As tax season approaches, it’s important to be prepared with all the necessary documents and forms to file your federal income taxes. One crucial step in the process is obtaining the correct tax forms for the year in question. For the tax year 2019, there are various forms that individuals and businesses may need to fill out and submit to the IRS.

Whether you are an employee, self-employed individual, or business owner, understanding which forms are required for your specific tax situation is essential. Fortunately, the IRS provides printable versions of all necessary tax forms on their website, making it easy for taxpayers to access and complete the required paperwork.

2019 Federal Income Tax Forms Printable

2019 Federal Income Tax Forms Printable

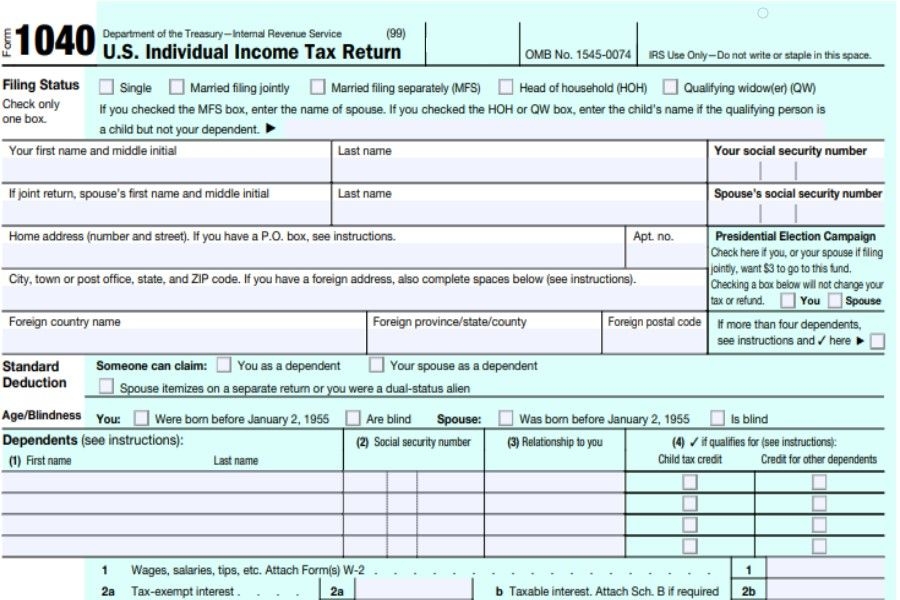

When filing your federal income taxes for 2019, some of the key forms you may need include the 1040 individual income tax return, Schedule A for itemized deductions, Schedule C for self-employment income, and various other schedules and forms depending on your specific financial circumstances. It’s important to carefully review the instructions for each form to ensure accurate and timely filing.

For individuals who prefer to file their taxes by mail rather than electronically, having access to printable tax forms is essential. By visiting the IRS website, taxpayers can easily locate and download the necessary forms to complete their tax return. Additionally, many tax preparation software programs also offer printable versions of federal income tax forms for those who prefer to file online.

As the tax deadline approaches, it’s important to stay organized and gather all necessary documentation to accurately report your income and deductions. By utilizing printable federal income tax forms for the year 2019, you can streamline the tax filing process and ensure that your return is filed correctly and on time.

In conclusion, obtaining and completing the necessary tax forms is a crucial step in the tax filing process. For the year 2019, individuals and businesses can access printable versions of federal income tax forms on the IRS website. By staying informed and following the instructions provided, taxpayers can ensure a smooth and successful tax filing experience.