As tax season approaches, it’s important to gather all necessary documents and information to ensure a smooth filing process. One way to stay organized is by using a printable income tax checklist. This checklist will help you keep track of all the required paperwork and ensure you don’t miss any important deductions or credits.

Whether you’re filing your taxes on your own or using a professional tax preparer, having a checklist can save you time and stress. By checking off each item as you gather it, you can feel confident that you have everything you need to accurately file your taxes and potentially maximize your refund.

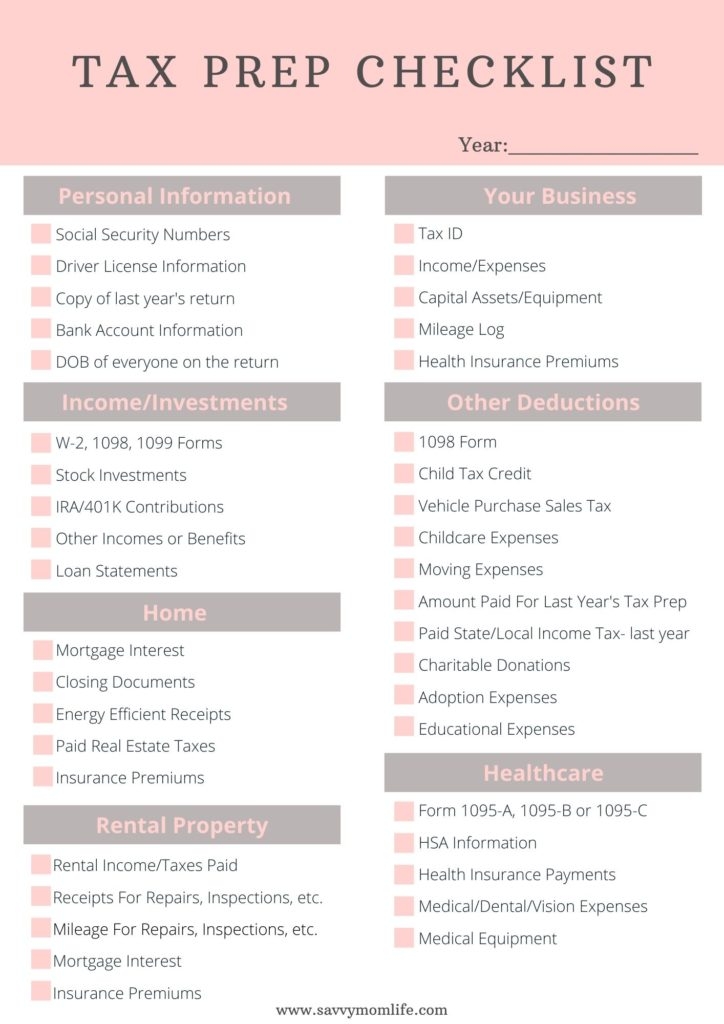

Printable Income Tax Checklist

Printable Income Tax Checklist

Printable Income Tax Checklist

Here are some common items that may be included in a printable income tax checklist:

- W-2 forms from all employers

- 1099 forms for any additional income

- Receipts for deductible expenses (such as medical expenses, charitable donations, and business expenses)

- Proof of any additional income (such as rental income or investment earnings)

- Social Security numbers for yourself, your spouse, and any dependents

By using a printable income tax checklist, you can ensure that you have all necessary documentation in one place and avoid any last-minute scrambling to find missing paperwork. This can help streamline the tax filing process and reduce the risk of errors on your return.

It’s important to review the checklist carefully and make sure you have everything you need before starting your tax return. If you’re missing any documents, reach out to the appropriate sources (such as employers or financial institutions) to request copies as soon as possible.

In conclusion, utilizing a printable income tax checklist can help simplify the tax filing process and ensure you don’t miss any important details. By staying organized and keeping track of all necessary documents, you can file your taxes accurately and potentially receive the maximum refund or reduce any tax liability. Take the time to gather all required paperwork and use the checklist to guide you through the process, making tax season a little less stressful.