensure they receive the maximum benefit. The Printable Earned Income Credit Form can be easily accessed online and printed out for convenience. This form will ask for information such as income, filing status, and number of qualifying children.

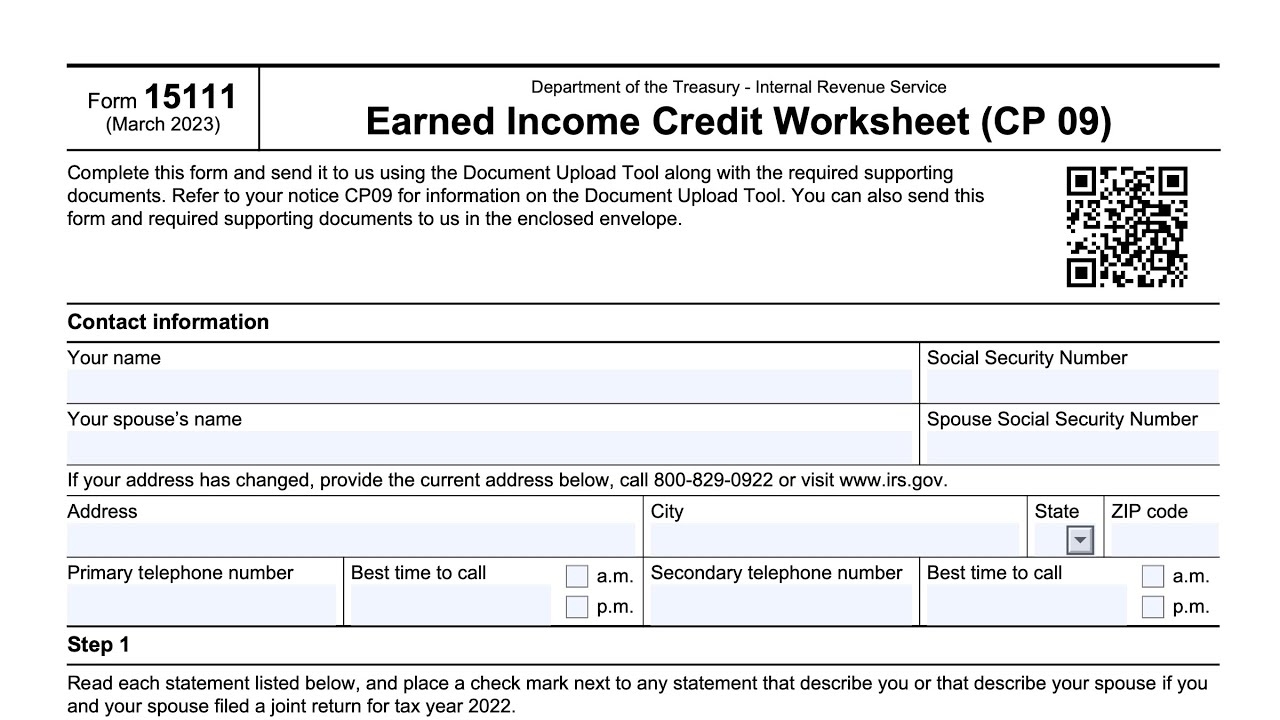

Printable Earned Income Credit Form

Printable Earned Income Credit Form

By filling out the Printable Earned Income Credit Form correctly, individuals and families can potentially receive a significant refund that can help with expenses such as bills, rent, or even savings for the future. It is important to take advantage of this credit if you qualify, as it can make a big difference in your financial situation.

Additionally, by utilizing the Printable Earned Income Credit Form, individuals can ensure that they are taking advantage of all available tax credits and deductions. This can help maximize their refund and potentially provide more financial stability.

Overall, the Printable Earned Income Credit Form is a valuable tool for those who qualify for this tax credit. By accurately filling out this form, individuals and families can potentially receive a significant refund that can help improve their financial situation. It is important to take advantage of all available resources during tax season to ensure you are getting the most out of your tax return.

So, if you qualify for the Earned Income Credit, make sure to utilize the Printable Earned Income Credit Form to maximize your refund and potentially improve your financial well-being. Don’t miss out on this valuable opportunity to secure a better financial future for yourself and your family.