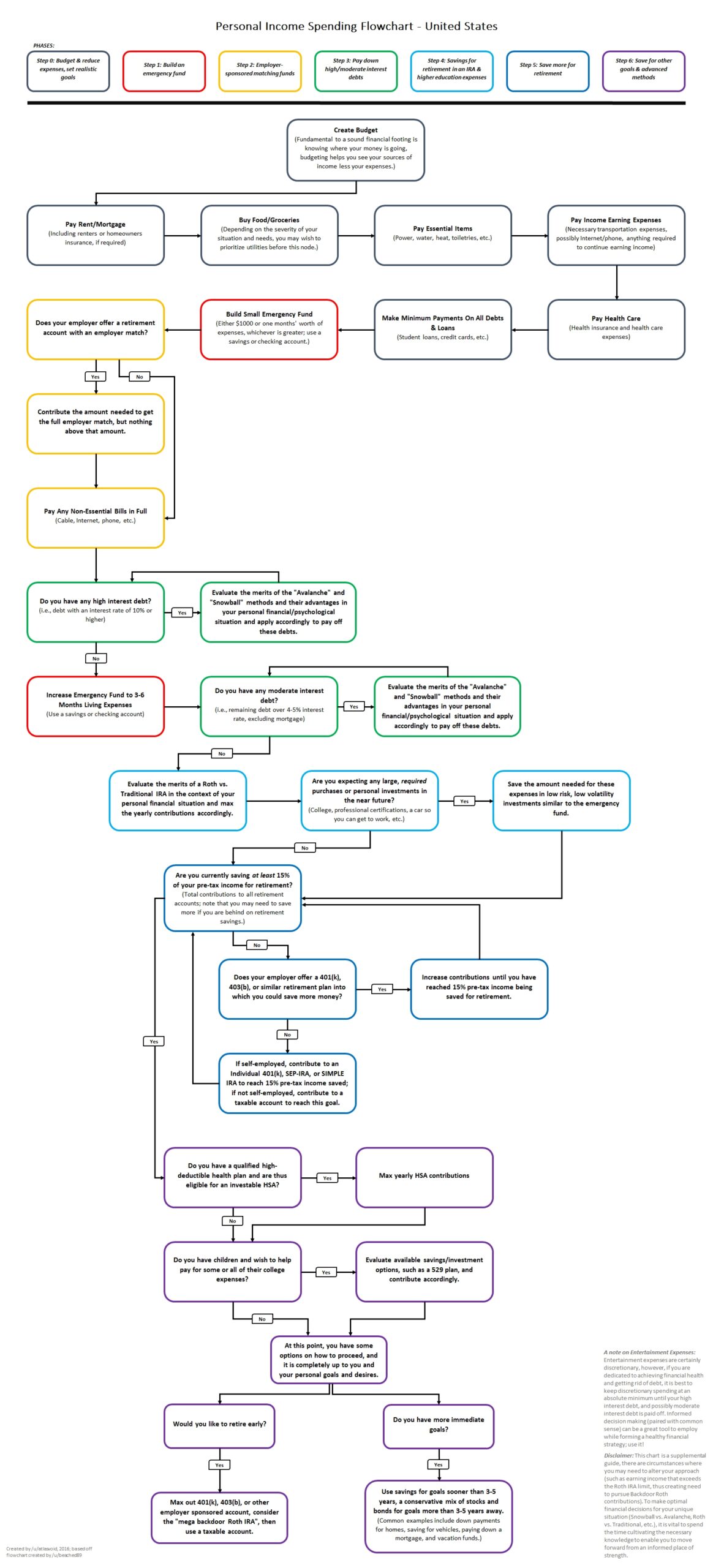

Managing personal finances can be a daunting task, but having a visual representation of your income and spending can make it easier to track where your money is going. A flowchart is a great way to visually map out your income sources and where you are allocating those funds. By having a clear picture of your financial flow, you can make better decisions about budgeting, saving, and investing for the future.

Creating a personal income spending flowchart can help you see the bigger picture of your financial situation. Whether you are a visual learner or just like to have a visual representation of data, having a flowchart can simplify the process of analyzing your income and spending habits.

Personal Income Spending Flowchart Printable

Personal Income Spending Flowchart Printable

Start by listing all your sources of income, such as salary, bonuses, investments, and any other income streams. Next, categorize your expenses into fixed expenses (rent, utilities, etc.) and variable expenses (entertainment, dining out, etc.). Once you have all your income and expenses listed, start mapping out the flow of money from your income sources to your various expenses.

Use arrows to indicate the flow of money from your income sources to your expenses. This will help you see where your money is going and identify areas where you may need to cut back on spending or reallocate funds. By visually representing your financial flow, you can make informed decisions about how to manage your money more effectively.

Having a printable version of your personal income spending flowchart can be a handy tool to keep you on track with your financial goals. You can refer to it regularly to see if you are staying within your budget and making progress towards your financial goals. Update the flowchart regularly to reflect any changes in your income or expenses, and use it as a guide to help you make smart financial decisions.

In conclusion, a personal income spending flowchart can be a valuable tool in managing your finances effectively. By visually mapping out your income and expenses, you can gain a better understanding of where your money is going and make informed decisions about budgeting and saving. Use a printable version of your flowchart to keep yourself accountable and on track with your financial goals.