As tax season approaches, many individuals are gearing up to file their federal income taxes for the year 2023. One important aspect of this process is having access to the necessary tax forms in order to accurately report income, deductions, and credits. Fortunately, the Internal Revenue Service (IRS) provides printable versions of these forms online for taxpayers to easily access and fill out.

Having the ability to print out federal income tax forms for the year 2023 can be incredibly convenient for individuals who prefer to file their taxes manually. These forms contain essential information such as W-2s, 1099s, and other documents needed to accurately report income and deductions. By having these forms readily available in a printable format, taxpayers can ensure that they are completing their tax returns correctly and in a timely manner.

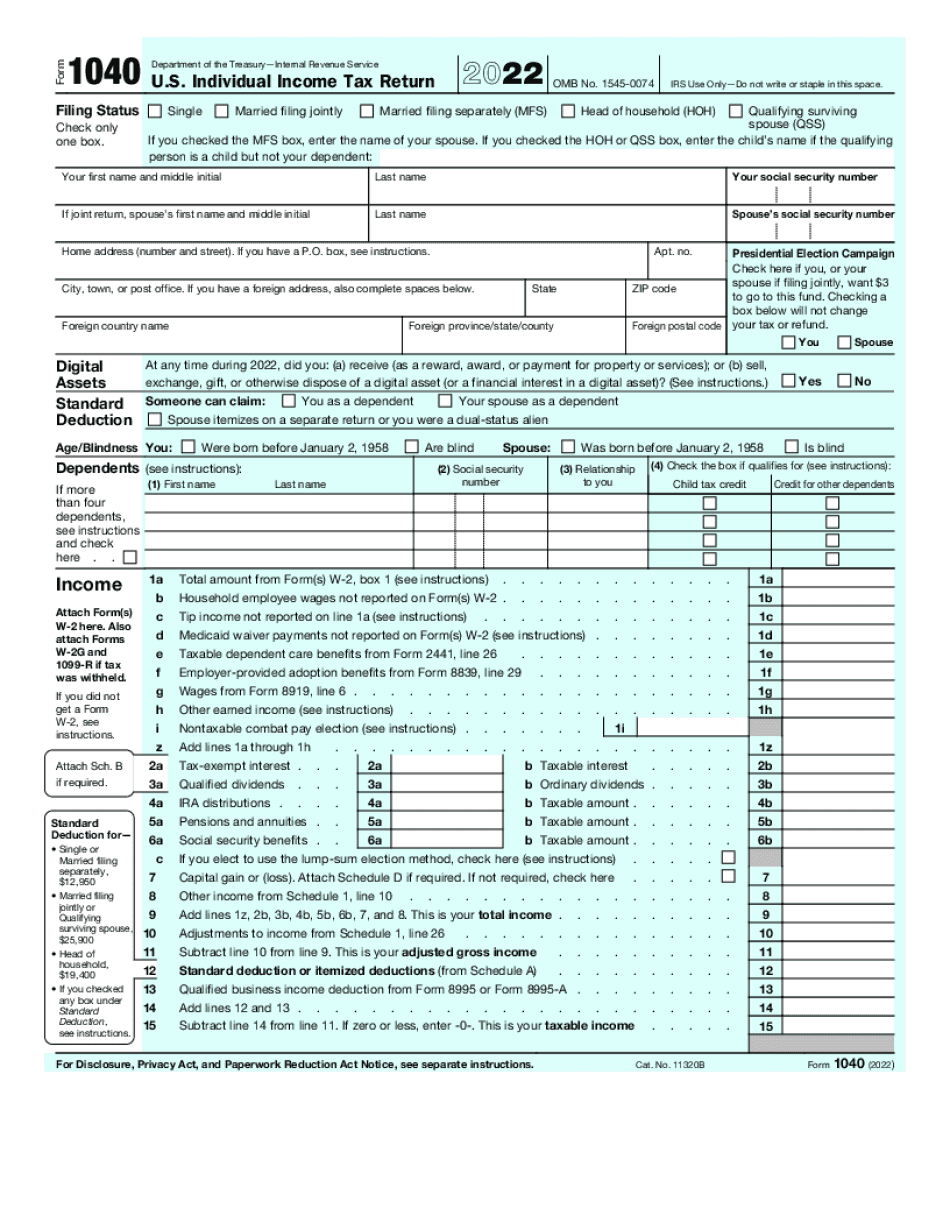

2023 Federal Income Tax Forms Printable

2023 Federal Income Tax Forms Printable

When visiting the IRS website, taxpayers can easily navigate to the forms and publications section to find the necessary documents for filing their federal income taxes. From Form 1040 to Schedules A and B, there are a variety of forms available for different types of income and deductions. Additionally, the IRS provides instructions on how to fill out each form, making the process as straightforward as possible for taxpayers.

It is important for individuals to carefully review each form before filling it out to ensure that all information is accurate and up to date. Any errors or omissions could lead to delays in processing the tax return or potential penalties from the IRS. By using the printable versions of the federal income tax forms for 2023, taxpayers can take their time to review and double-check their information before submitting their returns.

In conclusion, having access to printable federal income tax forms for the year 2023 is essential for individuals who prefer to file their taxes manually. By utilizing these forms, taxpayers can accurately report their income, deductions, and credits in order to comply with IRS regulations. It is recommended that individuals carefully review each form and follow the instructions provided by the IRS to ensure a smooth and successful filing process.