As the tax season approaches, it is important for taxpayers to gather all necessary documents to file their income tax returns for the year 2016. One of the essential documents needed for this process is the income tax form for the year 2016. These forms provide taxpayers with a detailed outline of their income, deductions, and credits for the year.

It is crucial for taxpayers to accurately fill out these forms to avoid any potential penalties or audits from the IRS. The IRS provides printable versions of these forms on their official website for taxpayers to easily access and fill out.

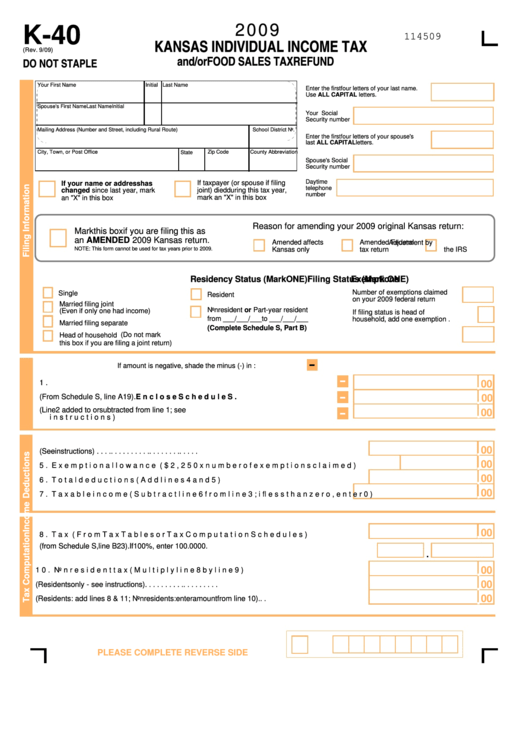

2016 Income Tax Forms Printable

2016 Income Tax Forms Printable

When filling out the 2016 income tax forms, taxpayers will need to provide information such as their income from various sources, deductions they are eligible for, and any tax credits they may qualify for. It is important to double-check all information entered on the forms to ensure accuracy.

Additionally, taxpayers should keep a copy of their completed forms for their records and submit them before the deadline to avoid any late filing penalties. The IRS typically requires taxpayers to file their income tax returns by April 15th of the following year.

Overall, having access to printable 2016 income tax forms makes the tax filing process easier and more convenient for taxpayers. By carefully filling out these forms and submitting them on time, taxpayers can ensure compliance with tax laws and avoid any potential issues with the IRS.

As the tax season comes around, taxpayers should take the time to gather all necessary documents and fill out their income tax forms accurately. By utilizing the printable 2016 income tax forms provided by the IRS, taxpayers can streamline the tax filing process and ensure compliance with tax laws.