Georgia state income tax is an important aspect of living and working in the state. Understanding and filing your state income tax return is crucial to ensure compliance with state tax laws. If you are a resident of Georgia or earn income in the state, you will need to file a state income tax return each year.

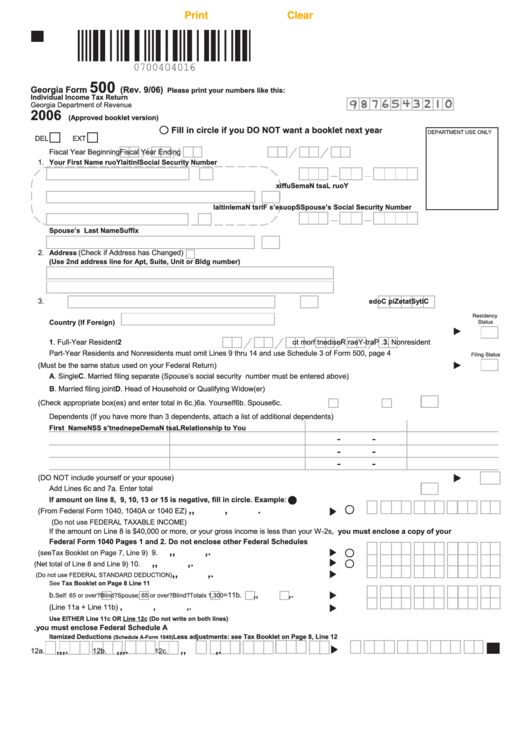

One of the key steps in filing your Georgia state income tax return is obtaining the necessary forms. The Georgia Department of Revenue provides printable forms on their website for individuals to download and complete. These forms include the Georgia Individual Income Tax Return (Form 500), as well as any additional schedules or worksheets that may be required based on your individual tax situation.

Printable Georgia State Income Tax

Printable Georgia State Income Tax

When filling out your Georgia state income tax forms, it is important to gather all necessary documentation, such as W-2s, 1099s, and any other income statements. You will also need to have information on any deductions or credits you may be eligible for, as this can impact the amount of tax you owe or the refund you may receive.

After completing your Georgia state income tax forms, you can either file electronically through the Georgia Department of Revenue’s website or mail in a paper copy. If you choose to file by mail, be sure to send your forms to the correct address listed on the form instructions to avoid any delays in processing your return.

It is important to note that the deadline for filing your Georgia state income tax return is typically April 15th, unless that date falls on a weekend or holiday. If you need more time to file, you can request an extension; however, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

In conclusion, understanding and filing your Georgia state income tax return is an important responsibility for residents and individuals earning income in the state. By obtaining the necessary forms and documentation, completing your return accurately, and meeting the filing deadline, you can ensure compliance with state tax laws and avoid any potential penalties or interest.