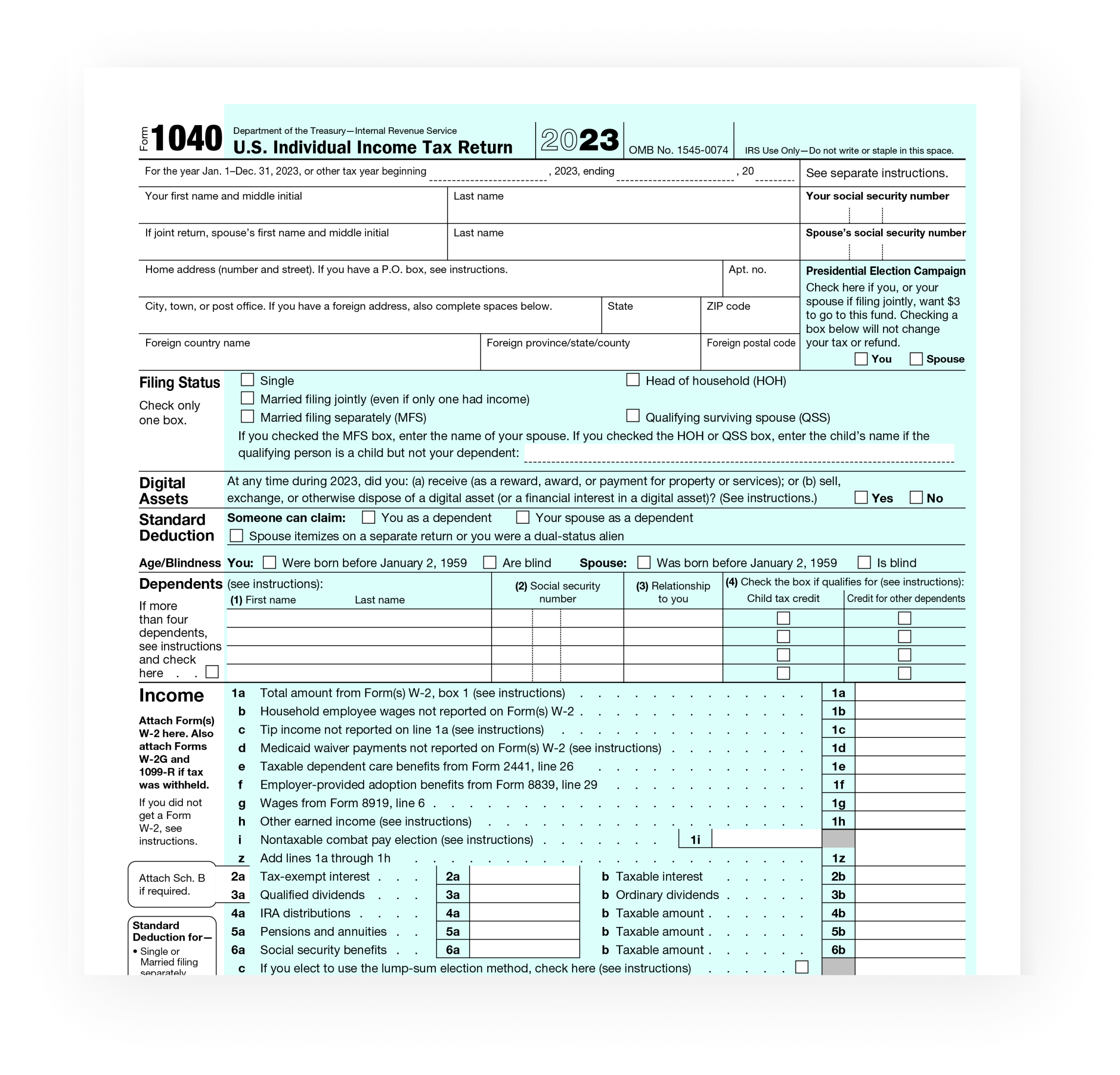

When tax season rolls around, it’s important to have all the necessary forms and documents in order to ensure a smooth and accurate filing process. One of the most crucial components of this process is having access to printable income tax forms. These forms provide taxpayers with a way to easily and conveniently report their income, deductions, and other financial information to the IRS.

Printable income tax forms are readily available online through the IRS website or various tax preparation software programs. These forms come in a variety of formats, including PDF and fillable online forms, making it easy for taxpayers to choose the option that works best for them. By having access to printable forms, taxpayers can ensure they have all the necessary documents at their fingertips when it comes time to file their taxes.

One of the key benefits of printable income tax forms is the ability to fill them out at your own pace and convenience. Whether you prefer to complete your forms in one sitting or over the course of several days, printable forms allow you to work on them whenever and wherever you choose. This can help reduce stress and ensure that you have all the information you need to accurately report your income and deductions.

Another advantage of printable income tax forms is the ability to save a copy for your records. By downloading and saving a copy of your completed forms, you can easily refer back to them in the future if needed. This can be especially helpful in the event of an audit or if you need to provide proof of your tax filings for any reason.

In conclusion, printable income tax forms play a vital role in the tax filing process. By providing taxpayers with easy access to the necessary documents, these forms help ensure a smooth and accurate filing experience. Whether you choose to fill out your forms online or on paper, having printable income tax forms at your disposal can make the tax season a little less stressful.