As tax season approaches, it is important for Wisconsin residents to stay organized and on top of their finances. One way to do this is by utilizing the 2019 Wisconsin Estimated Income Tax Voucher 1-Es Printable. This handy tool helps individuals accurately estimate their income tax liability and make timely payments to the state.

By using the 2019 Wisconsin Estimated Income Tax Voucher 1-Es Printable, taxpayers can avoid penalties and interest charges for underpayment of taxes. It allows them to plan ahead and budget for their tax obligations, ensuring they are in compliance with state tax laws.

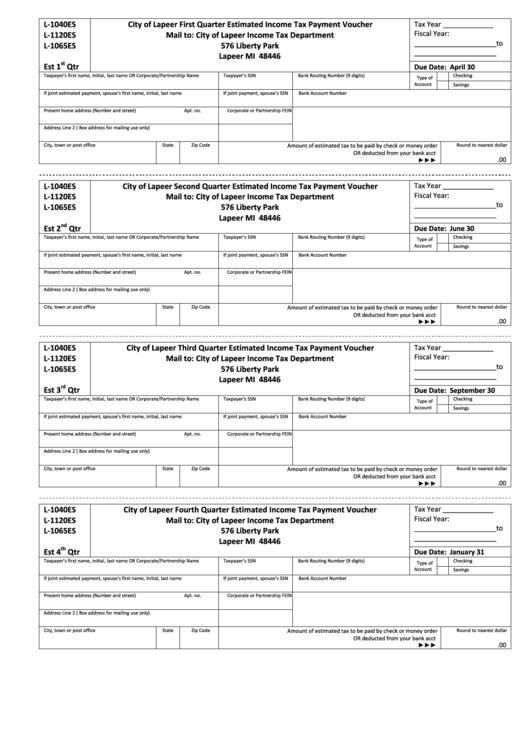

2019 Wisconsin Estimated Income Tax Voucher 1-Es Printable

2019 Wisconsin Estimated Income Tax Voucher 1-Es Printable

Estimating income tax can be a complex process, but this printable voucher simplifies the task. It provides clear instructions on how to calculate estimated tax liability based on income, deductions, and credits. Taxpayers can then fill out the voucher and submit it along with their payment to the Wisconsin Department of Revenue.

It is important to note that the deadline for submitting the 2019 Wisconsin Estimated Income Tax Voucher 1-Es Printable is April 15, 2020. Failure to file by this date may result in penalties and interest charges. Therefore, individuals should make sure to complete the voucher accurately and submit it on time to avoid any issues.

Overall, the 2019 Wisconsin Estimated Income Tax Voucher 1-Es Printable is a valuable resource for taxpayers in the state. It helps them stay organized, plan ahead, and meet their tax obligations in a timely manner. By utilizing this tool, individuals can ensure compliance with state tax laws and avoid unnecessary penalties and fees.

Stay ahead of tax season by using the 2019 Wisconsin Estimated Income Tax Voucher 1-Es Printable and take control of your financial responsibilities today.