As tax season approaches, it’s important for individuals to start gathering all necessary documents in order to file their taxes accurately and on time. One crucial component of this process is obtaining the appropriate tax forms for the year in question. In 2014, there were several income tax forms that individuals may need to fill out depending on their financial situation.

Income tax forms are essential for reporting income, deductions, and credits to the Internal Revenue Service (IRS). These forms provide a detailed breakdown of an individual’s financial information for the year, which is used to calculate the amount of taxes owed or refunded. In 2014, there were different forms available depending on whether an individual was employed, self-employed, had investments, or other sources of income.

2014 Income Tax Forms Printable

2014 Income Tax Forms Printable

For individuals who were employed in 2014, the most common form is the W-2, which reports wages, tips, and other compensation received from an employer. Self-employed individuals may need to file a Schedule C to report business income and expenses. Additionally, individuals with investments may need to report interest, dividends, and capital gains on forms such as the 1099-INT, 1099-DIV, and Schedule D.

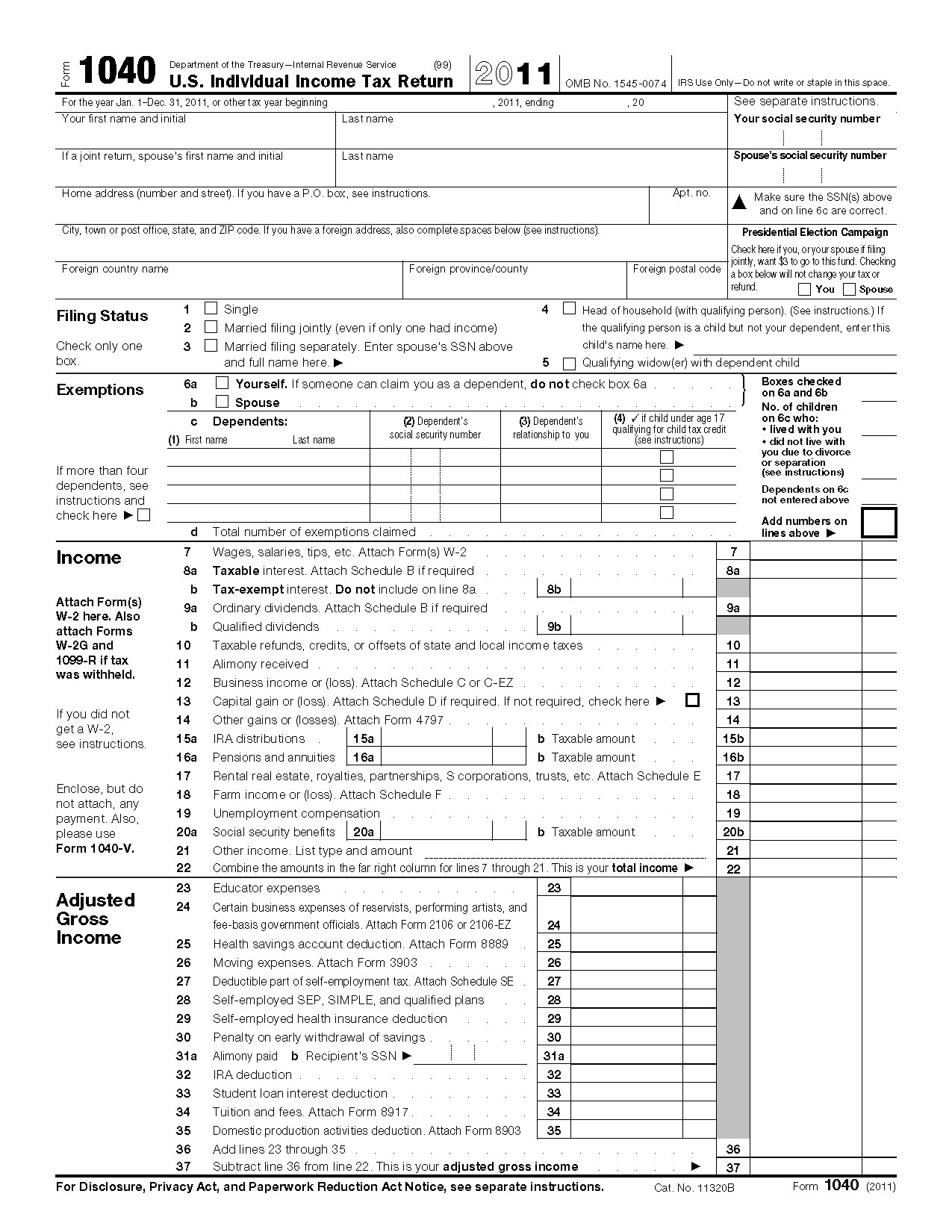

Other forms that individuals may need to file in 2014 include the 1040, which is the standard individual income tax return form, as well as various schedules and worksheets for reporting specific types of income or deductions. It’s important for individuals to carefully review the instructions for each form to ensure that they are filling them out correctly and including all necessary information.

Overall, obtaining and filling out the correct income tax forms for the 2014 tax year is crucial for individuals to accurately report their financial information to the IRS. By being diligent and organized in gathering all necessary documents and completing the forms accurately, individuals can ensure a smooth tax filing process and potentially maximize their tax refund or minimize any taxes owed.

As tax season approaches, individuals should start preparing their income tax forms for the 2014 tax year to ensure a timely and accurate filing process. By gathering all necessary documents and filling out the forms correctly, individuals can avoid potential errors and delays in processing their tax returns. Remember to consult with a tax professional or utilize tax preparation software to ensure that all forms are completed accurately and in compliance with IRS regulations.