When it comes to filing your taxes, understanding the federal income tax brackets for the year 2017 is crucial. Knowing which bracket you fall into can help you determine how much you owe or how much of a refund you may be entitled to. The IRS updates these brackets each year to account for inflation and changes in tax laws.

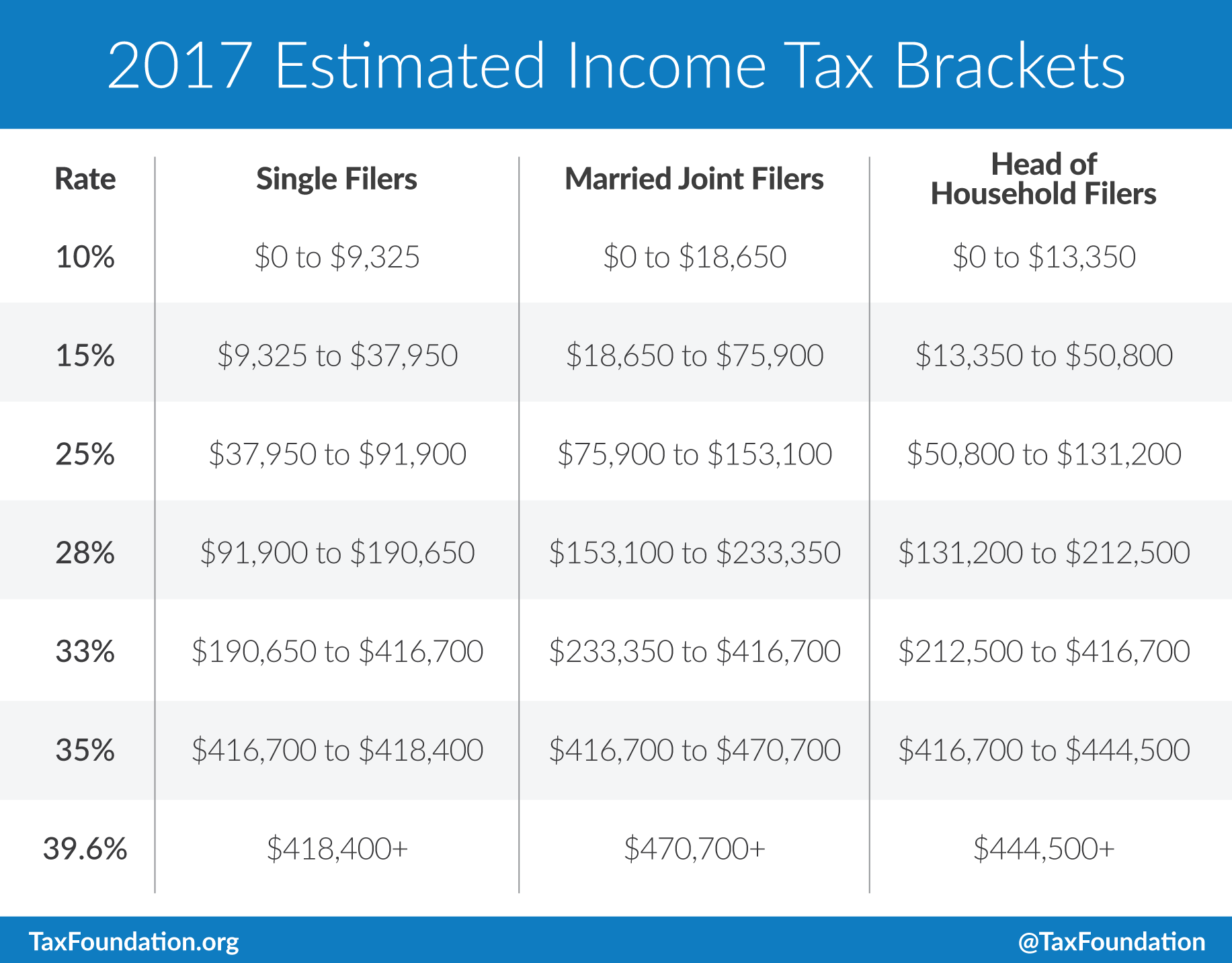

For the tax year 2017, there are seven tax brackets ranging from 10% to 39.6%. Each bracket corresponds to a certain range of income, with higher brackets applying to higher income levels. It’s important to note that the tax brackets are based on taxable income, not gross income.

Federal Income Tax Brackets 2017 Printable

Federal Income Tax Brackets 2017 Printable

Here are the federal income tax brackets for 2017:

- 10%: $0 – $9,325

- 15%: $9,326 – $37,950

- 25%: $37,951 – $91,900

- 28%: $91,901 – $191,650

- 33%: $191,651 – $416,700

It’s important to keep in mind that these brackets are for single filers. If you are married filing jointly or head of household, the income ranges for each bracket may be different. You can easily find a printable version of the federal income tax brackets for 2017 online or on the IRS website.

Using a printable version of the tax brackets can help you determine how much you owe in taxes and plan accordingly. You can also use tax software or consult with a tax professional to ensure you are accurately calculating your tax liability. Remember to file your taxes on time to avoid any penalties or interest charges.

Understanding the federal income tax brackets for 2017 is essential for anyone who wants to stay on top of their tax obligations. By knowing which bracket you fall into, you can better plan for your tax liability and ensure you are paying the correct amount. Be sure to consult with a tax professional if you have any questions or need assistance with your tax return.