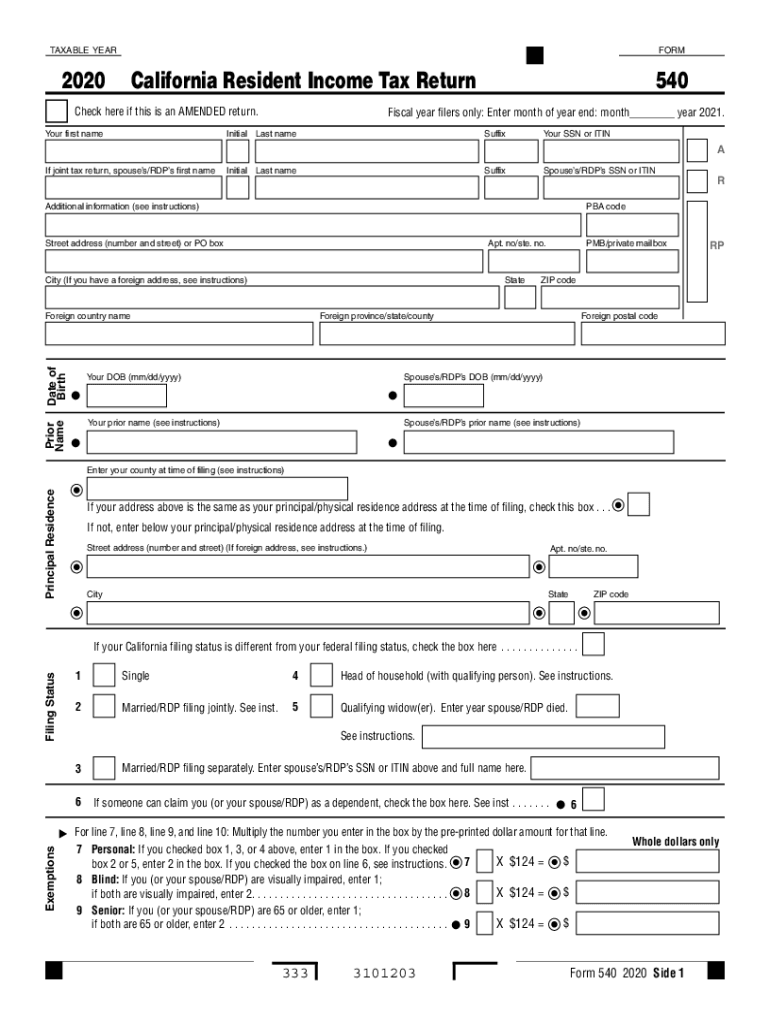

When it comes to filing your income taxes in California, it’s important to understand the instructions provided on the Form 540. This form is used by California residents to report their income, deductions, credits, and calculate their tax liability. By following the instructions carefully, you can ensure that your tax return is accurate and complete.

Whether you are filing your taxes online or by mail, it’s crucial to have a clear understanding of the Form 540 instructions to avoid any errors or delays in processing your return. These instructions provide detailed guidance on how to fill out each section of the form, including where to report different types of income and deductions.

California Resident Income Tax Return 540 Printable Instructions

California Resident Income Tax Return 540 Printable Instructions

Instructions

1. Start by entering your personal information, including your name, address, and Social Security number, at the top of the form. Make sure this information is accurate and up to date to prevent any issues with your return.

2. Next, report your income from various sources, such as wages, interest, dividends, and rental income, in the appropriate sections of the form. Be sure to include all necessary documentation, such as W-2s and 1099s, to support your income figures.

3. Deductions and credits can help reduce your tax liability, so be sure to take advantage of any deductions you qualify for, such as mortgage interest, charitable contributions, and education expenses. Follow the instructions on the form to report these deductions accurately.

4. Finally, calculate your tax liability based on your total income and deductions. The Form 540 instructions provide a tax table to help you determine the amount of tax you owe based on your filing status and income level. Make sure to double-check your calculations to avoid any mistakes.

5. Once you have completed the form and reviewed all the instructions, sign and date your return before submitting it to the California Franchise Tax Board. If filing electronically, follow the e-file instructions provided on the form or through the FTB website.

By following the California Resident Income Tax Return 540 Printable Instructions carefully, you can ensure that your tax return is filed accurately and on time. If you have any questions or need further assistance, consider seeking help from a tax professional or contacting the FTB directly for guidance.