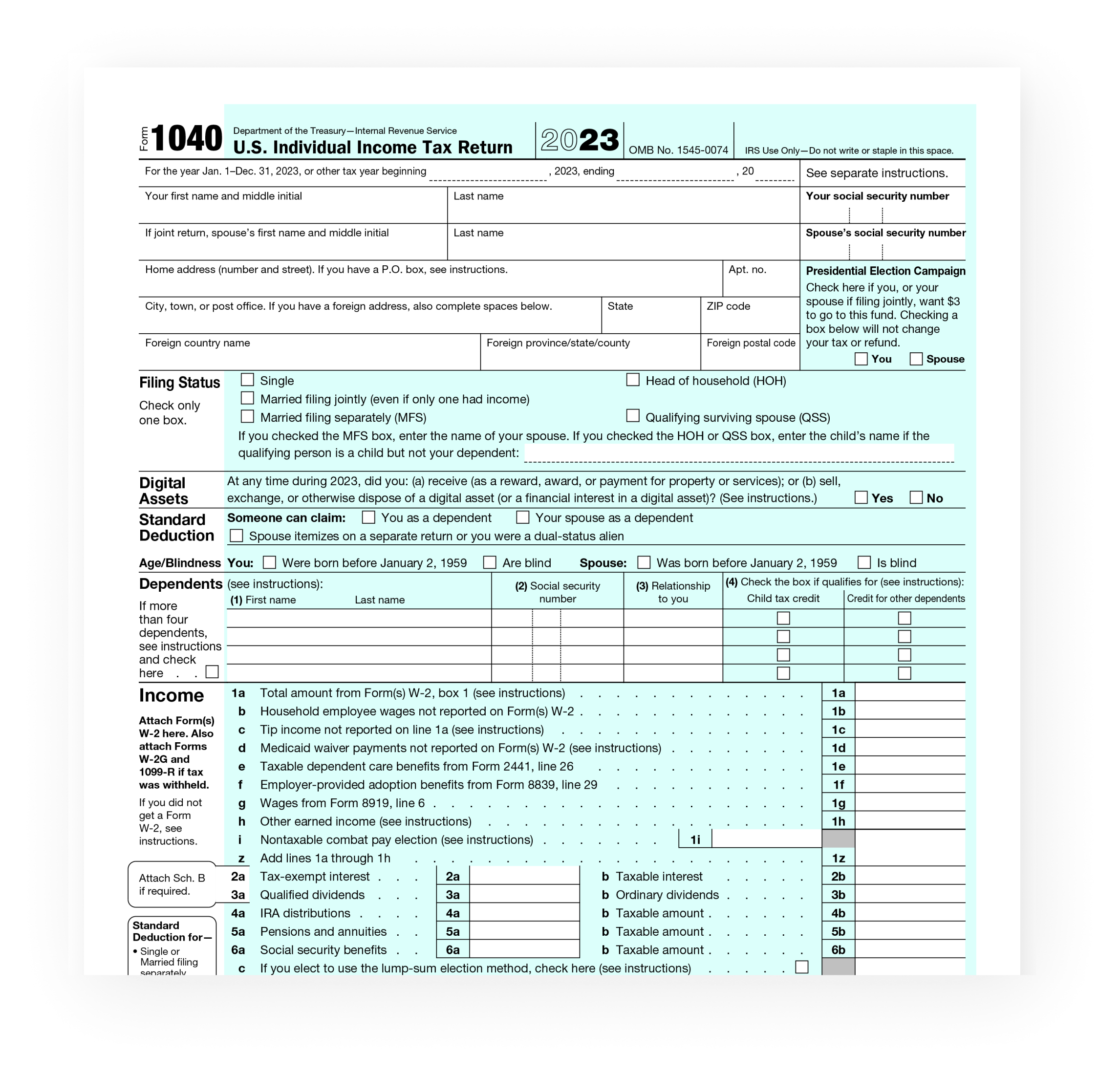

Filing your federal income taxes can be a daunting task, but having the right form can make the process much easier. The 2018 Federal Income Tax Form 1040 is a crucial document that individuals use to report their annual income and determine how much tax they owe or are owed by the government.

Whether you are filing as an individual, married couple, or head of household, the 2018 Federal Income Tax Form 1040 provides a comprehensive overview of your financial situation for the year. It is important to accurately fill out this form to avoid any penalties or delays in receiving your tax refund.

Printable 2018 Federal Income Tax Form 1040

Printable 2018 Federal Income Tax Form 1040

The 2018 Federal Income Tax Form 1040 is available for download and printing online. This printable form can be easily accessed from the IRS website or other reputable tax preparation websites. Once you have the form in hand, you can begin filling in your personal information, income, deductions, and credits to calculate your final tax liability.

It is important to note that the 2018 Federal Income Tax Form 1040 may have undergone some changes compared to previous years, so it is crucial to carefully review the instructions and guidelines provided with the form. If you have any questions or need assistance, it is recommended to seek help from a tax professional or use tax preparation software to ensure accuracy and compliance with tax laws.

After completing the 2018 Federal Income Tax Form 1040, you can file your taxes electronically or mail the form to the IRS. Be sure to keep a copy of your completed form for your records and to track any potential refunds or payments. Filing your taxes on time and accurately can help you avoid penalties and ensure a smooth tax season.

In conclusion, the 2018 Federal Income Tax Form 1040 is a crucial document for individuals to report their annual income and calculate their tax liability. By utilizing this printable form and following the instructions provided, you can effectively file your taxes and stay compliant with tax laws. Make sure to file your taxes on time and accurately to avoid any issues with the IRS and to receive any refunds owed to you.