Filing your state income taxes can be a daunting task, but having the necessary forms can make the process much easier. For residents of Kentucky, the state income tax form is a crucial document that needs to be filled out accurately to ensure compliance with state tax laws.

Whether you are a full-time resident of Kentucky or a part-time resident with income earned in the state, you will need to report your income and calculate your tax liability using the Kentucky state income tax form. This form is essential for individuals, businesses, and anyone else required to pay taxes in the state.

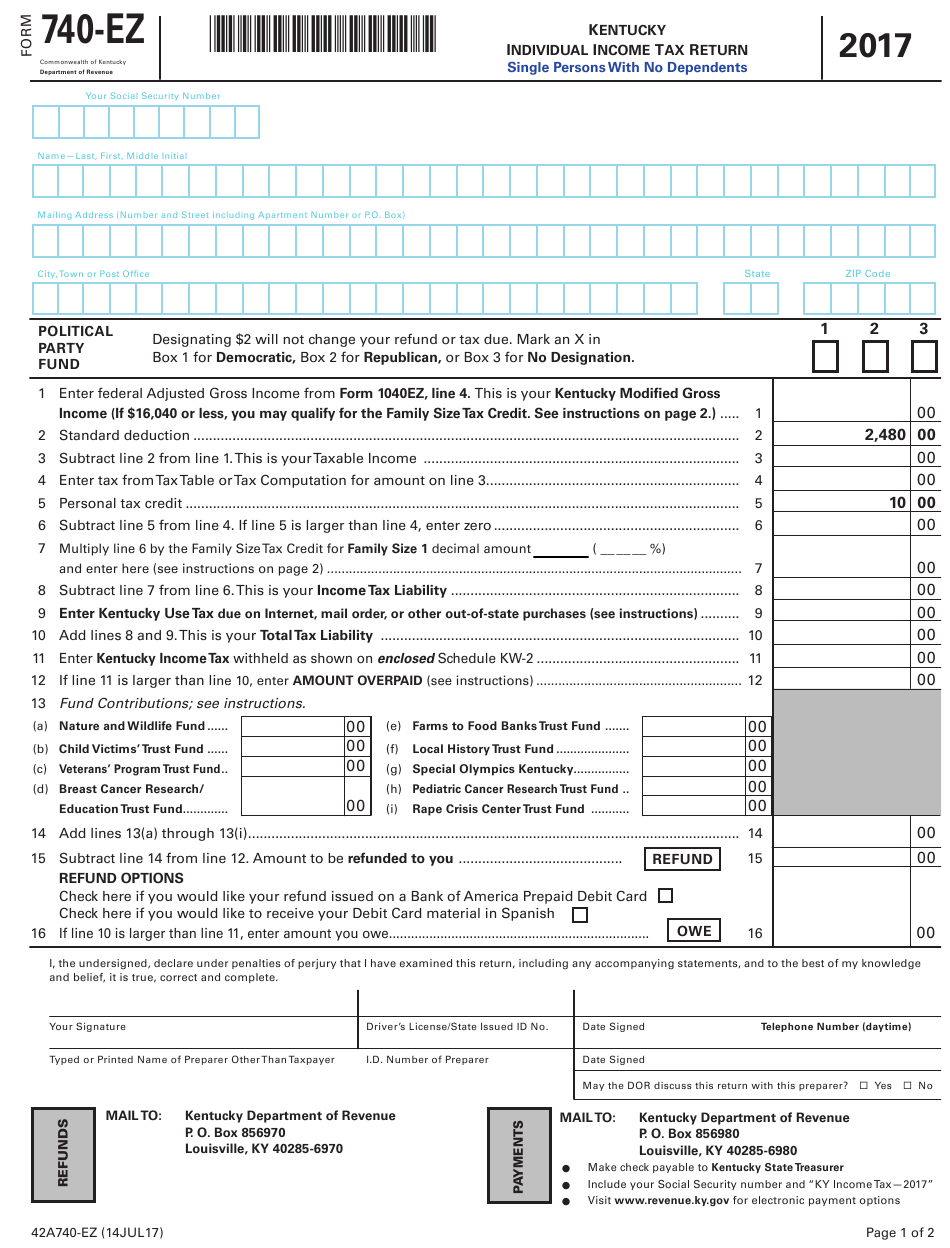

Printable Ky State Income Tax Form

Printable Ky State Income Tax Form

Printable Ky State Income Tax Form

One convenient way to access the Kentucky state income tax form is by downloading and printing it from the official Kentucky Department of Revenue website. The form typically includes sections for reporting income, deductions, credits, and other relevant information needed to calculate your tax liability.

When filling out the form, it is important to double-check all entries and calculations to avoid errors that could result in penalties or delays in processing your tax return. Additionally, be sure to include any required documentation, such as W-2 forms, receipts, and other supporting documents that may be needed to substantiate your income and deductions.

After completing the form, you can submit it electronically through the Kentucky Department of Revenue website or mail it to the appropriate address provided on the form. Be sure to keep a copy of your completed form and any supporting documents for your records in case you need to refer to them in the future.

By utilizing the printable Kentucky state income tax form, you can streamline the tax filing process and ensure that you are meeting your tax obligations in the state. Remember to file your taxes on time and seek assistance from a tax professional if you have any questions or concerns about your tax return.

In conclusion, the printable Kentucky state income tax form is a valuable resource for residents of the state who need to file their state taxes accurately and efficiently. By accessing and completing this form, you can fulfill your tax obligations and avoid potential penalties for non-compliance. Make sure to use the form responsibly and seek assistance when needed to ensure a smooth tax filing process.