Utah residents who need to file their state income taxes can easily access printable forms online. These forms are essential for individuals and businesses to report their income, deductions, and credits to the Utah State Tax Commission. By using these printable forms, taxpayers can accurately file their taxes and ensure they meet their obligations to the state.

Printable Utah State Income Tax Forms provide a convenient way for taxpayers to fill out their tax returns without the need for complicated software or professional assistance. These forms can be easily downloaded from the official Utah State Tax Commission website or various online tax preparation websites. Whether you are a full-time employee, self-employed individual, or business owner, these forms are tailored to meet your specific needs.

Printable Utah State Income Tax Forms

Printable Utah State Income Tax Forms

Printable Utah State Income Tax Forms

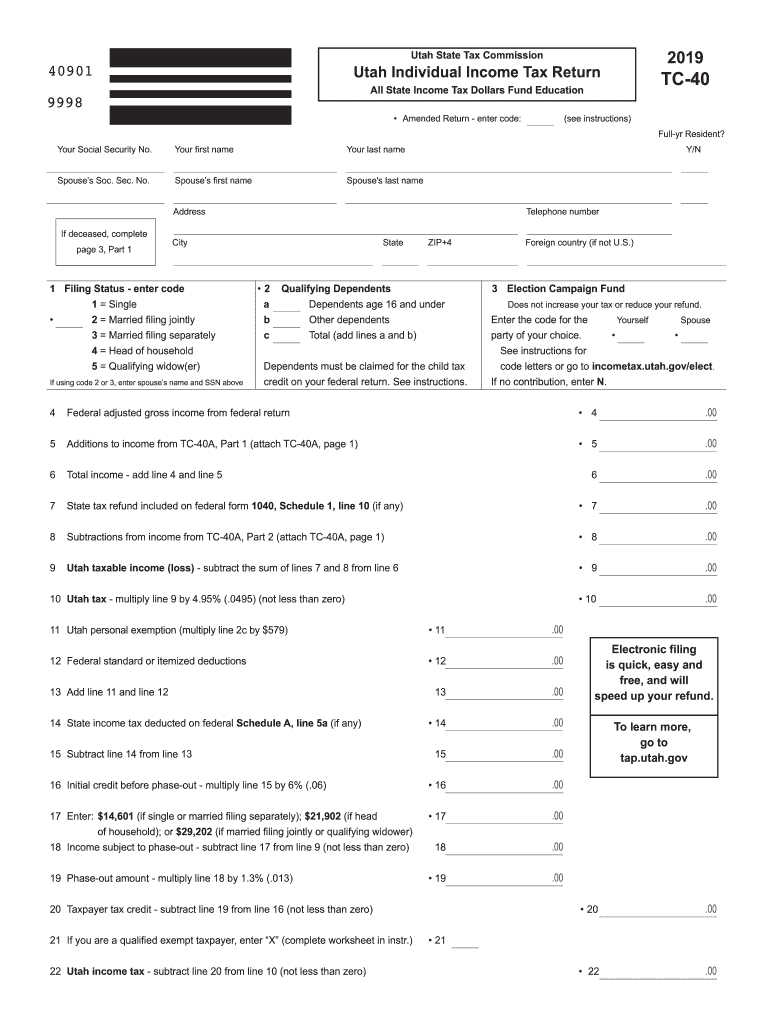

Individuals can choose from a variety of printable forms depending on their tax situation. Some of the most commonly used forms include Form TC-40, which is the standard individual income tax return form for Utah residents. This form allows taxpayers to report their income, deductions, and credits to determine their tax liability for the year.

For individuals who have income from sources other than employment, there are additional forms such as Form TC-40B, which is used to report income from business activities or rental properties. Business owners can also use Form TC-65, the Utah Corporation Franchise Tax Return, to report their business income and calculate their tax liability.

Before filling out these printable forms, taxpayers should gather all necessary documents such as W-2s, 1099s, and receipts for deductions. It is important to carefully review the instructions provided with each form to ensure accurate and timely filing. Once the forms are completed, they can be mailed to the Utah State Tax Commission or submitted electronically through the Utah Taxpayer Access Point (TAP).

Overall, Printable Utah State Income Tax Forms offer a convenient and accessible way for taxpayers to fulfill their tax obligations to the state. By using these forms, individuals and businesses can accurately report their income, deductions, and credits to ensure compliance with Utah state tax laws.

So, if you are a Utah resident looking to file your state income taxes, be sure to take advantage of these printable forms to simplify the tax filing process and avoid potential penalties for non-compliance.