When tax season rolls around, it’s important to have all the necessary forms and documents in order to file your taxes accurately and efficiently. For residents of Puerto Rico, this includes specific income tax forms that must be filled out and submitted to the local tax authorities. Fortunately, there are printable versions of these forms available online, making it easier for taxpayers to access and complete them without hassle.

Whether you are a full-time resident of Puerto Rico or earn income from sources within the territory, you are required to file an income tax return with the Puerto Rico Department of Treasury. This means you will need to gather all relevant financial information, such as W-2 forms, 1099s, and any other income documentation, in order to accurately report your earnings and claim any deductions or credits you may be eligible for.

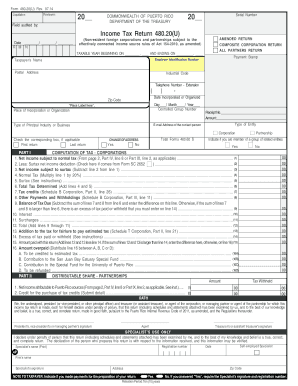

Printable Puerto Rico Income Tax Forms

Printable Puerto Rico Income Tax Forms

One of the most commonly used forms for Puerto Rico income tax purposes is Form 480.6A, which is used to report individual income tax returns. This form covers various types of income, including wages, salaries, tips, and self-employment earnings. Additionally, taxpayers may need to fill out supplemental forms depending on their specific financial situation, such as Form 480.7C for capital gains or losses.

Another important form for Puerto Rico residents is Form 499R-2/W-2PR, which is used by employers to report wages and taxes withheld for their employees. This form is essential for employees to accurately report their income and ensure that they are claiming the correct amount of taxes paid throughout the year. By accessing printable versions of these forms online, taxpayers can easily download and print them from the comfort of their own homes.

Overall, having access to printable Puerto Rico income tax forms makes the tax filing process more convenient and streamlined for taxpayers. By ensuring that all necessary forms are filled out accurately and submitted on time, individuals can avoid potential penalties and delays in processing their tax returns. So, if you are a resident of Puerto Rico or earn income from sources within the territory, be sure to take advantage of these printable forms to stay compliant with local tax regulations.

Make sure to check the official Puerto Rico Department of Treasury website for the most up-to-date versions of these forms and any additional requirements for filing your income tax return. With the right tools and resources at your disposal, you can tackle tax season with confidence and peace of mind.