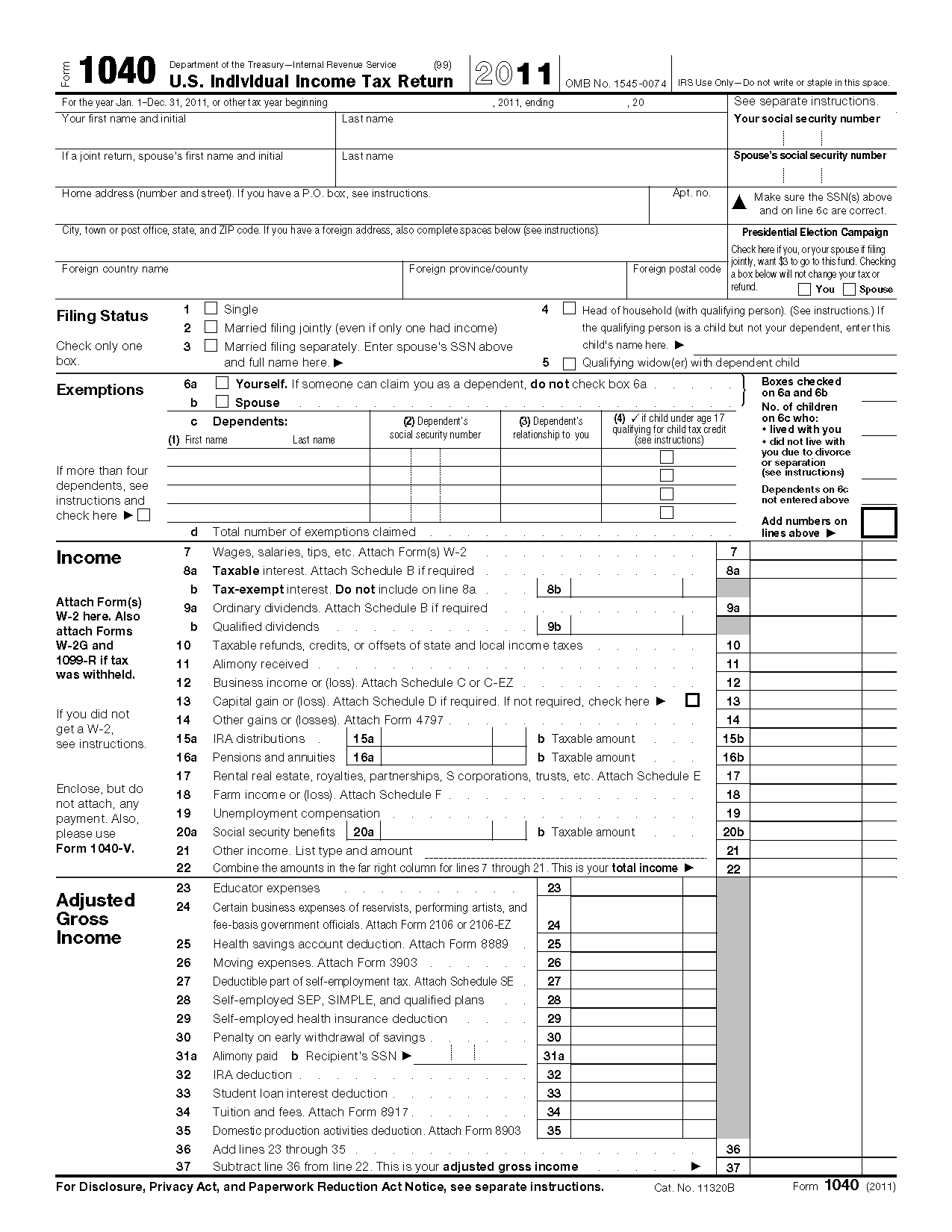

As tax season approaches, it’s important for New York residents to be aware of the various income tax forms that are required for filing. In 2016, there were several changes to the tax laws that may affect how individuals need to report their income. It’s crucial to have access to the necessary forms to ensure accurate and timely filing.

Whether you’re a full-time employee, freelancer, or business owner, understanding the different tax forms is essential for meeting your tax obligations. By having access to the 2016 New York income tax forms, you can easily gather the information needed to report your income, deductions, and credits.

2016 New Your Income Tax Forms Printable

2016 New Your Income Tax Forms Printable

When it comes to filing your taxes for the 2016 tax year, there are several key forms that you may need to fill out. These include the New York State Resident Income Tax Return (Form IT-201), Nonresident and Part-Year Resident Income Tax Return (Form IT-203), and various schedules and worksheets depending on your individual tax situation.

Additionally, if you have income from sources outside of New York, you may need to file additional forms such as the New York State Department of Taxation and Finance Nonresident Audit Program Questionnaire. It’s important to carefully review the instructions for each form to ensure that you are providing accurate information and avoiding any potential penalties for incorrect filing.

By staying organized and keeping track of all your income and expenses throughout the year, you can make the tax filing process much smoother. Utilizing the 2016 New York income tax forms printable, you can ensure that you have all the necessary documentation to complete your tax return accurately and efficiently.

In conclusion, having access to the 2016 New York income tax forms printable is essential for individuals to meet their tax obligations and comply with state tax laws. By familiarizing yourself with the various forms and requirements, you can streamline the tax filing process and avoid any potential issues with the tax authorities. Make sure to gather all the necessary documents and seek assistance from a tax professional if needed to ensure a successful tax season.