As the tax season approaches, it’s important to understand the federal income tax brackets for the year 2018. These brackets determine the percentage of your income that you owe in taxes, based on your filing status and income level. Knowing where you fall in these brackets can help you plan and prepare for your tax filing.

Understanding the federal income tax brackets is essential for individuals and businesses to accurately calculate and pay their taxes. By knowing which bracket you fall into, you can determine how much of your income is subject to taxation and plan accordingly. This information is crucial for budgeting and financial planning throughout the year.

Printable 2018 Federal Income Tax Brackets

Printable 2018 Federal Income Tax Brackets

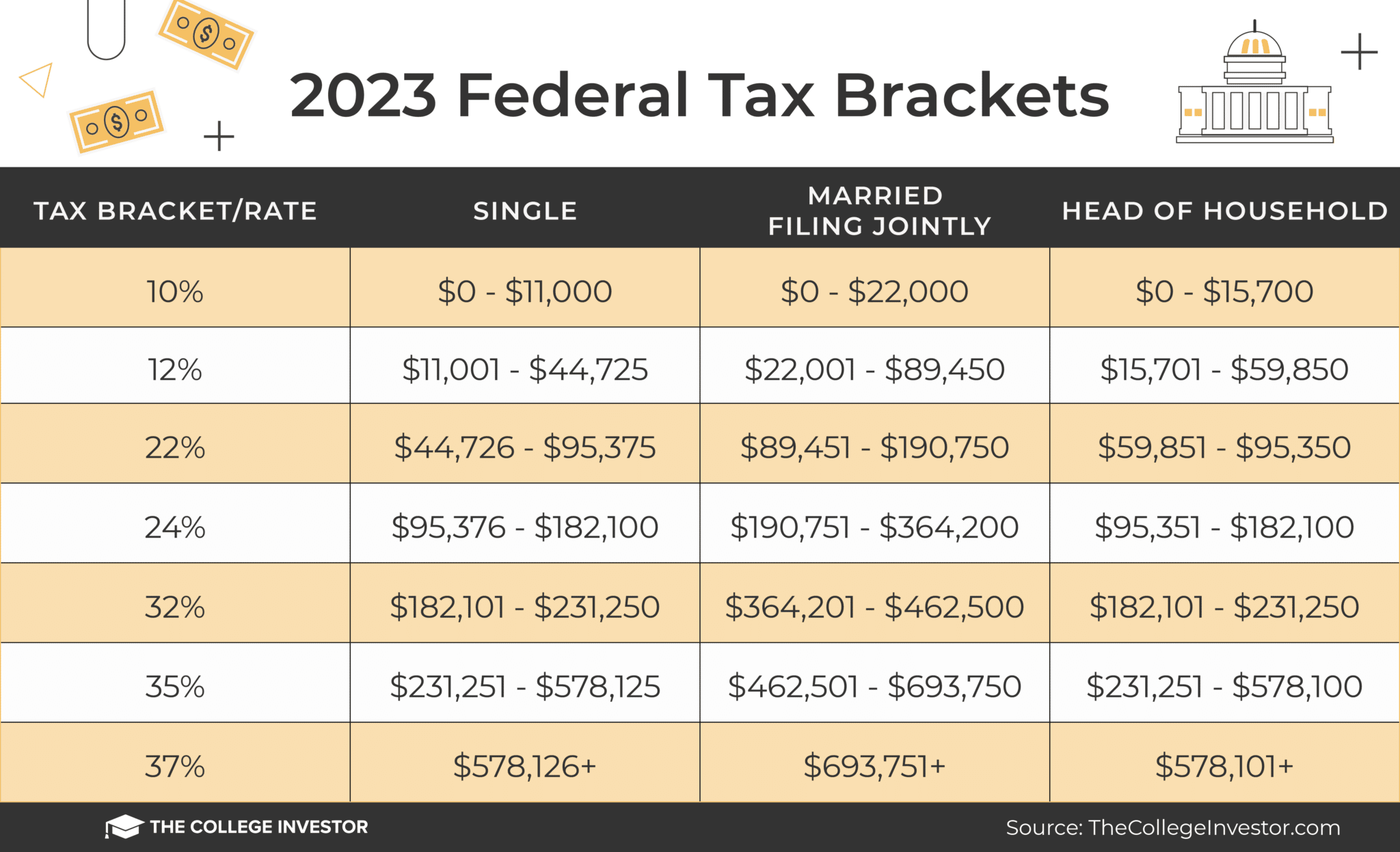

For the year 2018, the federal income tax brackets range from 10% to 37%, depending on your filing status and income level. The brackets are divided into seven categories, with different tax rates applied to each category. It’s important to note that these brackets are subject to change each year, so it’s essential to stay updated on the current rates.

Individuals and couples can use the printable 2018 federal income tax brackets to help them calculate their tax liability accurately. This tool allows taxpayers to input their income and filing status to determine which bracket they fall into and how much tax they owe. By using these brackets, taxpayers can ensure that they are paying the correct amount of taxes and avoid any potential penalties.

Overall, understanding the federal income tax brackets for the year 2018 is crucial for all taxpayers. By knowing which bracket you fall into, you can accurately calculate your tax liability and plan for any potential tax payments. Utilizing the printable 2018 federal income tax brackets can help simplify the tax filing process and ensure that you are compliant with the current tax laws.

As tax season approaches, be sure to familiarize yourself with the 2018 federal income tax brackets and use them to accurately calculate your tax liability. By staying informed and utilizing the available resources, you can ensure a smooth and stress-free tax filing process.