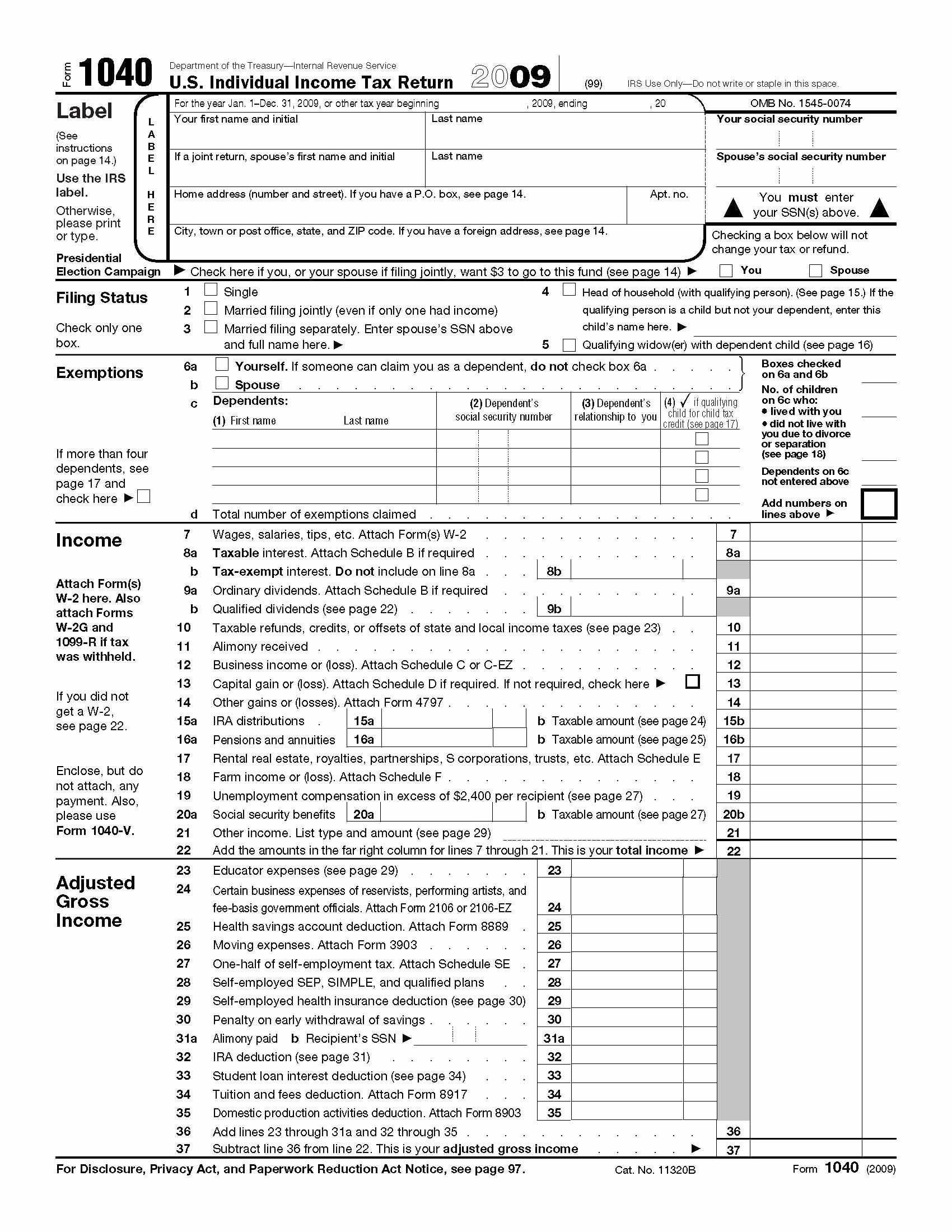

Filing your federal income tax can be a daunting task, but with the help of a printable Form 1040 ES, it can become a much more manageable process. This form is designed to help self-employed individuals, freelancers, and others with non-wage income estimate and pay their quarterly taxes.

By using this form, you can ensure that you are meeting your tax obligations throughout the year and avoid any potential penalties or interest charges. It provides a clear breakdown of your income, deductions, and credits, making it easier to calculate your estimated tax liability.

A Printable Forum 1040 Es Federal Income Tax

A Printable Forum 1040 Es Federal Income Tax

A Printable Forum 1040 Es Federal Income Tax

The Form 1040 ES is divided into four quarterly sections, each with its own payment due dates. This allows you to stay on top of your tax payments and avoid any surprises come tax season. By filling out this form accurately and on time, you can ensure that you are in compliance with federal tax laws.

One of the key benefits of using Form 1040 ES is that it helps you avoid underpayment penalties. By estimating your tax liability and making quarterly payments, you can spread out the financial burden of your taxes and avoid any hefty penalties that may arise if you wait until the end of the year to pay.

Overall, a printable Form 1040 ES can be a valuable tool for self-employed individuals and others with non-wage income. By utilizing this form, you can stay organized, avoid penalties, and ensure that you are meeting your tax obligations throughout the year. So, if you fall into this category, be sure to take advantage of this resource to make your tax filing process a smooth and stress-free experience.

In conclusion, the Form 1040 ES is a valuable resource for self-employed individuals and others with non-wage income. By using this form to estimate and pay your quarterly taxes, you can stay on top of your tax obligations and avoid any potential penalties. So, take advantage of this printable form to simplify your tax filing process and ensure compliance with federal tax laws.