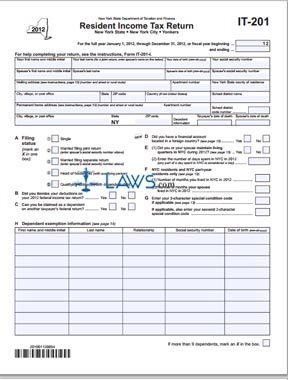

As tax season approaches, it’s important for individuals to have access to the necessary forms to file their taxes accurately and efficiently. One such form is the 2018 Income Tax Form IT-201, which is used by New York State residents to report their income and calculate their state tax liability.

Completing the IT-201 form can be a daunting task for some taxpayers, but having a printable version of the form can make the process much easier. By having the form in a printable format, individuals can fill it out at their own pace and have a physical copy for their records.

2018 Income Tax Form It-201 Printable

2018 Income Tax Form It-201 Printable

When filling out the 2018 Income Tax Form IT-201, taxpayers will need to provide information such as their income, deductions, and credits. It’s important to double-check all information entered on the form to ensure accuracy and avoid any potential errors that could lead to penalties or delays in processing.

One key benefit of using the printable IT-201 form is that it allows taxpayers to take their time and review their information before submitting it. This can help reduce the likelihood of mistakes and ensure that all necessary details are included for an accurate tax return.

After completing the form, individuals can either mail it to the appropriate tax agency or submit it electronically, depending on their preference. It’s important to keep a copy of the completed form for your records and to track the status of your tax return.

Overall, having access to the printable 2018 Income Tax Form IT-201 can make the tax filing process more efficient and less stressful for individuals. By taking the time to accurately complete the form and submit it on time, taxpayers can ensure that they are in compliance with state tax laws and avoid any potential issues down the road.

As tax season comes to a close, it’s important for individuals to stay informed and up-to-date on the latest tax forms and regulations. By utilizing resources such as the printable IT-201 form, taxpayers can make the process of filing their taxes as smooth and hassle-free as possible.