As tax season approaches, it is important for Canadian taxpayers to have access to the necessary forms to file their income tax returns for the year 2010. The Canada Revenue Agency (CRA) provides printable income tax forms online for individuals to download and use. These forms are essential for reporting income, deductions, and credits accurately to ensure compliance with tax laws.

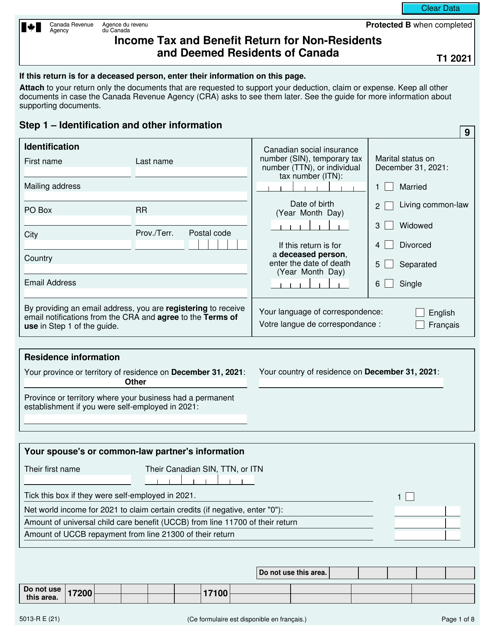

With the availability of printable income tax forms for the year 2010, taxpayers can easily access and fill out the necessary paperwork to submit their tax returns. These forms include the T1 General form, which is used by individuals to report their income, deductions, and credits for the tax year. Having these forms readily available online streamlines the tax filing process and helps taxpayers meet the deadline for filing their returns.

Printable Income Tax Forms 2010 Canada

Printable Income Tax Forms 2010 Canada

When using printable income tax forms for the year 2010, taxpayers should ensure they have all the necessary documentation and information to complete the forms accurately. This includes income statements, receipts for deductions, and any other relevant financial records. By carefully reviewing and filling out the forms, taxpayers can avoid errors and potential audits from the CRA.

It is important for taxpayers to be aware of any changes to the tax laws and regulations for the year 2010 when using printable income tax forms. The CRA may have updated guidelines or requirements that could impact how income is reported or deductions are claimed. By staying informed and seeking assistance if needed, taxpayers can navigate the tax filing process effectively.

Overall, having access to printable income tax forms for the year 2010 Canada simplifies the tax filing process for individuals. By utilizing these forms and following the guidelines provided by the CRA, taxpayers can accurately report their income and claim any eligible deductions or credits. As tax season approaches, it is essential for taxpayers to gather their documentation and begin filling out the necessary forms to meet the deadline for filing their returns.