As tax season approaches, many individuals and businesses are looking for the necessary forms to file their taxes. The IRS provides a variety of forms that taxpayers can use to report their income, deductions, credits, and other tax-related information. One convenient option for taxpayers is to use printable income tax forms, which can be easily accessed online and filled out at their convenience.

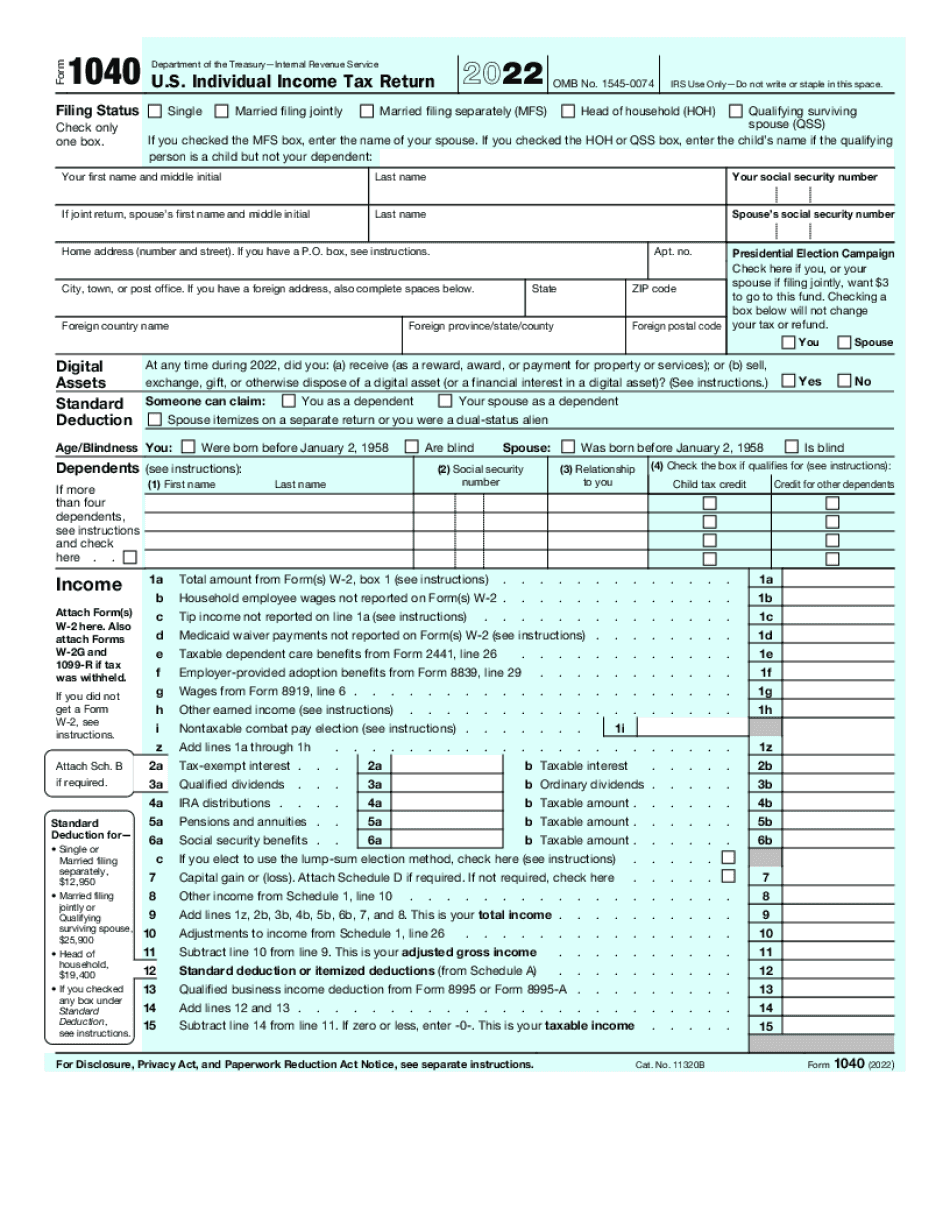

Printable income tax forms for the year 2022 are readily available on the IRS website and can be downloaded and printed for free. These forms include the 1040 series for individual taxpayers, as well as various schedules and worksheets for reporting specific types of income or deductions. By using printable forms, taxpayers can avoid the hassle of picking up forms at a local IRS office or waiting for them to arrive in the mail.

Printable Income Tax Forms 2022

Printable Income Tax Forms 2022

One of the advantages of using printable income tax forms is the ability to fill them out electronically before printing. This can help minimize errors and ensure that all necessary information is included before submission. Taxpayers can also save a copy of the completed forms for their records, making it easier to reference in the future or for audit purposes.

Another benefit of printable income tax forms is the option to e-file them, which can speed up the processing of tax returns and any refunds owed to the taxpayer. Many tax preparation software programs also allow users to import information directly from printable forms, making the filing process even more efficient. Additionally, e-filing can help reduce the risk of errors and ensure that tax returns are submitted on time.

In conclusion, printable income tax forms for 2022 offer taxpayers a convenient and efficient way to file their taxes. By utilizing these forms, individuals and businesses can accurately report their income and deductions, potentially expedite the processing of their returns, and ensure compliance with tax laws. Whether filing electronically or by mail, printable forms provide a user-friendly option for meeting tax obligations.