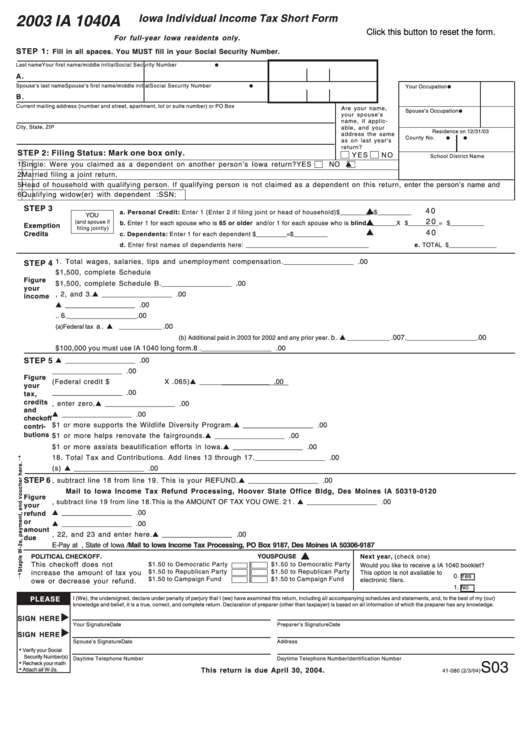

In 2016, Iowa residents were required to file their income tax returns with the state’s Department of Revenue. The forms for this year were crucial for taxpayers to accurately report their income, deductions, and credits to determine their tax liability or refund.

It is essential for individuals and families in Iowa to access and utilize the correct tax forms to ensure compliance with state laws and regulations. The 2016 Iowa income tax forms were available for download and printing from the official Department of Revenue website.

2016 Iowa Income Tax Forms Printable

2016 Iowa Income Tax Forms Printable

2016 Iowa Income Tax Forms Printable

The 2016 Iowa income tax forms included the IA 1040 for individual income tax returns, IA 1040ES for estimated tax payments, and various schedules for reporting specific types of income or deductions. Taxpayers were required to carefully fill out these forms and submit them by the specified deadline to avoid penalties or interest.

One of the key aspects of the 2016 Iowa income tax forms was the electronic filing option, which allowed taxpayers to submit their returns online for faster processing and confirmation. However, printable forms were still necessary for those who preferred to file by mail or needed physical copies for their records.

Additionally, the 2016 Iowa income tax forms provided instructions and guidelines for taxpayers to follow when completing their returns. These resources helped individuals understand the various sections of the forms, calculate their tax liability, and determine any credits or deductions they were eligible for.

Overall, the availability of printable 2016 Iowa income tax forms made it easier for residents to fulfill their tax obligations and ensure accuracy in reporting their financial information to the state. By utilizing these forms and following the instructions provided, taxpayers could navigate the filing process with confidence and peace of mind.

As the tax season approached in 2016, Iowa residents were encouraged to access the necessary forms online, print them out, and begin preparing their income tax returns promptly. By staying organized and informed, taxpayers could effectively meet their obligations and avoid potential issues with the Department of Revenue.