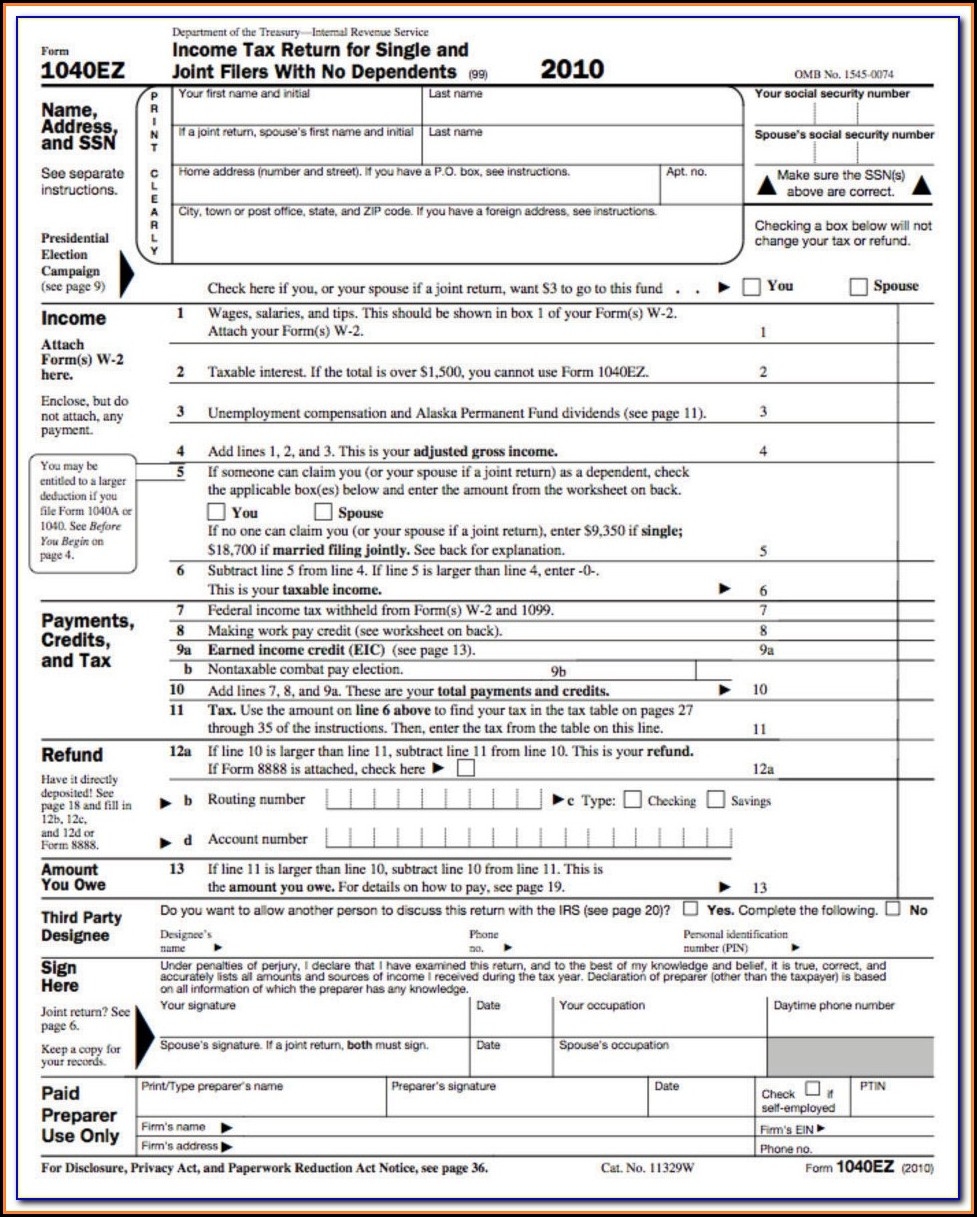

As tax season approaches, many individuals are starting to gather their documents and prepare to file their federal income taxes. One important aspect of this process is having access to the necessary tax forms, including the 2024 federal income tax forms. These forms are essential for accurately reporting income, deductions, and credits to the IRS.

Having access to printable versions of the 2024 federal income tax forms can make the filing process much easier for individuals. Being able to download and print these forms from the comfort of their own homes allows taxpayers to complete their taxes at their own pace and convenience.

2024 Federal Income Tax Forms Printable

2024 Federal Income Tax Forms Printable

There are several key forms that individuals may need to file their federal income taxes in 2024. These may include Form 1040 for individual income tax returns, as well as various schedules and worksheets for reporting additional income, deductions, and credits. It is important for taxpayers to carefully review the instructions for each form to ensure they are completing them accurately.

One of the benefits of using printable federal income tax forms is that they often come with helpful instructions and guidelines for filling them out. This can be particularly useful for individuals who are filing their taxes for the first time or who have complicated tax situations. These instructions can help taxpayers navigate the forms and ensure they are reporting their financial information correctly.

As tax laws and regulations can change from year to year, it is important for individuals to use the most current versions of the federal income tax forms when filing their taxes. By accessing printable 2024 federal income tax forms, taxpayers can be confident that they are using the most up-to-date documents provided by the IRS for that tax year.

In conclusion, having access to printable 2024 federal income tax forms is essential for individuals who are preparing to file their taxes. These forms provide a convenient and reliable way for taxpayers to report their financial information accurately to the IRS. By utilizing these forms and following the instructions provided, individuals can ensure that their taxes are filed correctly and in compliance with federal tax laws.