As tax season approaches, many individuals and families are gearing up to file their income taxes for the year 2018. One of the most commonly used forms for this purpose is the 1040 form, which is used to report an individual’s income and determine their tax liability for the year.

The 2018 1040 Income Tax Printable Form is a crucial document that taxpayers need to fill out accurately in order to avoid any penalties or fines from the IRS. This form is used to report various types of income, deductions, and credits that can affect a person’s tax return.

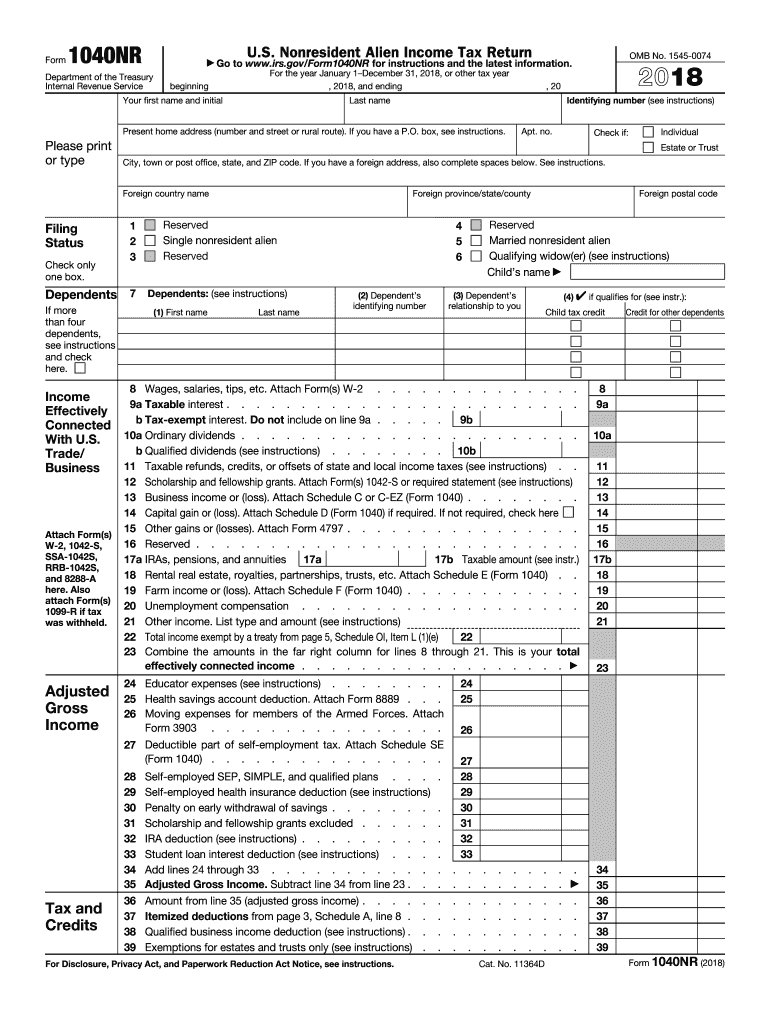

2018 1040 Income Tax Printable Form

2018 1040 Income Tax Printable Form

When filling out the 2018 1040 form, taxpayers will need to provide information such as their name, address, social security number, and details about their income sources. They will also need to report any deductions they qualify for, such as mortgage interest, charitable contributions, and medical expenses.

Additionally, the form includes sections for reporting tax credits, such as the Earned Income Tax Credit or the Child Tax Credit, which can help reduce a person’s tax liability. It is important for taxpayers to review their form carefully and ensure that all information is accurate before submitting it to the IRS.

Once the form is completed, taxpayers can either file it electronically through tax software or mail it to the IRS. It is essential to keep a copy of the completed form for your records and to double-check all calculations to avoid any errors that could lead to an audit or additional taxes owed.

Overall, the 2018 1040 Income Tax Printable Form is a crucial document that individuals and families need to fill out accurately to report their income and determine their tax liability for the year. By following the instructions carefully and seeking assistance if needed, taxpayers can ensure a smooth and successful filing process.