When it comes to filing your taxes in Idaho, it’s important to have the necessary forms ready to go. The Idaho Individual Income Tax Form is a crucial document that taxpayers need to fill out accurately to ensure compliance with state tax laws. Knowing where to find the printable version of this form can make the tax filing process much smoother.

Idaho residents who earn income in the state are required to file an individual income tax return each year. This form allows taxpayers to report their earnings, deductions, and credits to determine how much they owe in state taxes or if they are eligible for a refund.

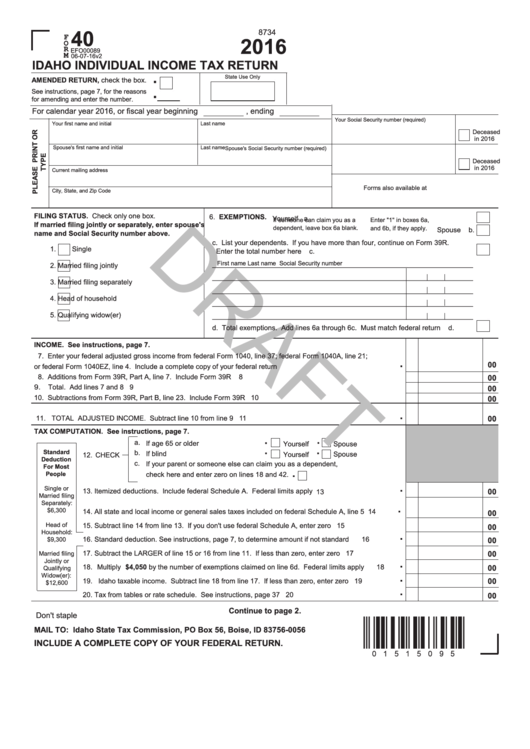

Idaho Individual Income Tax Form/Printable

Idaho Individual Income Tax Form/Printable

When searching for the Idaho Individual Income Tax Form, taxpayers can visit the official Idaho State Tax Commission website. Here, they can find the most up-to-date version of the form along with instructions on how to fill it out correctly. It’s essential to use the correct form for the tax year being filed to avoid any delays or errors in processing.

Once the form is downloaded and printed, taxpayers can begin the process of filling it out. It’s crucial to gather all necessary documents, such as W-2s, 1099s, and receipts for deductions, to ensure accurate reporting. Taking the time to review the instructions and double-checking all entries can help prevent mistakes that could lead to audits or penalties.

After completing the Idaho Individual Income Tax Form, taxpayers can submit it either electronically or by mail, along with any required payments or supporting documents. Filing taxes on time and accurately can help individuals avoid penalties and ensure they are in compliance with state tax laws.

In conclusion, the Idaho Individual Income Tax Form is a crucial document for residents to file their taxes accurately and on time. By finding the printable version of this form on the Idaho State Tax Commission website and following the instructions carefully, taxpayers can navigate the tax filing process with ease. Staying organized and thorough in reporting income and deductions can help individuals avoid issues and ensure compliance with state tax laws.