As tax season approaches, it’s important to make sure you have all the necessary forms in order to file your federal income taxes. For the year 2018, there are specific forms that need to be completed depending on your individual tax situation. Having printable forms readily available can make the process easier and more efficient.

Whether you are filing as an individual, married couple, or business entity, having access to printable federal income tax forms can help simplify the tax filing process. These forms provide a structured way to report your income, deductions, and credits to the IRS, ensuring that you are in compliance with tax laws and regulations.

2018 Printable Federal Income Tax Forms

2018 Printable Federal Income Tax Forms

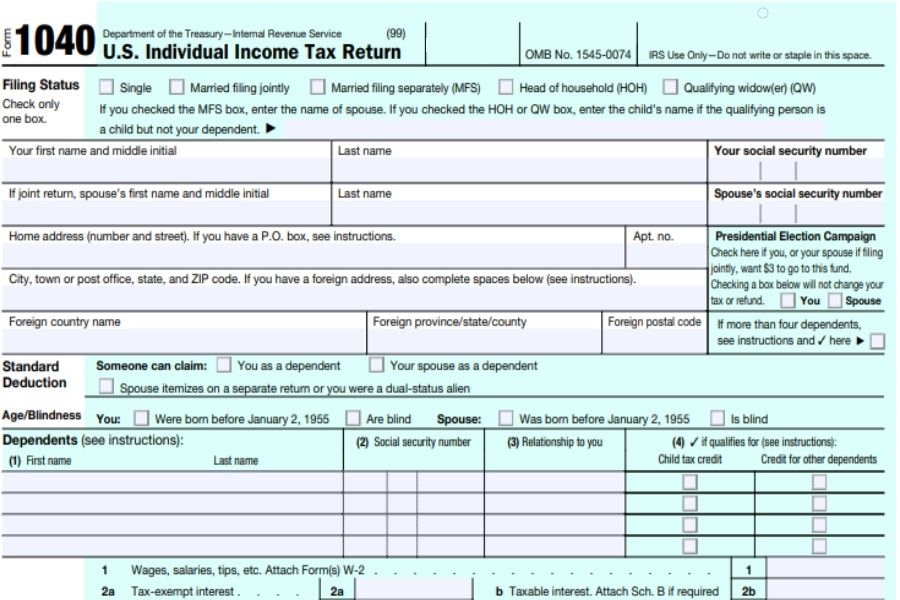

One of the most commonly used forms for individuals is the Form 1040, which is used to report income, deductions, and credits for the year. This form has several variations, depending on your filing status and income level. Additionally, there are other forms such as the 1040A and 1040EZ for simpler tax situations.

For those who have investments or own a business, there are additional forms that may need to be completed. Forms such as Schedule C for reporting business income and expenses, Schedule D for reporting capital gains and losses, and Form 8829 for claiming home office deductions are just a few examples of the various forms that may be necessary.

Having access to printable federal income tax forms can save you time and effort when it comes to filing your taxes. These forms can be easily downloaded from the IRS website or other reputable online sources. By having all the necessary forms in hand, you can ensure a smooth and accurate tax filing process.

As tax season approaches, it’s important to be prepared with all the necessary forms to file your federal income taxes. By utilizing printable forms, you can streamline the tax filing process and ensure that you are in compliance with tax laws. Make sure to gather all the required forms for your specific tax situation and file your taxes accurately and on time.