Filing state income taxes can be a daunting task for many individuals. However, the state of New Jersey offers a simple solution with their printable NJ State Income Tax Form. This form allows residents to easily report their income, deductions, and credits to ensure they are compliant with state tax laws.

By providing a printable form, the state of New Jersey aims to make the tax filing process as convenient as possible for its residents. Whether you prefer to file your taxes online or by mail, having a physical copy of the NJ State Income Tax Form can simplify the process and ensure you don’t miss any important information.

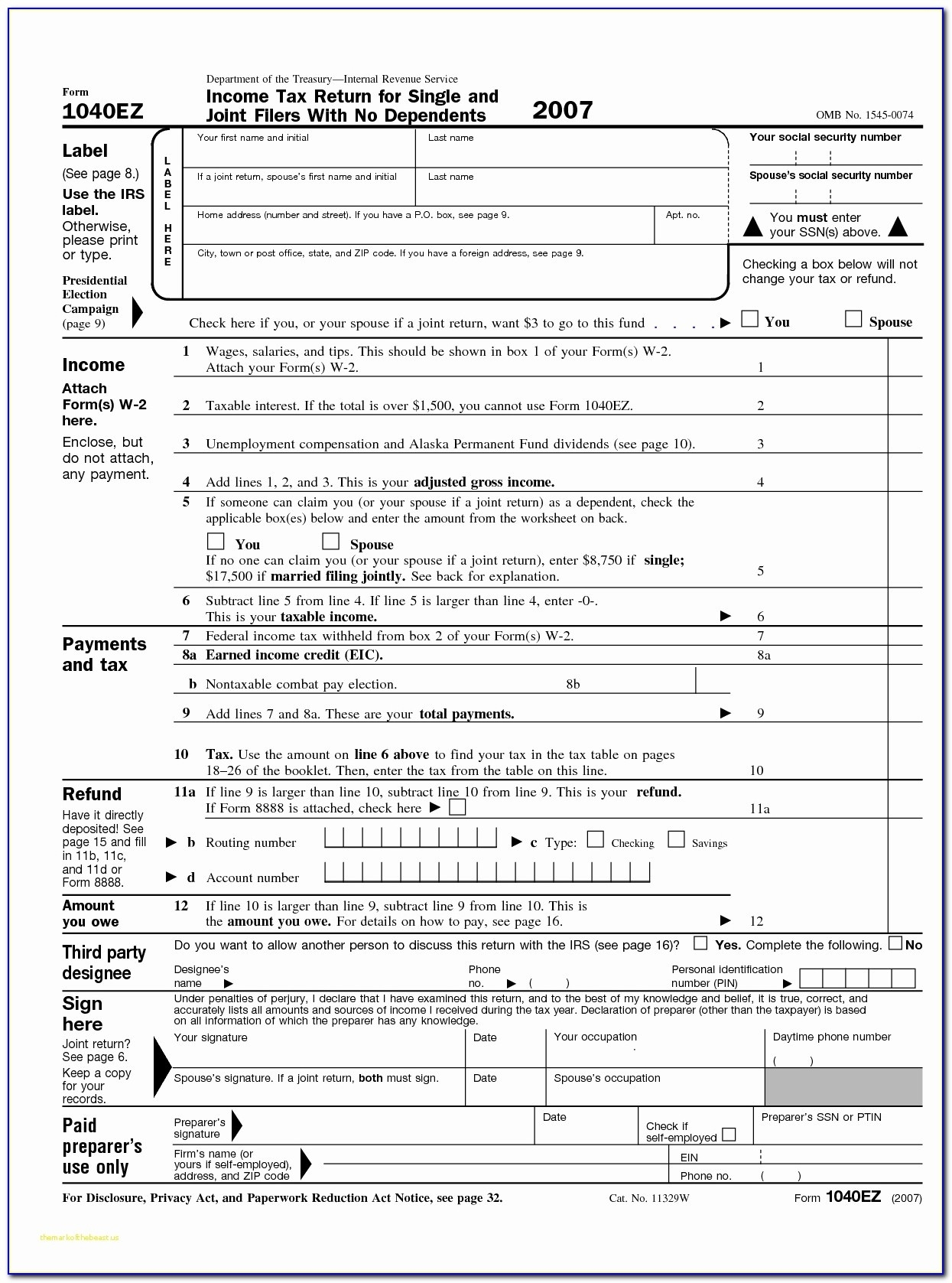

Printable Nj State Income Tax Form

Printable Nj State Income Tax Form

When filling out the NJ State Income Tax Form, it’s important to gather all necessary documents, such as W-2s, 1099s, and receipts for deductions. This will help ensure accuracy and prevent any delays in processing your tax return. Additionally, be sure to double-check your calculations and review the form for any errors before submitting it to the New Jersey Division of Taxation.

One benefit of using the printable NJ State Income Tax Form is the ability to file your taxes at your own pace. You can take your time to review your financial information and make sure everything is in order before submitting your tax return. This can help reduce the likelihood of errors and potentially save you from costly penalties or audits in the future.

Overall, the printable NJ State Income Tax Form offers a convenient and straightforward way for residents of New Jersey to fulfill their state tax obligations. By using this form, you can ensure that your taxes are filed accurately and on time, giving you peace of mind knowing that you are in compliance with state tax laws.

Take advantage of the printable NJ State Income Tax Form and make the tax filing process a breeze this year!