As tax season approaches, many individuals and businesses are gearing up to file their federal income taxes for the year 2018. One of the key components of this process is obtaining the necessary forms to accurately report income, deductions, and credits. The Internal Revenue Service (IRS) provides a variety of printable forms that can be easily accessed online.

These forms are essential for taxpayers to report their financial information to the IRS and determine their tax liability for the year. Whether you are an individual, a small business owner, or a corporation, there are specific forms that must be completed based on your unique financial situation. It is important to review the instructions carefully and ensure that all required information is accurately reported.

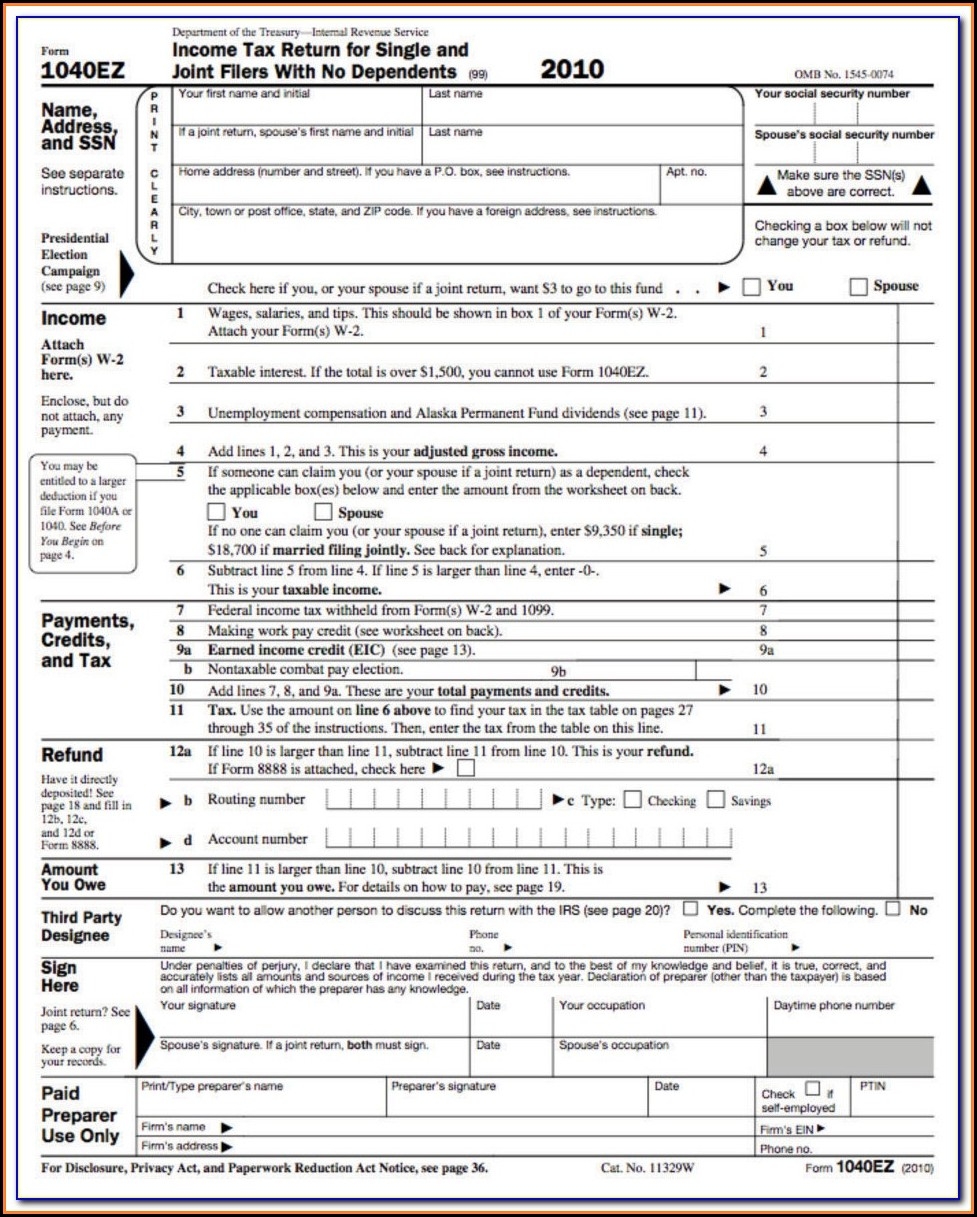

2018 Federal Income Tax Printable Forms

2018 Federal Income Tax Printable Forms

One of the most commonly used forms for individual taxpayers is the Form 1040, which is used to report income, deductions, and credits. In addition to this form, there are various schedules and worksheets that may need to be completed depending on the complexity of your financial situation. For businesses, the IRS provides forms such as the Form 1120 for corporations and the Form 1065 for partnerships.

It is important to note that the deadline for filing federal income tax returns for the year 2018 is typically April 15th, unless an extension has been granted. Failure to file by the deadline can result in penalties and interest charges, so it is crucial to ensure that all necessary forms are submitted in a timely manner. By utilizing the printable forms provided by the IRS, taxpayers can streamline the filing process and avoid potential errors.

In conclusion, obtaining and completing the necessary federal income tax forms is a critical step in the tax filing process for the year 2018. Whether you are an individual or a business entity, it is important to carefully review the instructions and accurately report your financial information to the IRS. By utilizing the printable forms available online, taxpayers can simplify the filing process and ensure compliance with federal tax laws.