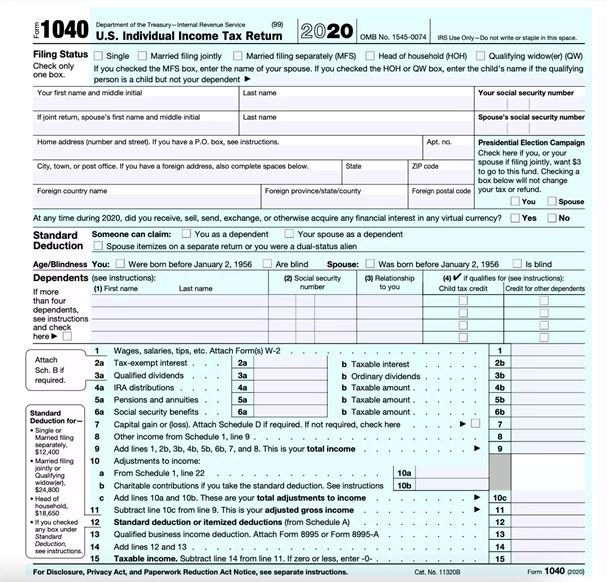

Filing your taxes can be a daunting task, but having the right forms can make the process much easier. One of the most commonly used forms is the Form 1040 Federal Individual Income Tax Return. This form is used by individuals to report their annual income to the Internal Revenue Service (IRS) and calculate how much tax they owe.

Form 1040 is the standard form used by most taxpayers to file their annual income tax return. It is used to report various types of income, deductions, and credits that may affect your tax liability. The form is updated each year to reflect changes in tax laws and regulations, so it is important to use the most current version when filing your taxes.

Form 1040 Federal Individual Income Tax Return Printable

Form 1040 Federal Individual Income Tax Return Printable

When filling out Form 1040, you will need to provide information about your income, deductions, and credits for the tax year. This includes details about your wages, salary, tips, interest, dividends, and any other sources of income you may have. You will also need to report any deductions you are eligible for, such as student loan interest, mortgage interest, and charitable contributions.

Once you have completed Form 1040, you will need to calculate your total tax liability for the year. This will determine whether you owe additional taxes or are entitled to a refund. If you owe taxes, you will need to make a payment to the IRS by the tax filing deadline. If you are due a refund, you can choose to have it deposited directly into your bank account or receive a check in the mail.

Form 1040 can be downloaded and printed from the IRS website, or you can pick up a copy at your local library or post office. It is important to carefully review the instructions for the form and ensure that you provide accurate information to avoid any errors or delays in processing your tax return. If you have any questions or need assistance, you can contact the IRS or consult with a tax professional for guidance.

In conclusion, Form 1040 Federal Individual Income Tax Return is an essential document for reporting your annual income and calculating your tax liability. By using this form correctly and accurately, you can ensure that you are in compliance with tax laws and regulations and avoid any penalties or fines. Make sure to file your taxes on time and keep copies of your tax returns for your records.