Filing taxes can be a daunting task, but having the right forms can make the process much smoother. For Pennsylvania residents, the PA State Income Tax Forms 2012 are essential for accurately reporting income and deductions for that tax year. These forms provide a clear structure for taxpayers to follow and ensure compliance with state tax laws.

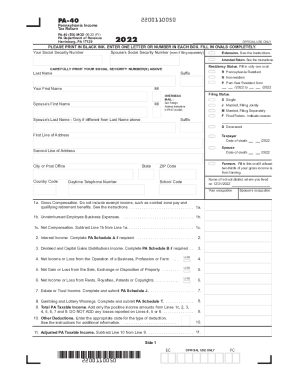

Whether you are a full-time resident, part-time resident, or nonresident of Pennsylvania, the PA State Income Tax Forms 2012 Printable are available for download on the Pennsylvania Department of Revenue website. These forms include the PA-40 for residents, PA-20S/PA-65 for partnerships and S corporations, and PA-41 for fiduciaries. It is important to use the correct form based on your filing status to avoid any delays or penalties.

Pa State Income Tax Forms 2012 Printable

Pa State Income Tax Forms 2012 Printable

When filling out the PA State Income Tax Forms 2012, taxpayers will need to provide information on their income, deductions, credits, and any taxes withheld. This includes details on wages, interest, dividends, retirement income, and any other sources of income earned during the tax year. Deductions such as mortgage interest, property taxes, and charitable contributions can also be claimed to reduce taxable income.

Once the forms are completed, taxpayers can either file electronically or mail them to the Pennsylvania Department of Revenue. Electronic filing is the preferred method as it is faster, more secure, and ensures accurate processing of tax returns. If mailing the forms, it is important to double-check all information and include any required documentation to avoid processing delays.

Overall, the PA State Income Tax Forms 2012 Printable provide a comprehensive guide for Pennsylvania residents to accurately report their income and deductions for the tax year. By using the correct form and following the instructions carefully, taxpayers can ensure compliance with state tax laws and avoid any penalties or audits. Be sure to download the forms from the official Pennsylvania Department of Revenue website to access the most up-to-date versions for the 2012 tax year.

In conclusion, having the right forms is crucial for filing taxes accurately and efficiently. The PA State Income Tax Forms 2012 Printable offer Pennsylvania residents a structured way to report their income and deductions for that tax year. By following the instructions and using the correct form based on your filing status, you can ensure compliance with state tax laws and avoid any potential issues with your tax return.