Filing your federal income tax return can be a daunting task, but having the right forms can make the process much smoother. The Internal Revenue Service (IRS) provides printable forms for individuals and businesses to report their income, deductions, and credits for the tax year. These forms are essential for accurately reporting your financial information and ensuring compliance with tax laws.

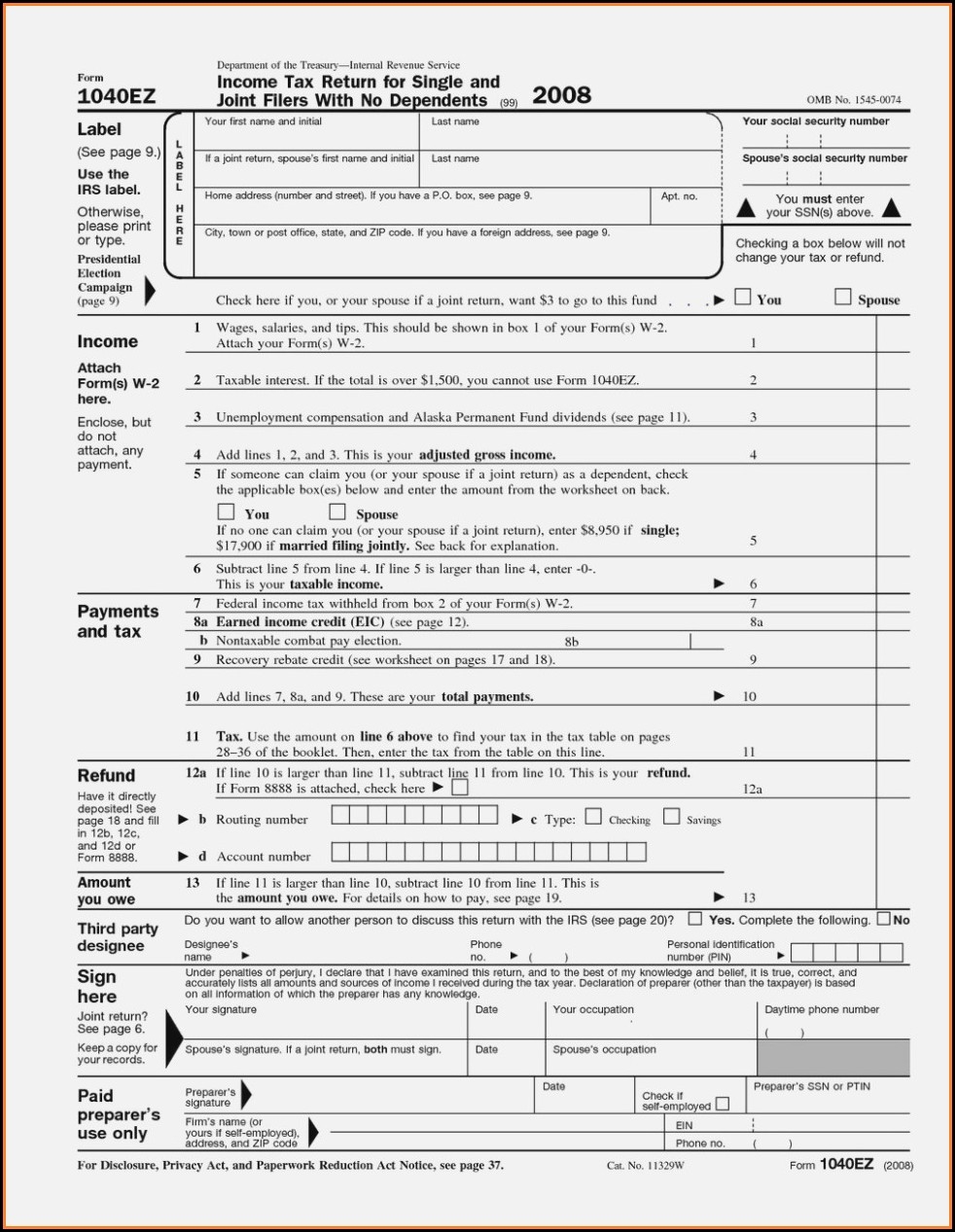

As tax season approaches, it is important to gather all the necessary documents and forms to file your federal income tax return. The IRS offers a variety of printable forms, including Form 1040, Form 1040A, and Form 1040EZ, depending on your filing status and income level. These forms are used to report your income, deductions, and credits for the tax year, and ultimately determine how much tax you owe or are owed as a refund.

Printable 2018 Federal Income Tax Forms

Printable 2018 Federal Income Tax Forms

When filling out your federal income tax forms, it is important to double-check all the information you provide to avoid errors or discrepancies that could result in penalties or delays in processing your return. Make sure to include all sources of income, deductions, and credits accurately to ensure that your tax liability is calculated correctly. Additionally, keep copies of all your tax forms and supporting documents for your records.

For individuals who prefer to file their federal income tax return electronically, the IRS also offers online filing options that allow you to submit your forms and documents digitally. This method can be quicker and more convenient than mailing in paper forms, and may also result in faster processing and refunds. However, if you choose to file by mail, be sure to send your completed forms to the appropriate IRS mailing address based on your location.

Overall, having access to printable 2018 federal income tax forms is crucial for accurately reporting your financial information and fulfilling your tax obligations. Whether you choose to file electronically or by mail, make sure to review all the forms and instructions carefully to ensure that you are complying with tax laws and reporting your income accurately. By staying organized and informed, you can navigate the tax filing process with confidence and peace of mind.

So, as tax season approaches, be sure to download and print the necessary 2018 federal income tax forms to ensure a smooth and efficient filing process. By having all the required forms on hand, you can accurately report your financial information and fulfill your tax obligations in a timely manner.