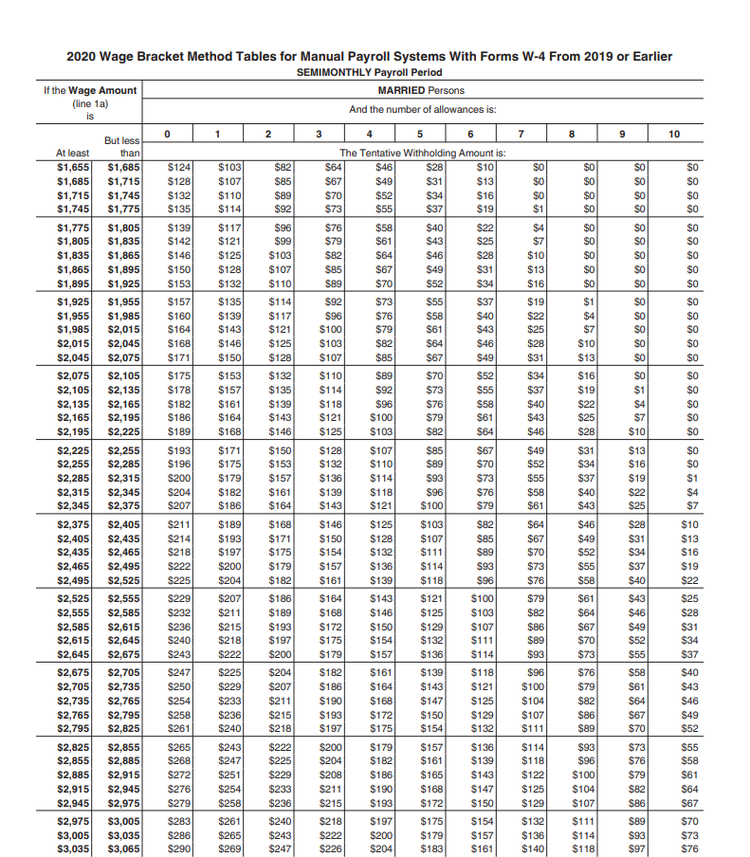

As tax season approaches, it’s important for individuals and businesses to understand the federal income tax withholding tables for the year 2018. These tables provide information on how much tax should be withheld from an employee’s paycheck based on their income, filing status, and other factors. By using these tables, employers can ensure that the correct amount of tax is withheld from each employee’s paycheck, helping to avoid underpayment or overpayment of taxes.

It is crucial for both employers and employees to be aware of the federal income tax withholding tables for 2018 to avoid any surprises come tax season. These tables are updated annually to reflect changes in tax laws and rates, so it’s essential to use the most current version when calculating withholding amounts.

Printable 2018 Federal Income Tax Withholding Tables

Printable 2018 Federal Income Tax Withholding Tables

Printable 2018 Federal Income Tax Withholding Tables

The printable 2018 federal income tax withholding tables can be easily found online on the Internal Revenue Service (IRS) website. These tables provide detailed information on how much tax should be withheld based on an individual’s income, filing status, and number of allowances claimed. Employers can use these tables to calculate the correct withholding amount for each employee, ensuring compliance with federal tax laws.

By referring to the federal income tax withholding tables for 2018, employers can accurately calculate the amount of tax to withhold from each paycheck. This helps to ensure that employees have the correct amount of tax withheld throughout the year, reducing the likelihood of owing taxes or receiving a large refund at tax time.

It is important for employers to stay up-to-date with changes to the federal income tax withholding tables to ensure compliance with federal tax laws. By using the most current tables, employers can avoid potential penalties for under withholding or over withholding taxes from employee paychecks.

In conclusion, understanding and utilizing the printable 2018 federal income tax withholding tables is crucial for both employers and employees. By using these tables to calculate the correct withholding amount, employers can ensure compliance with federal tax laws and avoid any surprises at tax time. It is recommended to consult with a tax professional or refer to the IRS website for the most current withholding tables to ensure accurate calculations.