When tax season rolls around, many individuals are scrambling to gather all their necessary documents and information to file their taxes. One essential form that taxpayers may need is the IRS Form 1040ez. This form is designed for individuals with straightforward tax situations and is the simplest of the 1040 series forms.

For those who are looking to file their taxes quickly and easily, the 1040ez form is a great option. It is specifically designed for individuals who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000. By using this form, taxpayers can streamline the filing process and potentially receive their tax refund sooner.

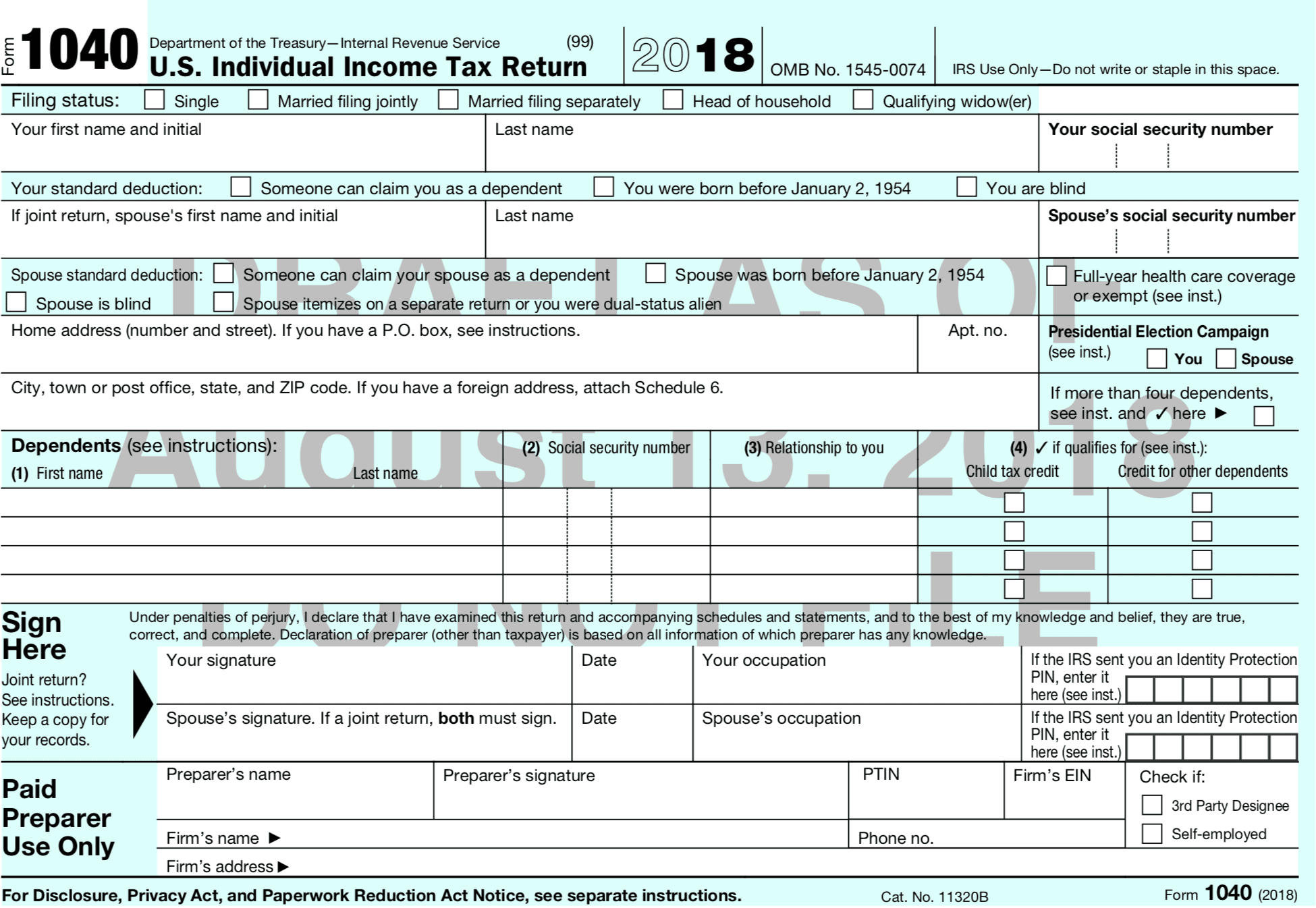

Printable Income Tax Forms 1040ez

Printable Income Tax Forms 1040ez

Printable versions of the 1040ez form can be easily found online. Taxpayers can visit the IRS website or other reputable tax preparation websites to download and print the form. Having a printable version of the form allows individuals to fill it out at their own pace and double-check their information before submitting it.

When filling out the 1040ez form, taxpayers will need to provide their personal information, income details, and any deductions or credits they may be eligible for. It is important to carefully review the form and ensure that all information is accurate to avoid any delays or errors in processing. Once the form is completed, individuals can either file it electronically or mail it to the IRS.

Overall, the 1040ez form is a convenient option for individuals with simple tax situations who are looking to file their taxes quickly and efficiently. By utilizing the printable version of the form, taxpayers can easily access and complete the necessary paperwork to fulfill their tax obligations. Whether filing online or by mail, the 1040ez form provides a straightforward way for individuals to meet their tax filing requirements.

As tax season approaches, it is important for individuals to be prepared and organized when filing their taxes. By utilizing the printable Income Tax Forms 1040ez, taxpayers can simplify the process and ensure that their tax obligations are met in a timely manner.