Are you a resident of Kansas looking to file your income taxes? If so, you may need to use Form Schedule S, which is used to report income adjustments for Kansas tax purposes. This form is essential for individuals who have income from sources such as partnerships, S corporations, estates, trusts, and more. It is important to accurately fill out this form to ensure that you are paying the correct amount of taxes.

Form Schedule S is a vital component of the Kansas income tax filing process. By reporting your income adjustments accurately, you can avoid potential penalties and ensure that you are in compliance with state tax laws. This form allows you to account for any discrepancies or differences between your federal income and your Kansas income, ensuring that you are paying the appropriate amount of taxes to the state.

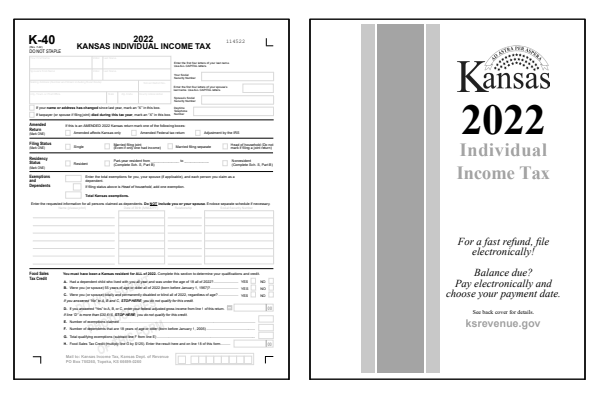

Kansas Income Ta Form Schedule S Printable

Kansas Income Ta Form Schedule S Printable

When filling out Form Schedule S, be sure to provide all necessary information and double-check your entries for accuracy. Failure to report income adjustments correctly can result in delays in processing your tax return or even potential audits by the Kansas Department of Revenue. It is always best to be thorough and precise when completing tax forms to avoid any issues down the line.

Make sure to keep all relevant documentation and records handy when filling out Form Schedule S. This includes any income statements, receipts, or other supporting documents that may be needed to complete the form accurately. By being organized and prepared, you can streamline the tax filing process and reduce the risk of errors or omissions on your return.

Once you have completed Form Schedule S, be sure to review it carefully before submitting it along with your other tax forms. It is always a good idea to review your entire tax return for accuracy and completeness to avoid any potential issues. If you have any questions or concerns about filling out Form Schedule S, consider seeking assistance from a tax professional or the Kansas Department of Revenue for guidance.

In conclusion, Form Schedule S is a crucial document for Kansas residents filing their income taxes. By accurately reporting income adjustments, you can ensure that you are in compliance with state tax laws and avoid potential penalties. Be diligent in completing this form and review it thoroughly before submission to ensure a smooth tax filing process.