As tax season approaches, it’s important to make sure you have all the necessary forms and documents in order to file your state income taxes accurately. In Pennsylvania, residents can access printable forms online for the 2015 tax year to help simplify the filing process.

Whether you’re a full-time employee, self-employed individual, or have other sources of income, having access to printable tax forms can make the process much easier. By ensuring you have all the necessary documents at your fingertips, you can avoid delays in filing and potentially missing out on deductions or credits.

2015 Pa State Income Tax Forms Printable

2015 Pa State Income Tax Forms Printable

2015 Pa State Income Tax Forms Printable

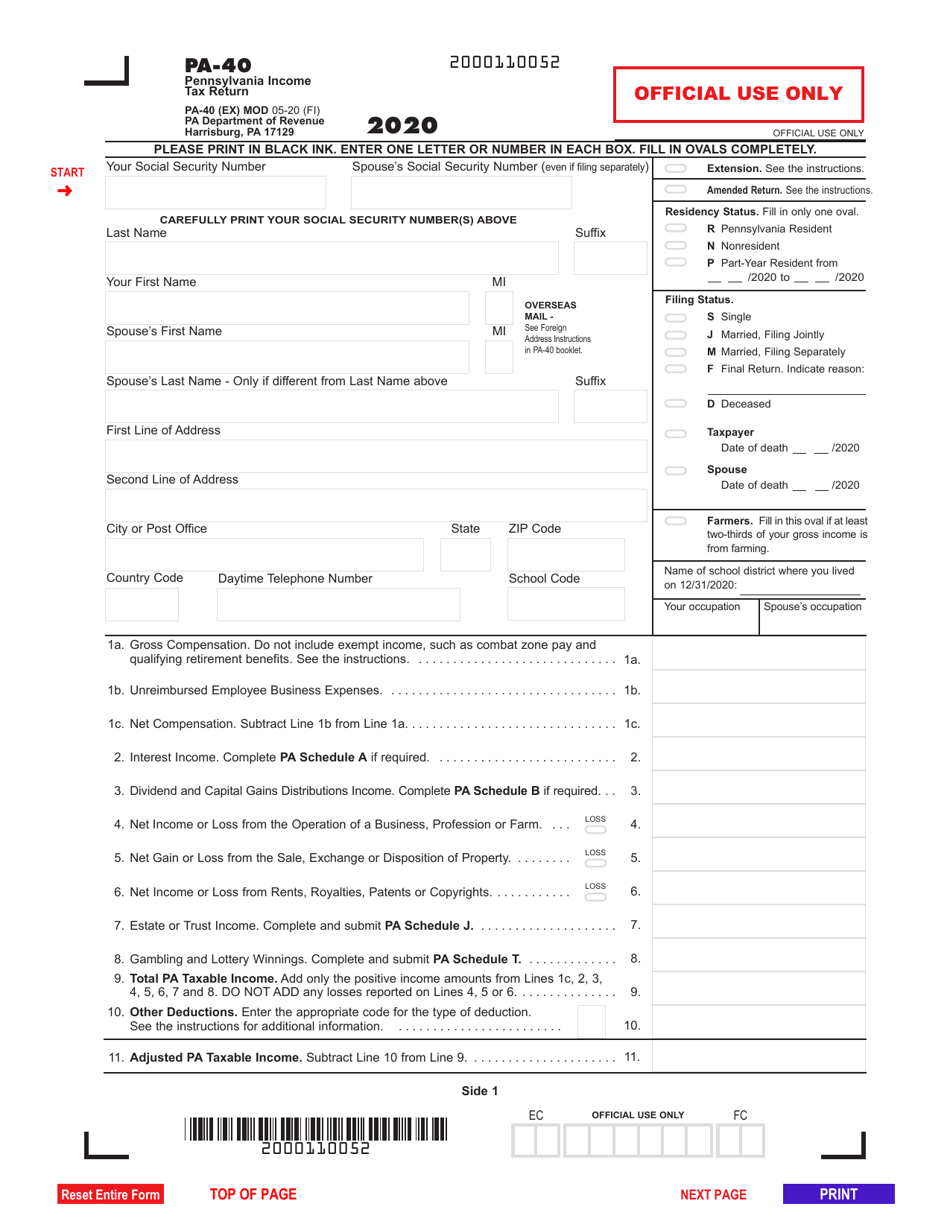

When it comes to filing your state income taxes in Pennsylvania for the 2015 tax year, there are several forms you may need to fill out depending on your individual circumstances. Some common forms include the PA-40, PA-40 Schedule A, PA-40 Schedule D, and PA-40 Schedule UE, among others.

By accessing the printable forms online, you can easily download and print them from the comfort of your own home. This eliminates the need to visit a tax office or wait for forms to be mailed to you, making the filing process more convenient and efficient.

It’s important to carefully review each form and instructions to ensure you are providing accurate information and claiming all eligible deductions and credits. By taking the time to fill out the forms correctly, you can help prevent errors and potential delays in processing your tax return.

As you gather your documents and prepare to file your state income taxes for the 2015 tax year, be sure to take advantage of the printable forms available online. By being proactive and organized, you can streamline the filing process and potentially maximize your tax refund or minimize any amount owed.

Don’t wait until the last minute to file your taxes – start gathering your documents and filling out the necessary forms today. With the convenience of printable forms, you can make the process easier and less stressful, ensuring you meet the filing deadline and avoid any penalties or interest.