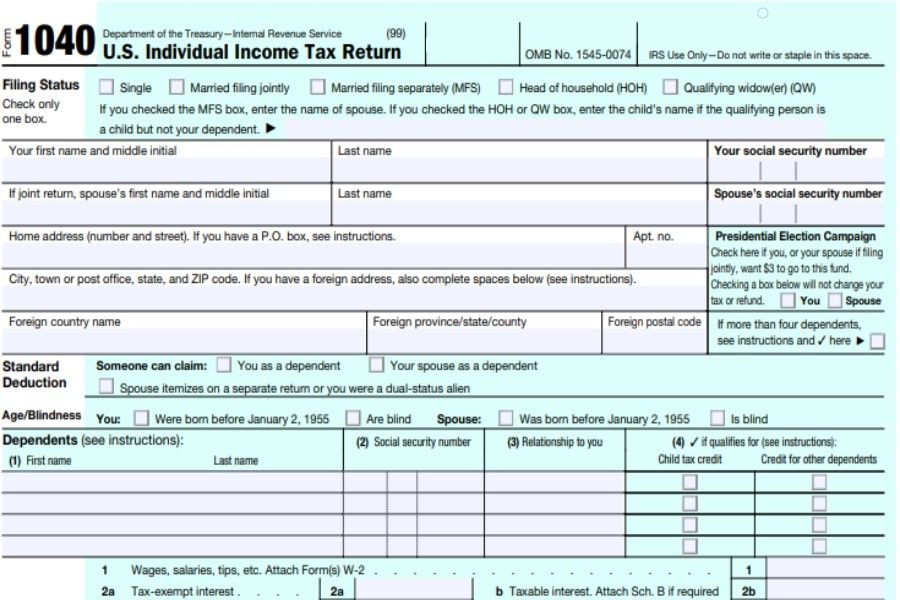

As tax season approaches, many individuals and businesses are gearing up to file their income tax returns. It is important to have the necessary forms and documents ready to ensure a smooth and accurate filing process. One of the key documents needed for filing federal income taxes is the IRS Form 1040 for the year 2014.

Printable Federal Income Tax Forms for the year 2014 are readily available online for taxpayers to download and fill out. These forms are essential for reporting income, deductions, and credits for the tax year 2014. By having access to printable forms, taxpayers can easily complete their tax returns and submit them to the IRS in a timely manner.

Printable Federal Income Tax Forms 2014

Printable Federal Income Tax Forms 2014

When filing taxes for the year 2014, taxpayers must accurately report their income, deductions, and credits to determine their tax liability or refund. The IRS Form 1040 is the standard form used by individuals to report their annual income and claim any deductions or credits they may be eligible for. Additionally, there are other forms and schedules that may need to be included depending on the taxpayer’s specific financial situation.

It is important for taxpayers to carefully review the instructions provided with the printable federal income tax forms for the year 2014 to ensure accurate completion. Mistakes or omissions on tax forms can result in delays in processing or even potential penalties from the IRS. By taking the time to fill out the forms correctly, taxpayers can avoid unnecessary complications and ensure compliance with tax laws.

In conclusion, having access to Printable Federal Income Tax Forms 2014 is crucial for individuals and businesses preparing to file their tax returns. By utilizing these forms, taxpayers can accurately report their income, deductions, and credits for the tax year 2014. It is important to carefully review the instructions and fill out the forms accurately to avoid any potential issues with the IRS. With the right resources and information, taxpayers can navigate the tax filing process with ease and confidence.