As we approach the tax season, it is essential to be prepared with all the necessary forms to file your income taxes accurately. The IRS Income Tax Forms for 2024 are now available for taxpayers to download, print, and fill out. These forms are crucial for reporting your income, deductions, credits, and other financial information to the IRS.

Whether you are an individual taxpayer, a business owner, or self-employed, you will need to use the appropriate IRS Income Tax Forms to report your income and pay any taxes owed. Having these forms ready will help streamline the tax filing process and ensure that you meet the filing deadline without any last-minute stress.

Irs Income Tax Forms 2024 Printable

Irs Income Tax Forms 2024 Printable

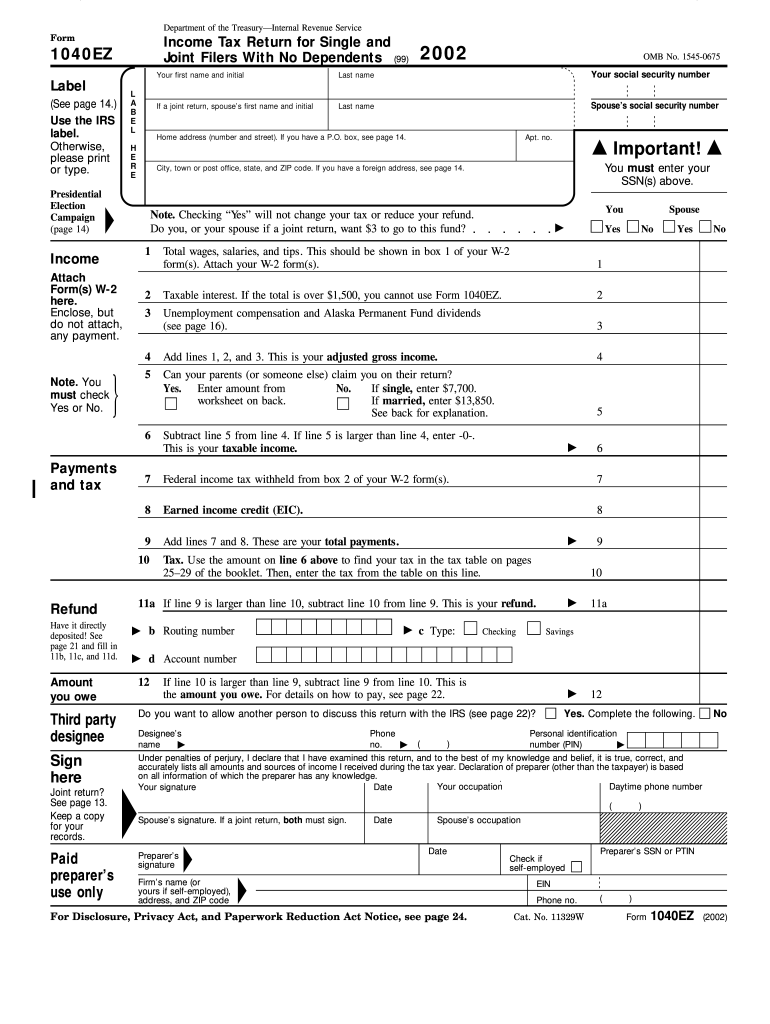

When it comes to filing your taxes, it is essential to use the correct forms to avoid any errors or delays in processing. The IRS Income Tax Forms for 2024 include forms such as the 1040, 1040A, and 1040EZ for individual taxpayers, as well as various schedules and worksheets for reporting specific types of income and deductions.

For business owners and self-employed individuals, there are forms such as the 1065 for partnerships, 1120 for corporations, and Schedule C for reporting business income and expenses. These forms are essential for accurately reporting your financial information to the IRS and calculating the amount of tax you owe.

By using the IRS Income Tax Forms for 2024, you can ensure that you are compliant with federal tax laws and avoid any penalties or fines for incorrect or late filing. It is crucial to review the instructions for each form carefully and seek professional assistance if needed to ensure that your taxes are filed accurately and on time.

In conclusion, the IRS Income Tax Forms for 2024 are now available for taxpayers to download, print, and fill out. By using the correct forms and following the instructions carefully, you can ensure a smooth tax filing process and avoid any potential issues with the IRS. Be sure to gather all the necessary documents and information before starting to fill out your tax forms to make the process as efficient and accurate as possible.