Michigan residents who need to file their state income taxes can do so using the Michigan 1040 Income Tax Printable Form. This form is used to report income, deductions, and credits for individuals and families in the state of Michigan. Filing your taxes accurately and on time is important to avoid penalties and interest, so it’s essential to use the correct form.

Before you begin filling out the Michigan 1040 Income Tax Printable Form, make sure you have all the necessary documents on hand. This includes W-2 forms from your employer, 1099 forms for any additional income, and receipts for any deductions you plan to claim. Having this information readily available will make the filing process much smoother.

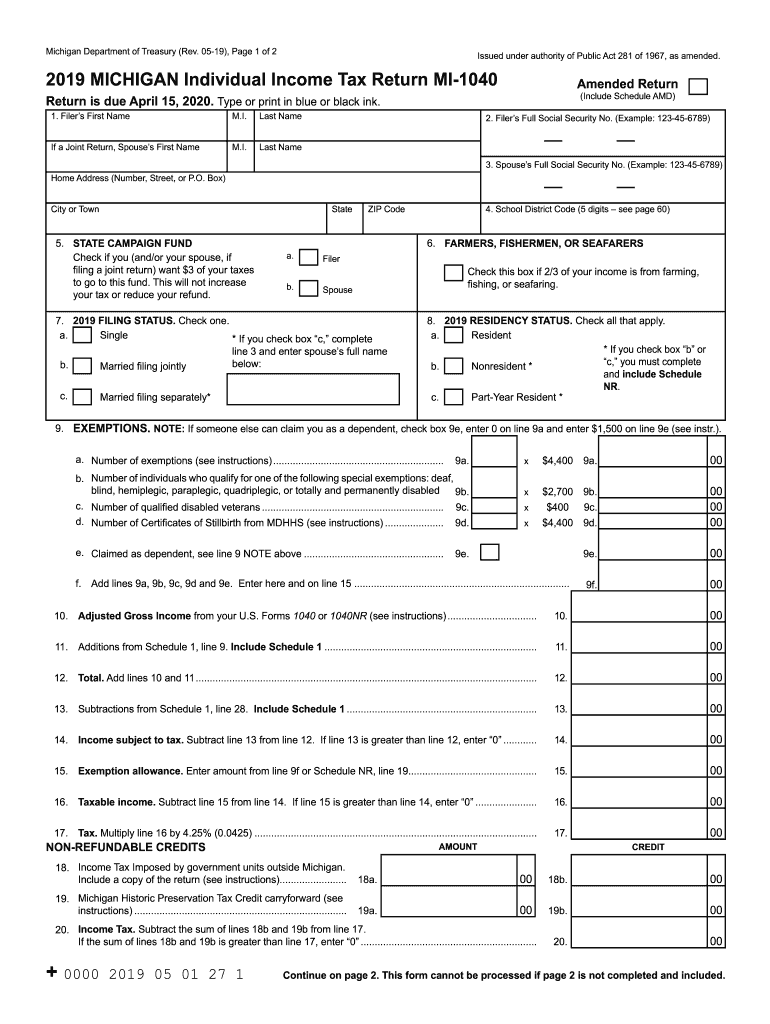

Michigan 1040 Income Tax Printable Form

Michigan 1040 Income Tax Printable Form

When filling out the Michigan 1040 form, be sure to double-check all of your information for accuracy. Any mistakes or omissions could delay the processing of your return and potentially result in penalties. Take your time and review each section carefully to ensure everything is filled out correctly.

Once you have completed the Michigan 1040 Income Tax Printable Form, you can either file it electronically or mail it to the Michigan Department of Treasury. If you choose to mail your form, be sure to include any additional documentation and payment if necessary. The deadline for filing your state income taxes is typically April 15th, so make sure to submit your form before this date to avoid any late fees.

Overall, the Michigan 1040 Income Tax Printable Form is a crucial document for Michigan residents to fill out accurately and on time. By following the instructions carefully and double-checking your information, you can ensure a smooth tax filing process and avoid any potential penalties. If you have any questions or need assistance, be sure to reach out to the Michigan Department of Treasury for guidance.

Don’t wait until the last minute to file your state income taxes – download the Michigan 1040 Income Tax Printable Form today and get started on your tax return!