As tax season approaches, many Americans are gearing up to file their federal income taxes for the year 2017. One of the key components of this process is obtaining the necessary forms to report income, deductions, and credits accurately. Fortunately, the Internal Revenue Service (IRS) provides printable forms that can be easily accessed and filled out by taxpayers.

With the deadline for filing taxes quickly approaching, it’s essential for individuals to have the proper forms in hand to avoid any delays or penalties. Whether you are filing as a single individual, married couple, or business entity, there are specific forms that must be completed to ensure compliance with federal tax laws.

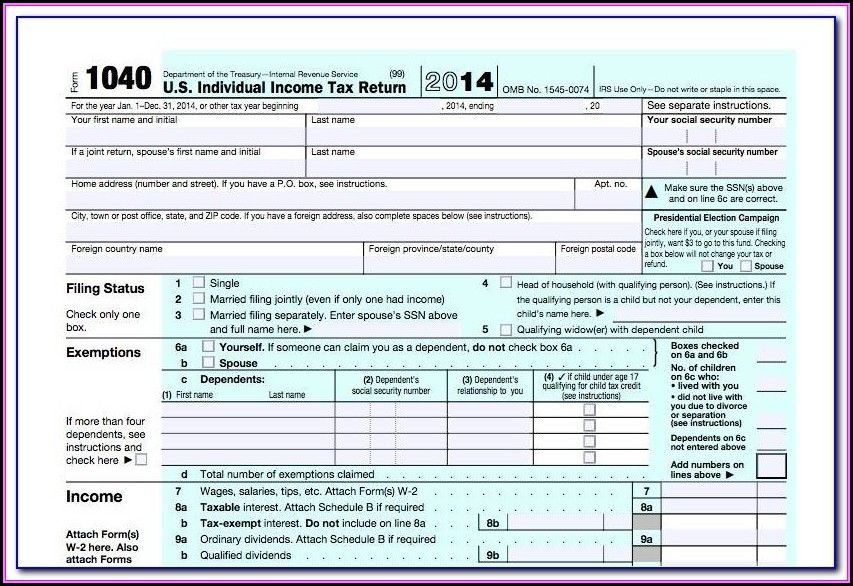

2017 Printable Federal Income Tax Forms

2017 Printable Federal Income Tax Forms

One of the most commonly used forms for individual taxpayers is the Form 1040, which is used to report income, deductions, and credits for the tax year 2017. Additionally, there are various schedules and worksheets that may need to be included with Form 1040, depending on the taxpayer’s specific financial situation.

For those who are self-employed or have income from sources other than traditional employment, additional forms such as Schedule C (Profit or Loss from Business) or Schedule D (Capital Gains and Losses) may be required. These forms provide a detailed breakdown of income and expenses related to specific types of income, such as freelance work or investments.

It is important for taxpayers to carefully review the instructions for each form they are required to file to ensure accuracy and completeness. Failing to provide accurate information could result in delays in processing your tax return or, in some cases, penalties for underreporting income or claiming false deductions.

By utilizing the printable federal income tax forms provided by the IRS, taxpayers can ensure that they are meeting their obligations and accurately reporting their financial information for the year 2017. These forms are readily available on the IRS website and can be easily downloaded and printed for convenience. With the proper forms in hand, taxpayers can navigate the tax filing process with confidence and ease.

As tax season comes to a close, it is crucial for individuals to file their federal income taxes accurately and on time. By using the printable forms provided by the IRS, taxpayers can streamline the filing process and avoid potential errors or penalties. Remember to double-check all information before submitting your tax return to ensure compliance with federal tax laws.