As we approach the tax season for the year 2023, it’s important to be prepared with all the necessary forms and documents to file your taxes accurately and on time. One of the key components of this process is having access to printable income tax forms that you can easily fill out and submit to the IRS.

These forms provide a structured way for you to report your income, deductions, credits, and other relevant information that will determine your tax liability for the year. Whether you file your taxes online or through the mail, having the right forms at your disposal is crucial for a smooth and efficient tax-filing experience.

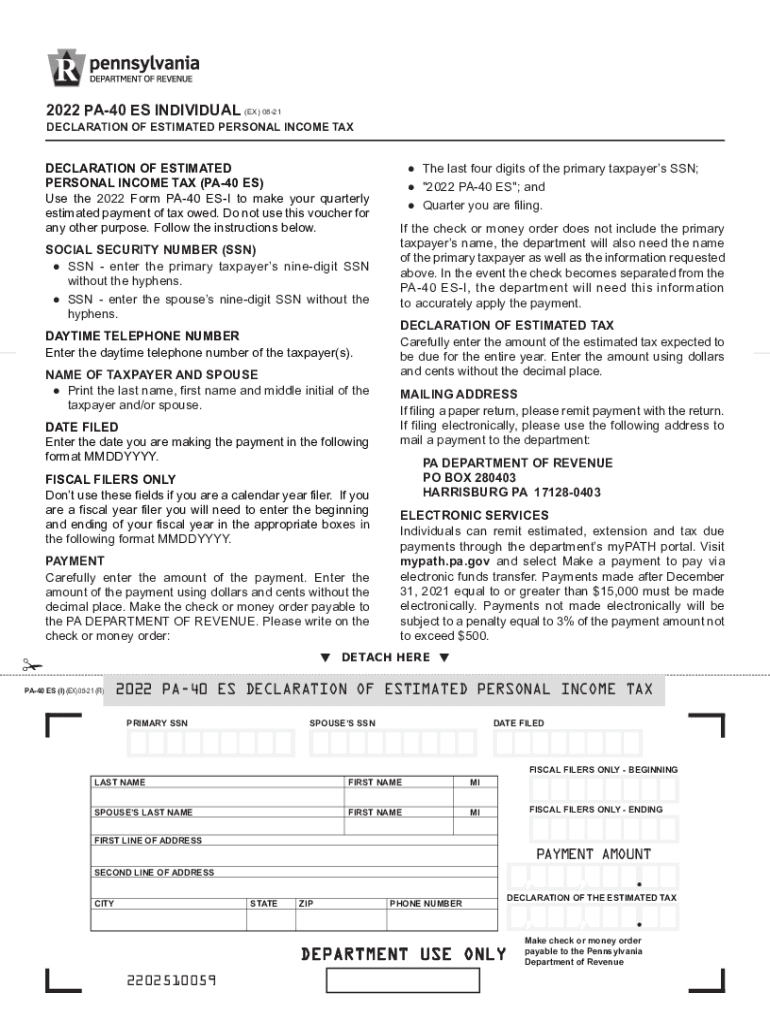

2023 Income Tax Forms Printable

2023 Income Tax Forms Printable

When it comes to printable income tax forms for the year 2023, you can expect to find a variety of options depending on your filing status and financial situation. Some of the most common forms include the 1040, 1040A, and 1040EZ, which cater to different types of taxpayers with varying income levels and deductions.

In addition to these basic forms, there are also specialized forms for reporting specific types of income or claiming certain tax credits. For example, if you have income from self-employment, investments, or rental properties, you may need to fill out additional schedules and forms to accurately report this income to the IRS.

It’s important to note that while many tax preparation software programs offer the convenience of auto-filling your information and calculating your tax liability for you, having a printable copy of your tax forms can serve as a valuable reference point and backup in case of any discrepancies or issues with your electronic filing.

Overall, having access to printable income tax forms for the year 2023 is essential for a successful tax-filing process. Whether you choose to file your taxes independently or seek the assistance of a professional tax preparer, having all the necessary forms and documents at your disposal will ensure that you can accurately report your income and deductions and avoid any potential penalties or audits from the IRS.